Royal London, the UK’s largest mutual life, pensions and investment provider, has secured its largest external Bulk Purchase Annuity (BPA) transaction to date with a £275 million buy-in completed with the Grant Thornton Pensions Fund.

Royal London was one of nine insurers that submitted proposals for the buy-in, demonstrating a thriving industry with plenty of choice for pension scheme trustees and sponsors. For the transaction, Aon advised the Trustee and the Firm, Osborne Clarke advised the Trustee and Royal London was advised by DLA Piper. Barnett Waddingham and Cardano provided actuarial and investment advice to the Trustee.

The Trustee and Royal London have developed a project plan for buyout of the Fund, at which time the 2,200 members of the Fund will become direct policyholders of Royal London.

Royal London – the only customer-owned mutual insurance company operating within the BPA market – has now secured around £560 million in premiums across seven buy-ins since the start of 2025, with transactions ranging from just over £20 million to this most recent £275 million buy-in.

Commenting on this latest transaction, Mark Sharkey, BPA Origination Lead at Royal London said:

“We’re incredibly proud to have been selected by the Trustee to partner with them on this transaction. We now look forward to building on the brilliant relationship that has been fostered with the Trustee, Aon, and Osborne Clarke, as we work towards welcoming their members to Royal London.

“As our largest external transaction to date, we hope the scale of this buy-in will further strengthen the appeal of our mutual-led proposition for many more trustee boards in the future.”

Commenting on the transaction, Leah Evans, Partner at Aon said:

“This is such a positive outcome for members, the Trustees and the Firm. Against the backdrop of a change in Firm ownership, we were able to design a process that delivered maximum insurer engagement and choice for the Trustees and allowed the Firm to complete its parallel corporate restructuring activity with clarity and confidence over their pensions obligations.

“In a market where hundreds of schemes are navigating the path from buy-in to buyout and getting caught in bottlenecks, the approach to post transaction implementation agreed with Royal London provides confidence that the Fund will achieve buyout on time.”

Commenting on the transaction, Carl Williams, Chair of the Grant Thornton Pensions Fund Trustees said:

“This transaction is a fantastic outcome for our members. The very competitive process and the insights provided by Aon throughout, meant we really could weigh up all options, including non-price factors, and we are confident that our members will be well supported going forward. This transaction and the agreed timetable to move on to full buyout reflects the strong support and collaborative engagement of all our advisors.”

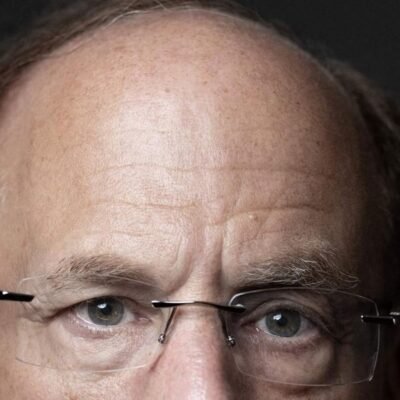

Commenting on the transaction, Malcolm Gomersall, CEO of Grant Thornton UK said:

“This transaction allows the Firm to move forward with a focus on its own growth strategy, while knowing that the members of the Fund are well looked after. As a challenger in our own market place, we are a firm believer in selecting partners on the basis of capability and willingness to partner in achieving a common goal.”