Some funds look weak at first glance. Then you click the little checkbox that enables a dividend reinvestment plan (DRIP), and the droopy fund springs to life. Those quarterly cash distributions can be game-changers in the long run when you reinvest them.

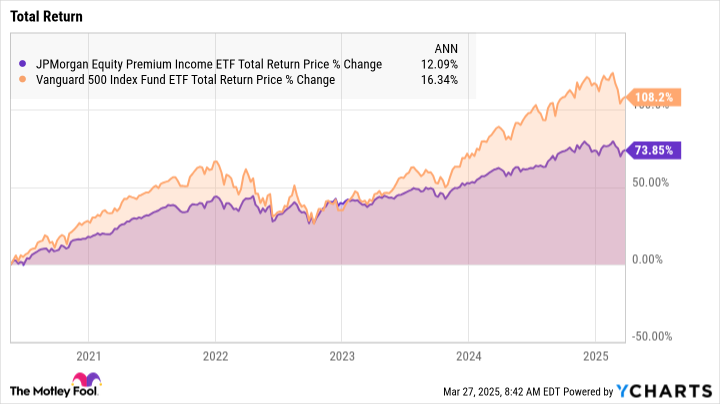

That’s how it works with the JPMorgan Equity Premium Income ETF (NYSEMKT: JEPI). If you just buy this exchange-traded fund (ETF) and hold it without taking the next step, you’ll fall behind simple market trackers like the Vanguard S&P 500 ETF (NYSEMKT: VOO) very quickly:

The same fund works much better when you automatically reinvest the dividend-style cash distributions into more shares of the same ETF. This ETF nearly catches up to the popular S&P 500 tracker when you measure performance by total returns instead:

The Equity Premium Income ETF is a pretty unique fund.

As the “equity” part of the name suggests, the portfolio is based on stocks. More specifically, it’s a diversified list of about 110 large-cap stocks, led by financial giants Visa (NYSE: V), MasterCard (NYSE: MA), and Progressive (NYSE: PGR).

Then there’s the “premium income” part. The fund managers at JPMorgan use an undisclosed structure of stock options to generate additional dividend-like cash payments from those stable stocks. In other words, these options provide extra “income” through option-based “premiums.”

With $39.6 billion of assets under management, this is the most popular actively managed ETF on the market today. It charges annual fees of 0.35%, which is a lot next to the forgettable 0.03% charged by the passively managed Vanguard S&P 500 ETF.

But the Equity Premium Income ETF team earns its fees by generating a robust income stream. The current yield is 7.4%, and the average value since the ETF’s inception in May 2020 is 8.7%. The average yield of the stock components is a modest 1%, with stock-specific yields ranging from zero to a single ticker just above the 7% mark.

It’s not easy to squeeze a reliable 7.4% yield out of more than a hundred lower-yield stock tickers. This Premium Income ETF is hard to beat if you’re looking for a stable and secure source of high dividend yields.

So the Equity Premium Income ETF can deliver respectable total returns in the long haul. When the time is right, you can switch off the DRIP function to collect dividend payouts instead of boosting the ETF’s overall returns. And the focus on large-cap stocks, with an active team of human analysts steering the portfolio, also keeps the volatility low.