Several investment banks including Goldman Sachs suffered bond trading losses in early April before staging a recovery later in the month following a brutal selloff in global debt markets that also heaped pain on some prominent hedge funds.

Goldman sustained more than US$100m in mark-to-market losses at the height of the volatility around April 10 from bonds and derivatives linked to US and Japanese interest rates, according to sources familiar with the matter. The bank has since recouped those losses, as its broader trading business performed well overall in April amid the volatility, sources said. It was a similar pattern for other banks: an initial hit, then a strong rebound.

A Goldman spokesperson declined to comment. Chief executive David Solomon said on an April 14 earnings call that the bank’s markets business was performing “very well” – a trend that appears to have extended across investment banks as client activity picked up after the initial US tariff announcement on April 2.

Many banks and investors struggled to cope with wild swings across global bond markets that followed US president Donald Trump’s announcement of sweeping tariffs, which he subsequently rowed back a few days later when they were due to be implemented.

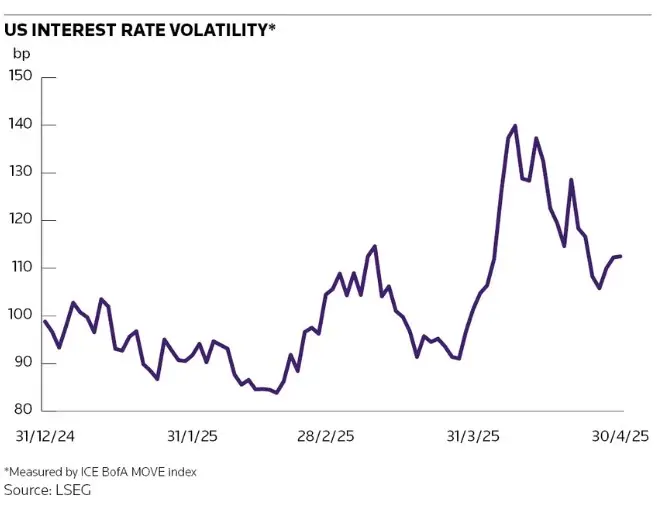

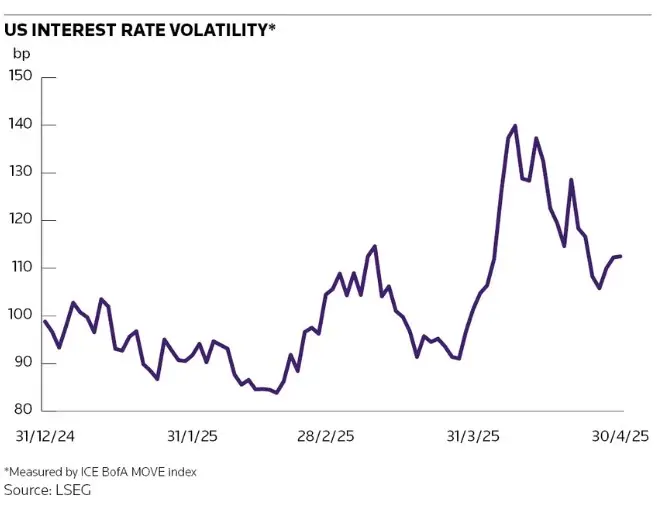

Ten-year Treasury yields rose 50bp in the space of a week to 4.50% on April 11 but had fallen back to about 4.20% last Friday, while the ICE BofA MOVE Index – which measures US interest rate volatility – jumped to its highest level since October 2023.

Some of the biggest losses were concentrated among hedge funds. Bloomberg News reported last month that a bond trader at Tudor Investment Corporation, which it said manages US$16bn in assets across the firm, lost about US$140m in early April before recovering somewhat.

Millennium Management also took a roughly US$100m mark-to-market hit on positions linked to US and Japanese interest rates, sources said. The hedge fund giant, which manages around US$73bn in assets, rebounded relatively quickly, sources said. A spokesperson for Millennium declined to comment.

“Overall, this was a big negative for the industry,” said a markets veteran, albeit one that was quickly reversed for most.

Japan losses

Much of the financial market commentary at the time of the selloff focused on the so-called Treasury basis trade, in which investors take leveraged bets on discrepancies between Treasuries and futures prices. However, traders say sharp moves in Japanese debt markets proved more damaging for some firms, including a widening in the basis between yen interest rate swaps and Japanese government bonds.

“The first half of the week was dominated by derisking, liquidations and stop-outs,” JP Morgan interest rate strategists wrote on April 11 on the moves in Japanese markets.

Deutsche Bank sustained mark-to-market losses in bond and derivative positions linked to Japanese interest rates in early April, sources said, before regaining ground as the month progressed. A Deutsche spokesperson declined to comment.

Deutsche executives acknowledged on the bank’s April 29 earnings call that its fixed-income and currencies trading unit had seen some “weaker days” in the first half of the month, but said it had since normalised and stood to record better revenues for April than the previous year.

“We look at this with sort of a relaxed view. Naturally in markets that are as turbulent as the ones we experienced in the first couple of weeks of April, you’re going to see some correlations break down, some impact on the books, but we were reasonably happy [with the trading performance],” said James von Moltke, Deutsche’s chief financial officer. “We’re well positioned to recapture the forgone revenues from the first half of April in the balance of the quarter.”

Nomura sustained some mark-to-market losses in products linked to Japanese interest rates in the early days of April, sources said, before staging a recovery as the month wore on. That hasn’t detracted from an otherwise strong period for Nomura’s broader global markets division, sources said, which registered its best performance for the month of April in several years amid a concerted push across sales and trading.

Barclays was another bank to sustain some mark-to-market losses in products linked to Japanese interest rates in early April, sources said, before rebounding strongly.

Spokespeople for Barclays and Nomura declined to comment.

Short-term pain

It is not unusual for bank trading desks to lurch into the red when there are sudden market reversals because of their tendency to take risk positions in anticipation of activity from institutional and corporate clients. Depending on how they’re managed, these mark-to-market losses can sometimes reverse if markets rebound. Trading desks can also profit in the aftermath of such events when bid-offer spreads widen and client activity increases as investors adjust to the new outlook.

“Anytime you have an exogenous shock it’s always hard for anyone in the reinsurance business,” Goldman’s co-head of global banking and markets Ashok Varadhan said in a 2023 interview shortly after the bank’s rates trading desk reportedly took a roughly US$200m hit during the US regional banking crisis. “Once you reach [a] new equilibrium, there’s a lot of business to do.”

Solomon struck a positive note about the bank’s markets business on the earnings call after reporting a strong first quarter. “We’re early in the quarter but so far the business is performing very well and clients are very active,” he said.

European banks have also made hay in the high-volatility trading environment that has characterised the start of 2025. Barclays and Deutsche reported respective 21% and 17% rises in first-quarter fixed-income trading revenue, comfortably outstripping the average 6% growth at the big five US banks.

Among other things, Deutsche capitalised on the volatility in European bond markets following the German government-in-waiting’s surprise announcement of a nearly €1trn fiscal bazooka in March, sources said.

Source: IFR