While India’s real estate market surges toward $1 Tn by 2030, its proptech sector has undergone a remarkable transformation. Just a decade ago, the landscape was notably fragmented and disorganised, with siloed technologies failing to address the industry’s complex challenges.

Tanuj Shori and his wife Kanika Gupta Shori decided to come up with a cohesive and comprehensive platform that seamlessly integrates search, transactions, financing, and post-sales services in real estate.

Square Yards

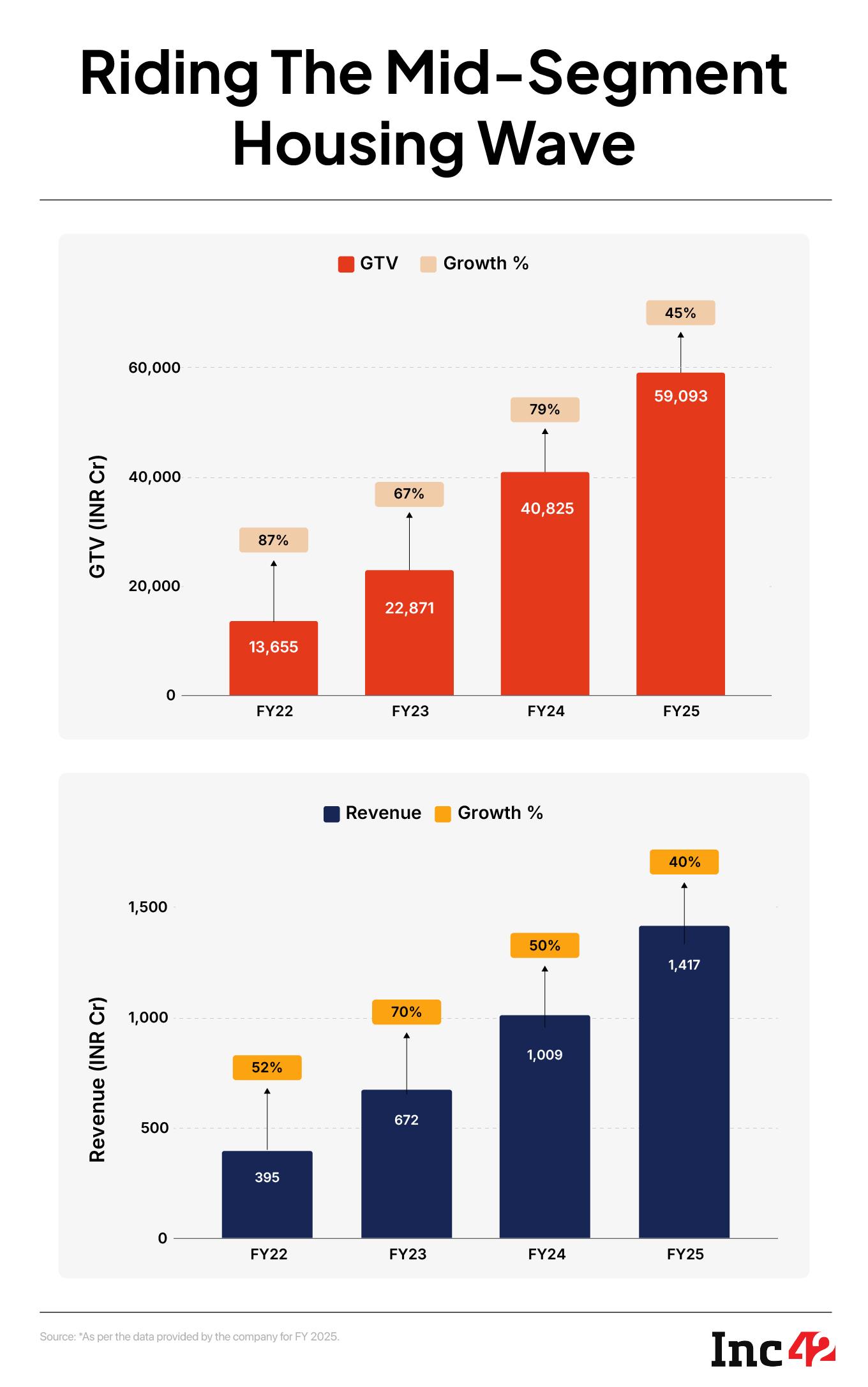

The company has reached a turnover of INR 1,417 Cr in FY25 maintaining a compounded annual growth rate (CAGR) of over 55% for the past four years, according to the company’s internal estimates.

Eleven years of continuous disruption and recalibration with emerging technology has kept the proptech player on a steady growth path. It earns from brokerages, transaction fees, loan disbursement commissions, and fees charged for services like home interiors and property management.

“We created Square Yards to simplify and digitise the entire real estate value chain, including property purchase, financing, legal documentation and home services. Global best practices inspired the model, but we tailored it according to the challenges of Indian and emerging markets, especially to solve for the lack of transparency and developer-buyer disconnect,” said Tanuj Shori.

The IIM Lucknow graduate had left the job of an executive director at Nomura to partner Kanika Gupta Shori, a Wharton graduate with over a decade spent in banking and entertainment, to give shape to the vision they shared.

The Shoris soon created a team of 20 cofounders, which has been one of the largest cofounding teams in the Indian startup ecosystem, to build a full-stack proptech ecosystem of services, providing an end-to-end journey to more than 8 Mn homebuyers and 80,000+ real estate and mortgage agents.

Blueprint For Financial Growth, Business Expansion

“During our initial phase, we had to deal with unpaid dues, unreliable partners, gaps in our sales processes and difficulty in hiring talent, as stereotypes against real estate as a profession were pretty negative. We also faced challenges in figuring out the tech, but this initial scuffle helped us to build a ‘change-ready’ DNA,” Shori told Inc42.

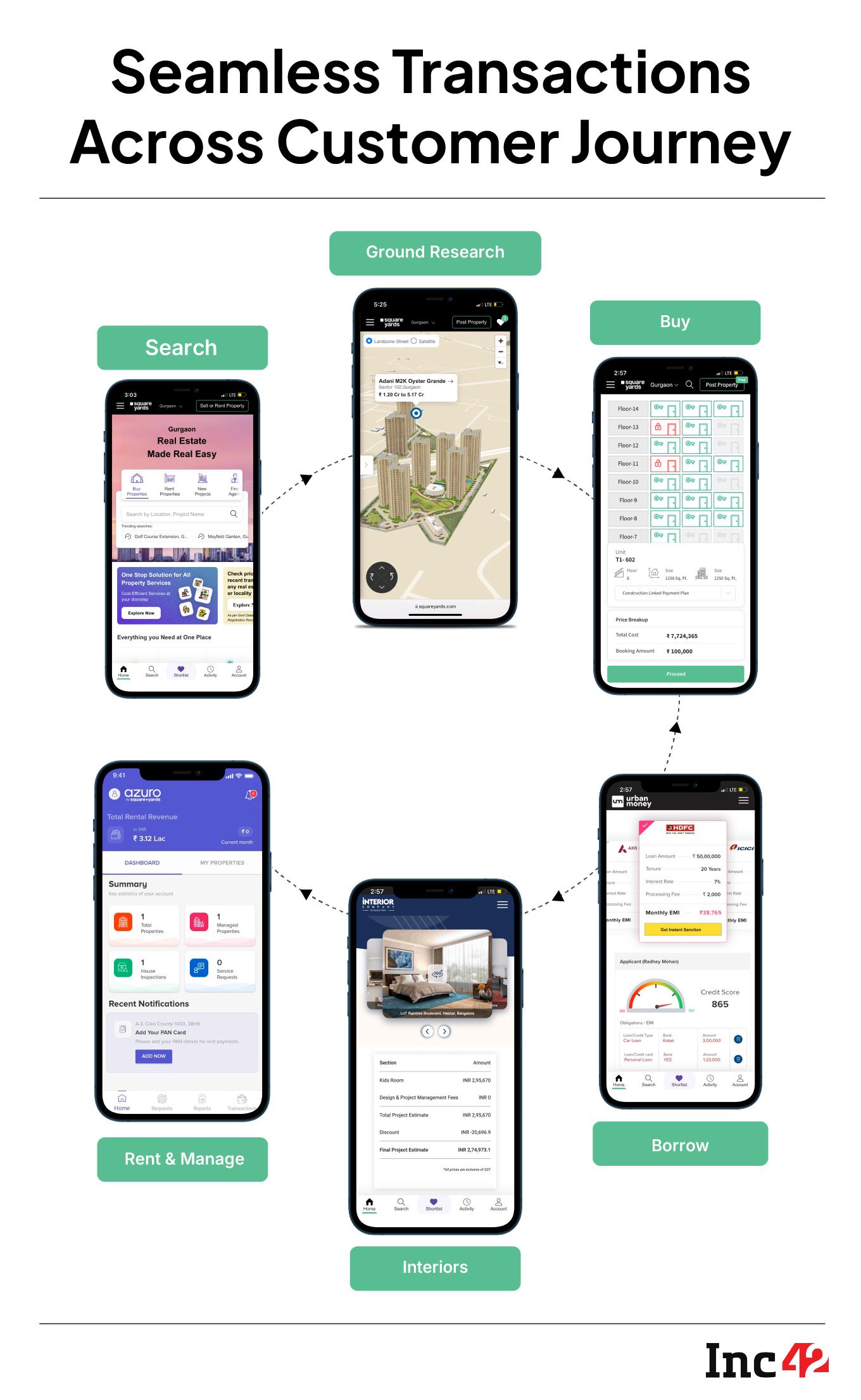

To square away the hurdles on its way into the proptech segment, the Shoris and the cofounders devised a strategic service profile with four categories.

#1 Proptech / Core Real Estate Service: Square Yards operates a full-stack real estate platform, facilitating the sale of both new (primary) and resale properties with a transaction-based monetisation model. Through their in-house agents, they handle $1.5 Bn+ in annual property sales and charge a 5%+ average brokerage fee as a percentage of the unit sales value. Their technology platform enhances the process with features like property investment scores, automated valuations, real-time inventory blocking, and digital transaction tools.

#2 Fintech Services: Through its fintech arm Urban Money, the company facilitates home loans, LAPs, personal and business loans, and insurance products, earning a percentage-based commission from financial institutions. Urban Money has witnessed phenomenal growth in the last few years and has emerged as one of the largest digital mortgage origination players in the country. It facilitated loan disbursal of INR 61,000 Cr in FY25.

#3 Interior Design And Home Furnishing: Square Yards also runs Interior Company, a tech-led platform for interior design and home renovation. It offers 3D visualisation, real-time cost estimation, and end-to-end project tracking. The platform has delivered over 5,000 homes to date.

#4: Digital Services and Products: The company offers a range of digital products and services including:

- PropVR: An AI-based VR platform that enables immersive digital property experiences.

- Azuro: A property management platform for online rent collections, house inspections and e-tracking of maintenance requests.

- Square Connect: A mobile-only aggregation platform for real estate brokers, financial institutions and online firms.

- PropsAMC: Capital Markets and Services vertical brings rent-yielding commercial and residential assets to investors. It also helps developers raise debt and mezzanine capital, including land transaction services for landowners and societies.

In FY25, the company’s revenue grew 40% from INR 1,009 Cr to INR 1,417 Cr as the company doubled down on its primary real estate transactions, especially in the mid-segment market,Even the Gross Transaction Value (GTV) stood at INR 59,093 Cr in FY25, a 45% increase from INR 40,825 Cr in FY24.

It is important to note that the proptech platform has been maintaining a consistent growth rate of over 55% CAGR (between FY22-FY25). During this period, the company has also significantly improved its financial health by reducing EBITDA losses and achieving profitability.

Instead of focussing on the luxury or high-end market, Square Yards focussed on a more populated market of first-time buyers, which was not only a larger pool but also had the potential of monetising the leads for multi-product sales.

Another enabler for Square Yards growth has been its bet on building effective relationships with Grade-A developers. The proptech company contributes up to 5-10%of the total sales of its partner developers through its platform, and this compels them to return to Square Yards. As a matter of fact, these returning partner developers bring in 85% of the company’s total business.

An estimated 2.17% annual increase in India’s urban population, a nearly 14.5% rise in disposable incomes in FY23, a consequent improvement in the standard of living, and a steady growth of the aspirational middle class that will account for 38% of country’s population by 2031 have been enabling proptech players like Square Yards to leverage the opportunities.

An Insight Into The Evolving Tech Stack

The supply-side real estate portal lists a million properties and more than 1,00,000 projects sourced from more than 2,000 developers. These listings serve over 8 Mn property seekers on its official website. The company has sharpened its architectural finesse to support its digital dexterity.

Square Yards runs a suite of data intelligence tools based on its large pool of property registration data to assist in price discovery and negotiation strategies in property deals. The tech stack also facilitates digital transactions both before and after the deal.

The native technology developed by the company offers real-time data on available properties for sale, e-escrow services, secure payment gateways, digital signatures for the documentation and on-the-fly loan approvals for those buyers who want banking assistance to complete the purchase. These tech tools ease the procedural bottlenecks common in India’s traditional real estate transactions.

Square Yards has also integrated itself within the frameworks of the credit bureaus and the banking systems. Instead of relying on traditional methods involving paperwork and manual checking of credit histories, Square Yards can fetch the credit records data directly. This accelerates loan approvals, reduces the operational costs, improves risk assessments and enables real-time updates for faster loan disbursals.

With the help of three-dimensional (3D) visualisations and geospatial intelligence, Square Yards is developing a real-world meta experience by creating ‘digital twins’ for prominent cities of India and the Middle East. Within these digital twins, the users can hunt for properties, click on any property to know more and get key insights such as distances and routes from key landmarks. This makes exploring properties more interactive and helps customers understand the aesthetic nuances which are difficult to sense in two-dimensional photographs.

The company also deploys machine learning models to personalise these virtual experiences based on customer behaviour data and preferences. The tech stack enables its 3,000+ sales professionals and 2,000+ mortgage agents with tools that support virtual meetings, instant collateral sharing, and comparative market analysis (CMA).

Shori shared that to deliver these ambitious technologies to the end user, Square Yards has joined hands with global technology leaders and fortified its intellectual property portfolio. It has filed over 16 patents in the field of virtual reality (VR) and artificial intelligence (AI), and five of them have been granted so far.

Chalking Out The Roadmap For The Future

Shori described to Inc42 a clear-headed approach towards expansion, “The future roadmap for Square Yards is rooted in a simple but powerful philosophy: ‘Be better at what we’re already doing’. Growth will come from continuously improving the core, rather than chasing distractions.”

The proptech firm’s founder suggested that over the next 1–2 years, the focus will be on profitability, targeting sustainable EBITDA margins, deepening relations with developers and banks, and further innovating its tech stack. It is aiming at stable corporate EBITDA margins within the next 2–3 years, while also scaling its AI-led tools like Sales Copilot to improve productivity and sales outcomes.

Currently, Square Yards operates across 100 cities in nine countries with a full-stack platform offering comprehensive property services.

Now, Square Yards is also actively evaluating entry into secondary property transactions, signalling a cautious but strategic growth approach. “For the longer term, Square Yards aims to become India’s most integrated, tech-forward real estate and financial services platform,” the founder shared the vision.