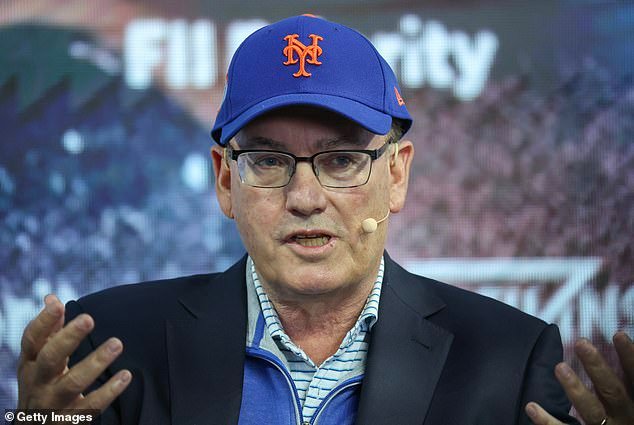

As Wall Street revels in steady — though slow — gains, Steve Cohen, the billionaire behind Point72 Asset Management and the owner of the New York Mets, isn’t so optimistic.

With a net worth of $14.8 billion, Cohen’s insights carry weight. The billionaire has expanded his net worth through several boom and bust cycles in the U.S. economy.

In rare public commentary on the state of the economy, Cohen expressed concerns about short-term market stability.

‘I think the best gains have been had,’ Cohen said during a summit in Miami. ‘It wouldn’t surprise me to see a significant correction.’

He said three main policy frameworks from the Trump administration are giving him pause.

Cohen said tariffs will increase prices. He said immigration policies will depress a jobs market that already has a shortage of workers.

He also worried that consistent federal job cuts from Elon Musk’s DOGE threaten to stem the flow of cash in certain markets.

‘Tariffs cannot be positive, I mean it’s a tax,’ he told viewers at the meeting. ‘On top of that we have slowing immigration, which means the labor force will not grow as rapidly as… over the last five years.’

Steve Cohen, the billionaire owner of the New York Mets, said he is uncertain about the economy’s growth future

So far, Wall Street has cautiously ticked higher in the new year – though, not as fast as other global markets

At Point72, Cohen’s team now predicts a sharp decline in U.S. economic growth, forecasting a drop from 2.5 percent to just 1.5 percent by the latter half of the year.

The economy grew at 2.8 percent in 2024 and 2.9 percent in 2023.

Other major investors are also pointing to potentially worrying signs as they warn about potential stock crashes.

Bank of America said that some of the nation’s biggest companies are suffering from ‘stock fragility’ as their market values rise well above their revenues.

Jamie Dimon, the JPMorgan Chase CEO, recently said stock prices are ‘kind of inflated, by any measure.’

Even Warren Buffett, the most iconic investor of our time, has pointed to the ‘Buffett Indicator’ as a potential sign of weakness.

The indicator compares the market cap of all the publicly traded stocks in the US to the country’s gross domestic product. A perfect economy runs close to a one-for-one ratio, according to Buffett.

The market cap is currently twice the gross domestic product.

Cohen doesn’t predict a huge market downturn – still, he believes that policies will slow stocks

Wall Street is keeping a close eye on the economy after several stores posted weaker-than-expected sales in January

Cohen’s predictions are also matching some recent speculations from major corporate players in the U.S.

Walmart, which has seen record sales growth since 2020, has also predicted a slowdown in growth.

The low-cost retailer expects sales growth of three to four percent in the year ahead. The new prediction is paltry compared to last year’s 9.7 percent growth.

Economists turn to Walmart as a bellweather for the overall economy, given its massive footprint of stores in America and its blend of essential groceries and discretionary products.

‘We have to acknowledge that we are in an uncertain time and we don’t want to get out over our skis here,’ Walmart’s CFO, John David Rainey, said during the company’s recent earnings call.

Other retailers are also reporting weaker demand throughout the U.S.

Texas Roadhouse, Applebee’s, and TGI Fridays all reported lower-than-expected sales in the first part of the year. Some are even shuttering stores in response.

Still, Cohen said he isn’t expecting a ‘disasterous’ downturn in the markets. Instead, he predicts that growth will continue to slow, even for major retailers.

‘I think this is one of those moments where there’s really a lot of uncertainty and I have pretty strong views here,’ he said.