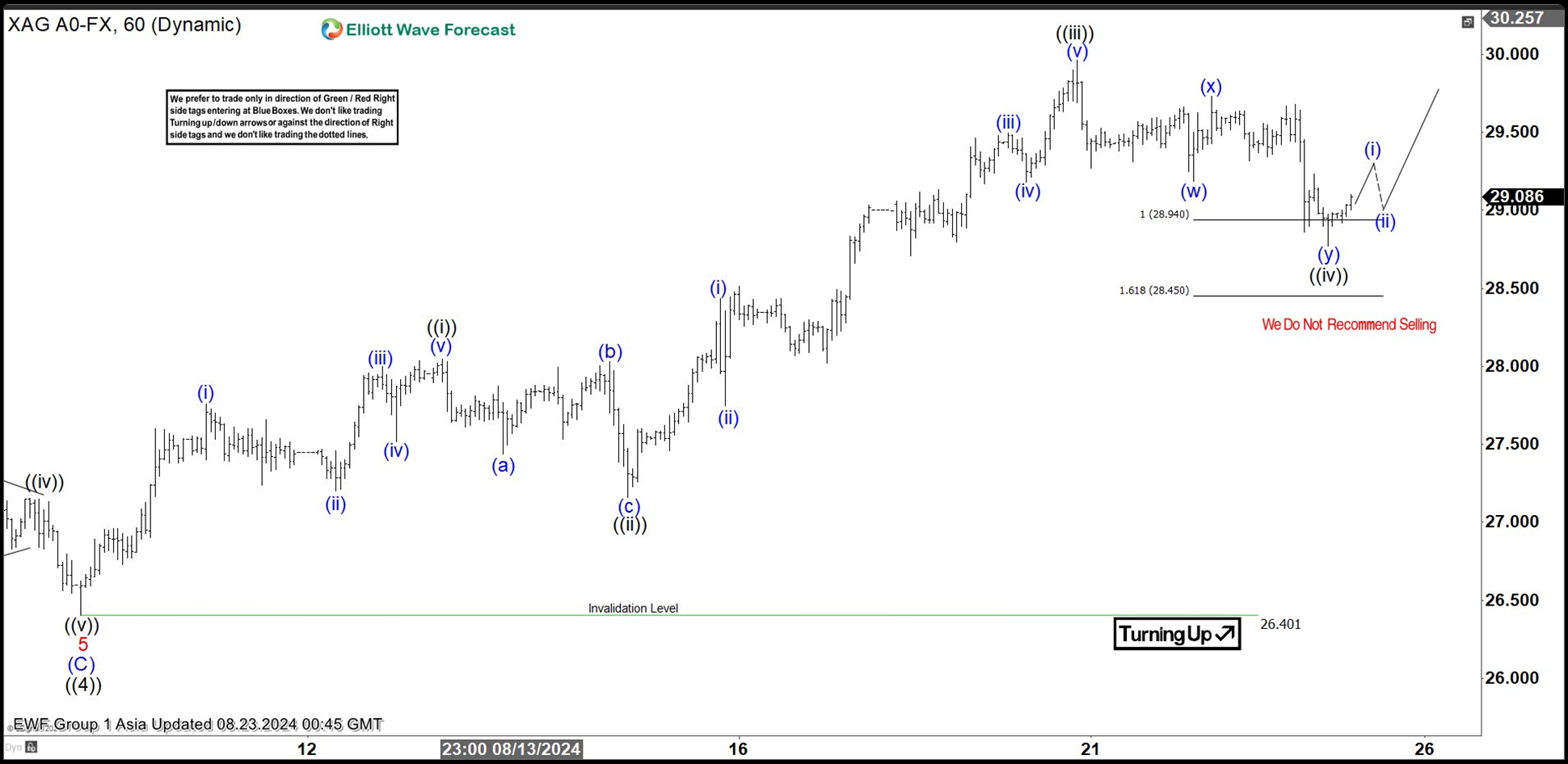

Short term Elliott Wave in Silver suggests that rally to 5.20.2024 high at 32.51 ended wave ((3)). Pullback in wave ((4)) ended at 26.4 as the 1 hour chart below shows. The metal has turned higher in wave ((5)), but it still needs to break above wave ((3)) at 32.51 to rule out a bigger double correction. Up from wave ((4)), wave (i) ended at 27.74 and wave (ii) dips ended at 27.2. Wave (iii) higher ended at 28, pullback in wave (iv) ended at 27.51. Final leg wave (v) ended at 28.04 which completed wave ((i)) in higher degree.

Pullback in wave ((ii)) ended at 27.16 with internal subdivision as a zigzag structure. Down from wave ((i)), wave (a) ended at 27.43 and wave (b) ended at 28.03. Wave (c) lower ended at 27.16 which completed wave ((ii)). The metal then resumed higher in wave ((iii)). Up from wave ((ii)), wave (i) ended at 28.43 and wave (ii) pullback ended at 27.74. The metal extended higher in wave (iii) towards 29.49 and dips in wave (iv) ended at 29.18. Final leg wave (v) ended at 29.96 which completed wave ((iii)) in higher degree.

Pullback in wave ((iv)) unfolded as a double three Elliott Wave structure. Down from wave ((iii)), wave (w) ended at 29.19 and wave (x) ended at 29.73. Wave (y) lower ended at 28.77 which completed wave ((iv)). Near term, as far as pivot at 26.4 low stays intact, expect pullback to find support in 3, 7, or 11 swing for further upside.

Silver (XAG/USD) 60 minutes Elliott Wave chart

XAG/USD Elliott Wave [Video]