By PAUL WISEMAN and CHRISTOPHER RUGABER, AP Economics Writers

The U.S. economy shrank at a 0.3% annual pace from January through March, the first drop in three years, as President Donald Trump’s trade wars disrupted business. First-quarter growth was slowed by a surge in imports as companies in the United States tried to bring in foreign goods before Trump imposed massive tariffs.

The January-March drop in gross domestic product — the nation’s output of goods and services — reversed a 2.4% gain in the last three months of 2024. Imports grew at a 41% pace, fastest since 2020, and shaved 5 percentage points off first-quarter growth. Consumer spending also slowed sharply — to 1.8% growth from 4% in October-December last year. Federal government spending plunged 5.1% in the first quarter.

Forecasters surveyed by the data firm FactSet had, on average, expected the economy to eke out 0.8% growth in the first quarter, but many expected GDP to fall.

The surge in imports — fastest since 1972 outside COVID-19 economic disruptions — is likely to reverse in the second quarter, removing a weight on GDP. For that reason, Paul Ashworth of Capital Economics forecasts that April-June growth will rebound to a 2% gain.

Trade deficits reduce GDP. But that’s mainly a matter of mathematics. GDP is supposed to count only what’s produced domestically. So imports have to be subtracted to keep them from artificially inflating domestic production.

Other aspects of Wednesday’s GDP report suggested that the economy looked solid at the start of the year.

A category within the GDP data that measures the economy’s underlying strength rose at a healthy 3% annual rate from January through March, up from 2.9% in the fourth quarter of 2024. This category includes consumer spending and private investment but excludes volatile items like exports, inventories and government spending.

Still, many economists say that Trump’s massive import taxes — the erratic way he’s rolled them out — will hurt growth in the second half of the year and that recession risks are rising.

“We think the downturn of the economy will get worse in the second half of this year,’’ wrote Carl Weinberg, chief economist at High Frequency Economics. “Corrosive uncertainty and higher taxes — tariffs are a tax on imports — will drag GDP growth back into the red by the end of this year.’’

Wednesday’s report also showed an increase in prices that is likely to worry the Federal Reserve which is still trying to cool inflation after a severe pandemic run-up. The Fed’s favored inflation gauge – the personal consumption expenditures, or PCE, price index – rose at an annual rate of 3.6%, up from 2.4% in the fourth quarter.

Excluding volatile food and energy prices, so-called core PC inflation registered 3.5%, compared with 2.6% from October-December. The central bank wants to see inflation at 2%.

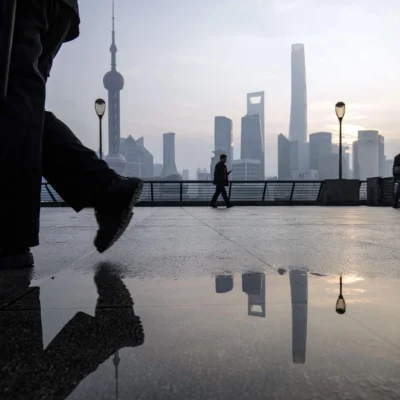

Trump inherited a solid economy that had grown steadily despite high interest rates imposed by the Fed in 2022 and 2023 to fight inflation. His erratic trade policies — including 145% tariffs on China — have paralyzed businesses and threatened to raise prices and hurt consumers.

Democrats were quick to blame Trump for disrupting several years of solid economic growth. Democratic Sen. Elizabeth Warren of Massachusetts said: “100 days into his presidency, Donald Trump’s red-light, green-light tariffs are shrinking our economy, with businesses stockpiling imports in anticipation of tariff doomsday.”