- XAU/USD jumps over 1% as global tensions mount, stocks slide, and US Dollar weakens.

- Trump’s 25% auto tariffs spark trade war jitters, driving safe-haven demand for Gold to new all-time highs.

- Risk appetite crumbles as Wall Street dips and DXY reverses.

- Traders await US Core PCE inflation amid firm jobs data and 64.5 bps of Fed cuts priced for 2025.

Gold price uptrend continued on Thursday with the yellow metal hitting a new record high of $3,059 amid uncertainty over trade policies enacted by US President Donald Trump, which escalated the trade war by imposing tariffs on automobiles. The XAU/USD trades at $3,051, up more than 1%.

Tariffs continue to drive price action, following Trump’s announcement of 25% duties on cars and automotive parts not manufactured in the United States (US). As uncertainty rises, Bullion traders bought the precious metal, which extended its gains past $3,050.

Consequently, risk appetite deteriorated with Wall Street trading in the red. The Greenback is also feeling the pain as the US Dollar Index (DXY), which measures the performance of the buck against a basket of six currencies, makes a U-turn, dropping 0.33% to 104.31.

This sparked reactions from global governments with Canada and the European Union (EU) threatening to retaliate against Trump’s actions.

The US labor market remains firm, following the unemployment claims report for the last week, while the economy remains strong after the release of Gross Domestic Product (GDP) data for the last quarter of 2024. Housing data improved but confirmed the slowdown in the housing market.

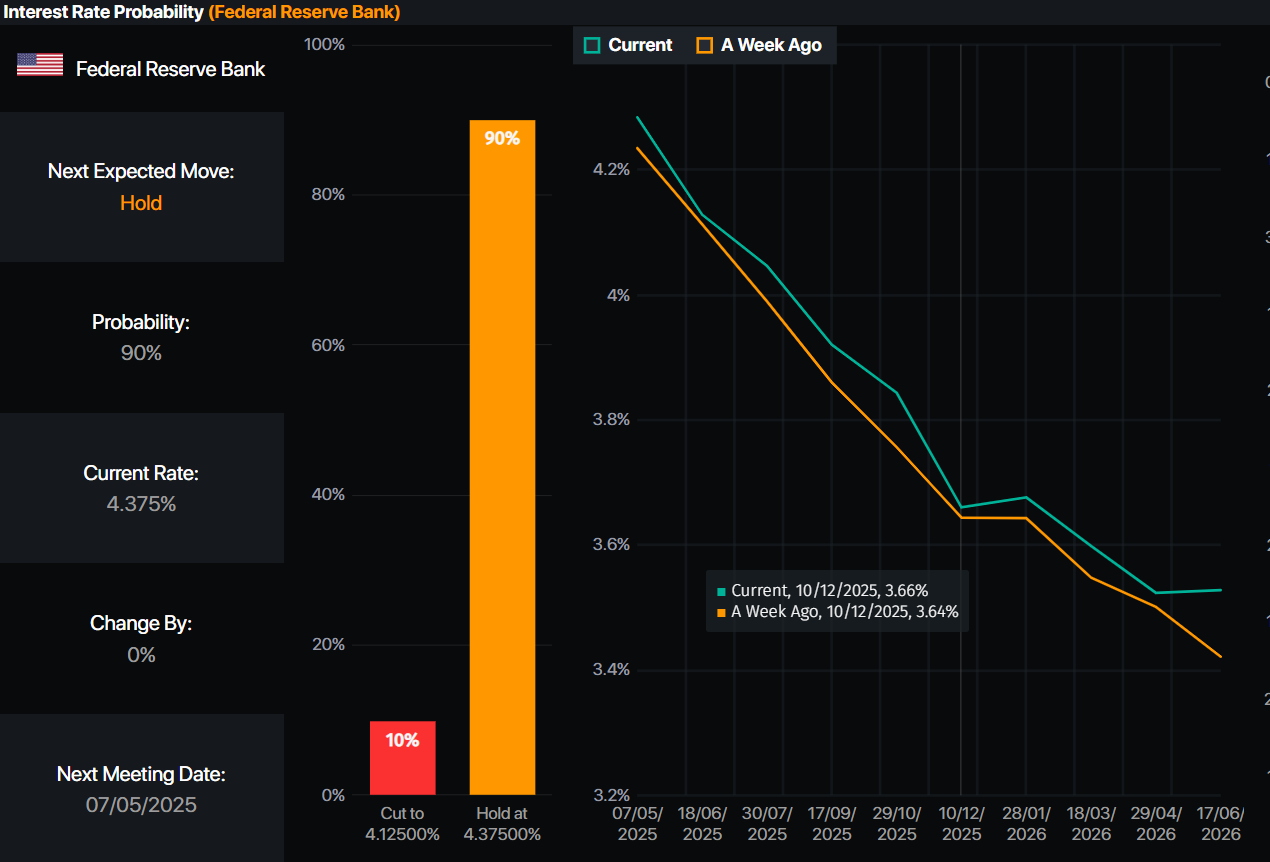

Meanwhile, money markets have priced in 64.5 basis points of Fed easing in 2025, according to Prime Market Terminal interest rate probabilities.

Source: Prime Market Terminal

Aside from this, traders’ focus shifts to the announcement of the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index.

Daily digest market movers: Gold price trades firm near $3,000, unfazed by Trump’s comments

- The US 10-year T-note yield is almost flat, up one basis point at 4.371%. US real yields edge down one bps to 1.979%, according to US 10-year Treasury Inflation-Protected Securities (TIPS) yields.

- US Initial Jobless Claims for the week ending March 22 rose to 224K, slightly below expectations of 225K, signaling continued strength in the labor market.

- The final reading of Q4 2024 GDP came in at 2.3% QoQ, up from the previous estimate of 1.9%, though just below the forecast of 2.4%.

- Pending Home Sales declined 3.6% YoY in February, marking an improvement from January’s steeper 5.2% drop, suggesting a modest recovery in housing activity.

XAU/USD technical outlook: Gold price rallies past $3,050

Gold price registered a new all-time high (ATH) of $3,059 as Trump provided the awaited catalyst before the release of PCE inflation figures on Friday. As the yellow metal reaches a new milestone, it sees that buyers are stepping in, putting a test of $3,100 in the near term back on the table.

The Relative Strength Index (RSI) suggests that buyers are gathering steam with the index turning overbought. Nevertheless, traders should be aware that in aggressive movements, the most extreme level would be 80.

The next resistance for XAU/USD would be $3,059. A breach of the latter will result in a $3,100 exposure. Conversely, Gold’s first support is $3,050. Once cleared, the next stop would be $3,000, followed by the February 24 swing high at $2,956, then the $2,900 mark and the 50-day Simple Moving Average (SMA) at $2,887.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.