“Output data reported in April showed the non-energy economy expanded by 3.4% last year, and we project the same pace of growth in 2025,” Oxford Economics said in its latest country report.

Tourism has provided significant support to non-energy growth and will remain a driver of future activity and employment, it said.

Qatar welcomed 5.1mn overnight arrivals in 2024, a 25% increase on 2023 and 138% higher than 2019 levels.

“The launch of the pan-GCC visa will likely help extend the positive performance and we forecast arrivals to increase to 5.3mn this year,” Oxford Economics said.

The researcher’s 2025 average inflation estimate remains at 1%, the lowest in the GCC region.

Oxford Economics said it thinks any upward pressure on imported inflation from recent US dollar weakness (via the currency peg) will likely be offset by the dampening effect of tariffs on global demand.

Qatar’s annual inflation rate was negative in the first quarter (Q1) for the first time since early 2021. Prices fell by 0.8% q-o-q in seasonally adjusted terms, led by declines in food prices and the cost of recreation and culture. The 3.2% y-o-y fall in food prices in Q1 was among the largest in the current series. The drag from the housing and utilities category on annual inflation deepened, with prices falling by 4.5% y-o-y, the most since Q3 2021.

“We still expect inflation to settle at around 2% in the medium term,” the report noted.

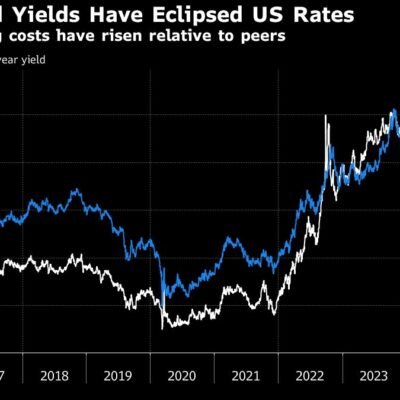

The Qatar Central Bank followed the US Federal Reserve in holding interest rates steady in May, continuing the pause from January this year.

In 2024, the US Fed delivered a cumulative 100bps of cuts.

Meanwhile, the QCB cut rates by a total of 115bps, with the lending rate at 5.1%.

“In the coming months, we think the QCB’s rate moves will echo those in the US, as we continue to expect the Fed to stay on pause until December. Our baseline anticipates a further 100bps of cuts next year,” Oxford Economics said.

The 2025 budget targets a deficit of QR13.2bn (1.6% of projected GDP). The authorities plan to raise spending by 4.6% relative to last year’s budget and 1.2% relative to realised expenditure, with a strong focus on development in education and healthcare.

The budget assumes an average oil price of $60/ barrel, Oxford Economics noted.