RHJ

Precious metals royalty and streaming companies represent a very interesting sub-industry of the precious metals mining industry. They provide some leverage to the growing metals prices, similar to the typical mining companies; however, they are less risky in comparison to them. Their incomes are derived from royalty and streaming agreements. Under a metal streaming agreement, the streaming company provides an upfront payment to acquire the right to future deliveries of a predefined percentage of metal production of a mining operation.

The streaming company also pays some ongoing payments that are usually well below the market price of the metal. They can be set as a fixed sum (e.g., $300/toz gold) or as a percentage (e.g., 20% of the prevailing gold price), or a combination of both (e.g., the lower of a) $300/toz gold and b) 20% of the prevailing gold price). The royalties usually apply to a small fraction of the mining project production (usually 1-3%), and they are not connected with ongoing payments. They can have various forms, but the most common is a small percentage of the net smelter return (“NSR”). The NSR is calculated as revenues from the sale of the mined products minus transportation and refining costs.

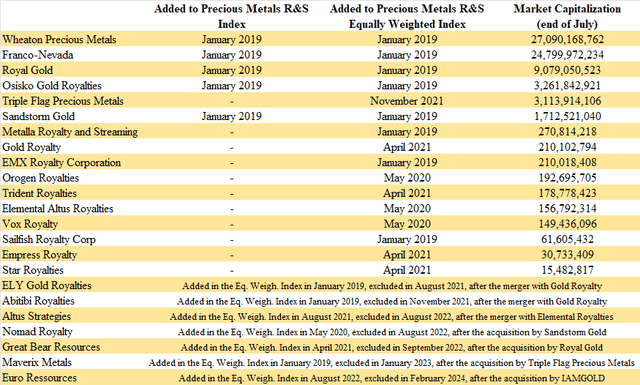

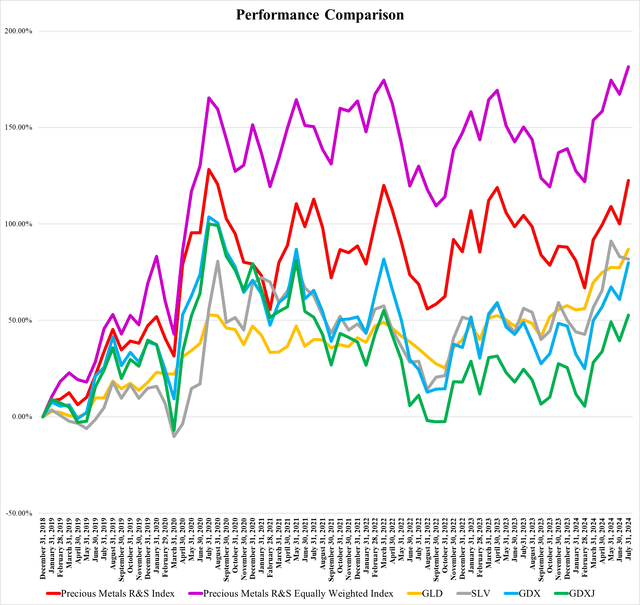

To better track the overall performance of the whole sub-industry, I created a capitalization-weighted index (the Precious Metals Royalty and Streaming Index) consisting of 11 companies (in June 2020, expanded to 15). Later, based on the inquiries of readers, I also introduced an equal-weighted version of the index. Until March 2021, both indices included the same companies and were calculated back to January 2019.

However, some major changes occurred in April 2021. Due to the boom of the royalty and streaming industry and the emergence of many new companies, the indices experienced two major changes. Firstly, the market capitalization-weighted index was modified to include only the 5 biggest companies: Franco-Nevada Corporation (FNV), Wheaton Precious Metals Corp. (WPM), Royal Gold, Inc. (RGLD), Osisko Gold Royalties Ltd (OR), and Sandstorm Gold Ltd. (SAND). The combined weight of these 5 companies on the old index was around 95%. Therefore, the small companies had only a negligible impact on their performance. The values of the index were re-calculated back to January 2019, and between January 2019 and March 2021, the difference in the overall performance of the old and the new index was only 2.29 percentage points. The second change is related to the equally weighted index that was expanded to 20 companies.

The previous editions of the monthly report can be found here: May 2019, June 2019, July 2019, August 2019, September 2019, October 2019, November 2019, December 2019, January 2020, February 2020, March 2020, April 2020, May 2020, June 2020, July 2020, August 2020, September 2020, October 2020, November 2020, December 2020, January 2021, February 2021, March 2021, April 2021, May 2021, June 2021, July 2021, August 2021, September 2021, October 2021, November 2021, December 2021, January 2022, February 2022, March 2022, April 2022, May 2022, June 2022, July 2022, August 2022, September 2022, October 2022, November 2022, December 2022, January 2023, February 2023, March 2023, April 2023, May 2023, June 2023, July 2023, August 2023, September 2023, October 2023, November 2023, December 2023, January 2024, February 2024, March 2024, April 2024, May 2024, June 2024.

Wheaton Precious Metals remains the biggest precious metals R&S company, with a market capitalization of more than $27 billion. Franco-Nevada is second with less than $25 billion. Not many changes occurred in the structure of the industry in July. Only Osisko outgrew Triple Flag Precious Metals Corp. (TFPM), and Orogen Royalties Inc. (OTCQX:OGNRF) outgrew Trident Royalties Plc (OTCQB:TDTRF). The smallest of the companies is still Star Royalties Ltd. (OTCQX:STRFF), with a market capitalization of slightly less than $15.5 million.

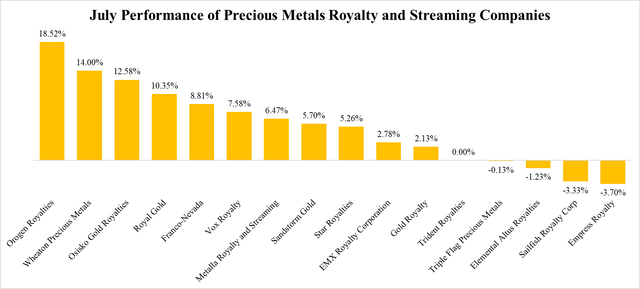

July was successful for the precious metals R&S companies. Out of 16, 11 ended in green numbers, one remained flat, and only four recorded a share price decline. And while the biggest gain amounted to 18.52% (Orogen), the biggest loss was only 3.7% (Empress Royalty Corp. (OTCQX:EMPYF)). Orogen’s performance was supported by several positive news, including a new discovery at First Majestic Silver Corp.’s (AG) Ermitano mine.

In July, the share price of the SPDR Gold Shares ETF (GLD) grew by 5.37%, and the share price of the iShares Silver Trust ETF (SLV) declined by 0.68%. The precious metals miners did well, with the VanEck Gold Miners ETF (GDX) and the VanEck Junior Gold Miners ETF (GDXJ) up by 11.79% and 9.62% respectively. Very nice returns were also recorded by the precious metals R&S companies. The Precious Metals R&S Index grew by 11.2%, and the Precious Metals R&S Equally Weighted Index grew by 5.36%. The Precious Metals R&S Equally Weighted Index even set a new record high.

The July News

The news flow improved notably in July. Besides preliminary Q2 operating results, also several deals and portfolio updates were announced. The biggest news is Franco-Nevada’s and Osisko’s $750 million Cascabel gold stream purchase.

Franco-Nevada Corporation (FNV) along with Osisko Gold Royalties Ltd (OR) announced the acquisition of a gold stream from SolGold Plc’s (OTCPK:SLGGF) Cascabel copper-gold project. The stream acquisition will be financed, and the stream will be divided on a 70:30 basis. The overall financing package will amount to $750 million ($100 million pre-construction financing and $650 million construction financing), of which, $525 million ($70 million + $455 million) will be provided by Franco-Nevada and $225 million ($30 million + $195 million) will be provided by Osisko. Cascabel is a world-class project with measured and indicated resources of 31.3 million toz gold, 91.3 million toz silver, and 27.3 billion lb copper. Franco-Nevada will be entitled to 14% of gold produced in concentrate until 525,000 toz gold have been delivered, and to 8.4% thereafter. Osisko will be entitled to 6% until 225,000 toz gold has been delivered, and to 3.6% thereafter. The ongoing payments will amount to 20% of the prevailing spot gold price. Based on the PFS figures, the mine should be producing 253,000 toz gold per year on average over the initial 28-year mine life. However, over the first 10 years, the production should average 392,000 toz gold per year. At this production rate, Franco-Nevada and Osisko Gold Royalties would be entitled to approximately 55,000 toz gold and 23,500 toz gold respectively.

The company also announced that it will release its Q2 financial results on August 13, after the market close.

Wheaton Precious Metals Corp. (WPM) announced that it will release its Q2 financial results on August 7, after the market close.

Royal Gold, Inc. (RGLD) reported that its Q2 gold equivalent sales amounted to 52,600 toz, including 39,200 toz gold, 593,200 toz silver, and 1,500 tonnes of copper. The company will release its Q2 financial results on August 7, after the market close.

Triple Flag Precious Metals Corp. (TFPM) reported Q2 sales of 27,192 toz of gold equivalent (59% gold, 41% silver), resulting in a record-high revenue of $63.6 million. Also, Triple Flag will release its Q2 financial results on August 7, after the market close.

The company also announced that its CEO Shaun Usmar, who is stepping down to assume a new leadership role with a major diversified mining company, will be replaced by Sheldon Vanderkooy one of Triple Flag’s founders.

Osisko Gold Royalties Ltd (OR) announced the Cascabel gold stream acquisition, as mentioned above. The company also reported that it earned 20,068 toz of gold equivalent in Q2. The preliminary revenues amounted to C$64.8 million ($46.8 million). The company held cash of C$65.7 million ($47.5 million) as of the end of Q2. Osisko will release its Q2 financial results on August 6, after the market close.

Sandstorm Gold Ltd. (SAND) reported Q2 sales of approximately 17,400 toz of gold equivalent and preliminary revenues of $41.4 million. Sandstorm will release its Q2 financial results on August 1, after the market close.

Gold Royalty Corp. (GROY) reported preliminary Q2 revenue of $2.2 million. The numbers should keep on improving over the coming quarters along with the ramp-up of the Cote mine. Gold Royalty will release its Q2 financial results on August 13, after the market close.

Metalla Royalty & Streaming Ltd. (MTA) announced that G Mining Ventures Corp. (OTCPK:GMINF) poured the first gold (440 toz) at the Tocantinzinho mine. Metalla holds a 0.75% Gross Value Royalty on the property.

Vox Royalty Corp. (VOXR) announced that at the Bulong deposit, gold production should start in September. Vox holds a 1% NSR royalty over Bulong. At Plutonic East (Vox holds a sliding-scale grade-linked tonnage royalty over a portion of the project), production should start in Q1 2025. On the other hand, the ramp-down process has been initiated at the Koolyanobbing iron ore mine, where Vox holds a 2.0% FOB revenue royalty.

The company also announced that it will release its Q2 financial results on August 7, after the market close.

Trident Royalties Plc (OTCQB:TDTRF) provided a timeline regarding the process of its acquisition by Deterra. If everything goes according to plan, Trident’s shares should stop training on September 2.

Sailfish Royalty Corp. (OTCQX:SROYF) announced a normal course issuer bid that enables it to purchase up to 3,539,756 shares (approximately 5% of issued and outstanding shares of the company). The scheme is valid until July 21, 2025.

Orogen Royalties Inc. (OTCQX:OGNRF) provided an exhausting update regarding its exploration stage assets. Its partners will fund around 30,000 meters of drilling across seven properties in 2024.

On July 31, Orogen announced a new gold-silver discovery at Ermitano, where Orogen holds a 2% NSR royalty. First Majestic Silver Corp. (AG) made some interesting drill intersections including 8.15 g/t gold and 427 g/t silver over 4.78 meters, or 54.93 g/t gold and 399 g/t silver over 1.82 meters, only 500 meters to the southwest of the Ermitano mine.

Elemental Altus Royalties Corp. (OTCQX:ELEMF) announced that Allied Gold Corp. (OTCPK:AAUCF) is conducting a 12,000-meter drill campaign aimed at expanding the gold resources at Diba, where Elemental holds a 2% NSR royalty. Elemental also announced that the maturity of its $50 million credit facility has been extended from December 2025 to June 2027.

On July 22, Elemental Altus announced the acquisition of a 4% NSR royalty over the Mactung tungsten project, and a 1% NSR royalty over the Cantung tungsten project, for $4.5 million in total. The Mactung project is more advanced, Fireweed Metals Corp. (OTCQX:FWEDF) plans to release an updated PEA later this year.

The August Outlook

In August, the majority of news should be focused on the Q2 financial results. Although some new deals cannot be excluded, they will hardly reach the magnitude of the recent Cascabel deal. The gold price remains close to its record highs. Any breakout to new highs should be positive for the precious metals R&S companies. On the other hand, the broader market sentiment turned pretty negative over the last couple of days, which weighs on the share prices heavily. The good thing is that market turbulences and potential interest rate cuts should be positive for gold prices. So even if the share prices of the precious metals R&S companies decline in the near term, their financial results should improve, which is positive from the long-term perspective.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.