(Bloomberg) — For Soroban Capital Partners founder Eric Mandelblatt, the future growth of stock-picking hedge funds won’t come from hedging.

Most Read from Bloomberg

“Where the world is heading, I think long-short will struggle to be a growth asset class,” Mandelblatt, who’s also Soroban’s chief investment officer, told Bloomberg in a rare interview.

Institutional investors such as pensions and endowments are increasingly putting their money into large, market-neutral multistrategy funds and long-only funds that only bet on stocks rising, according to Mandelblatt. Those investors choose long-only funds because they’ve struggled to capture benchmark-beating gains themselves, he said.

“The capital will increasingly flow to the ends of the barbells: the pod shops and long-only stock-pickers,” said Mandelblatt, whose firm oversees $10 billion.

Multistrategy funds have surged in popularity, with many doubling their assets in recent years. Meanwhile, Mandelblatt, 49, says he’s seeing demand for long-only strategies first-hand. Last year, Soroban raised about $4.5 billion for a long-only fund in just nine months after his investors asked him to create a carve-out from his hedge fund.

The vehicle now makes up almost half of the firm’s assets. Mandelblatt sees the majority of Soroban’s growth coming from the long-only pool and thinks it will soon become its largest vehicle, he said. Since its launch in April, the fund has gained 15.1% through December, according to an investor document seen by Bloomberg.

Meanwhile, short selling — betting that a company’s stock will fall — can be a tough strategy to pull off in a bull market. Mandelblatt said shorts are less compelling since they don’t benefit from compounding returns. The upside is capped at 100% and the downside is potentially unlimited, he added.

It’s part of the reason that Soroban has kept its short bets small, though Mandelblatt said they’ve still beaten benchmarks.

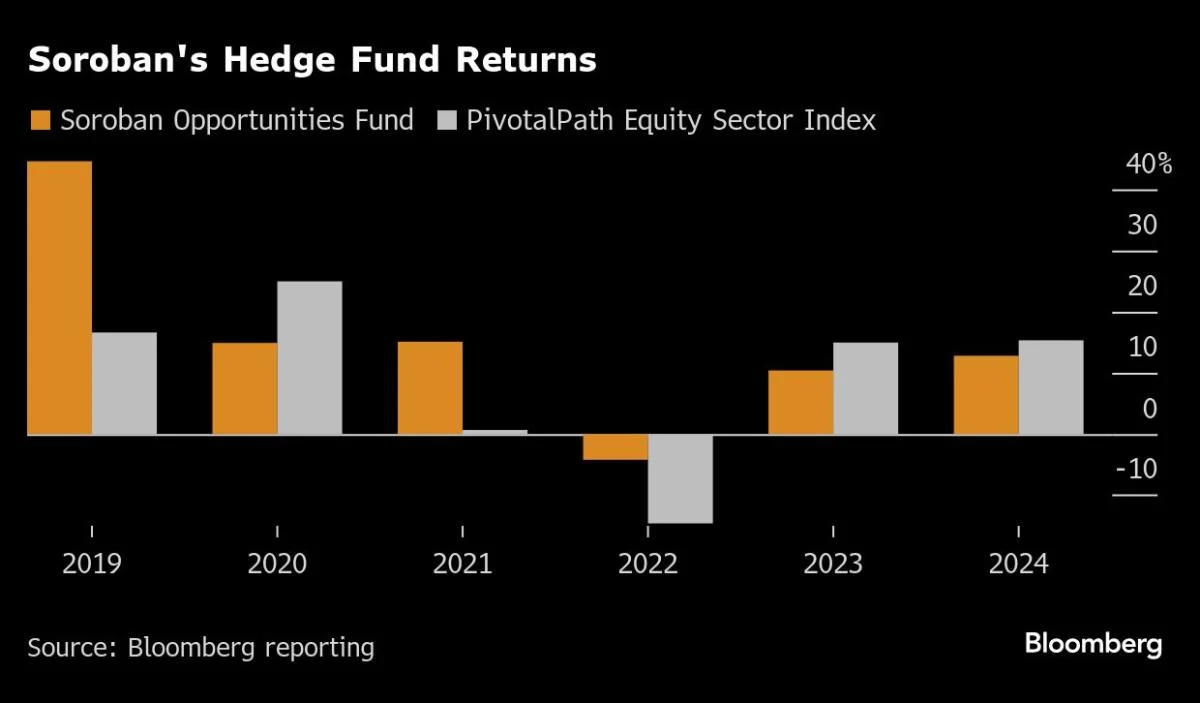

He remains “committed and enthusiastic” about the firm’s long-short Opportunities Fund and expects continued inflows into the vehicle, he said. A composite of Soroban’s Opportunities Fund and its earlier Master Fund has gained 13% annualized since inception in late 2010.

The MSCI Index of developed and emerging markets rose an annualized 10% over that time, while the PivotalPath Equity Sector Index gained 9.7%.