Davidson Kempner Capital Management was identified as the funder behind patent cases against Amazon’s Audible Inc. last month, the first time the $35 billion hedge fund was publicly outed as a player in litigation finance.

It’s a rare spotlight on hedge funds’ role in the outside backing of lawsuits, a now $16.1 billion industry that private equity firms and multi-strategy investment managers have been cashing in on for years. Funders dedicated to the sector actively market their services to law firms, but some asset managers choose to remain below the fray with their presence only revealed in court documents or regulatory filings, if at all.

“The market for capital and litigation finance is much larger than just the traditional litigation funders that advertise,” said Rebecca Berrebi, a litigation finance broker.

Asset managers often operate as limited partners investing in dedicated litigation finance funds, but they also directly back law firms and cases. Hedge funds co-invest with funders on deals to bankroll mass tort law firms or use insurance policies as collateral for loans. Berrebi says the private credit space is well suited to invest in litigation finance transactions, particularly portfolios.

BlackRock, Ellington Capital, Cliffwater, and Gramercy Funds Management also invest in court fights and the lawyers behind them.

BlackRock didn’t respond to a request for comment. Davidson Kempner, Ellington Capital, Cliffwater, and Gramercy Funds declined to comment.

Some may deliberately avoid the limelight. Soros Fund Management has an analyst handling litigation finance and private credit, according to LinkedIn. He updated his profile to remove the reference shortly after Bloomberg Law reached out.

Funds’ preference to remain in the background could be because financing litigation is overall a small portion of their portfolios. Or because some funders could be backing litigation against companies in which they separately invest. Davidson Kempner last year added a stake in Audible owner Amazon.com, according to a public filing.

Taking on Big Tech

Davidson Kempner is financing Audio Pod IP LLC’s suits against Audible Inc. through an LLC, according to the court filing. Lawyers for Audible outed the company in a countersuit filed in a federal court in Manhattan.

“Audio Pod deliberately reached out beyond its state of formation in Virginia to exploit New York’s robust financial market and obtain funding for its patent-assertion campaign against Audible,” they said.

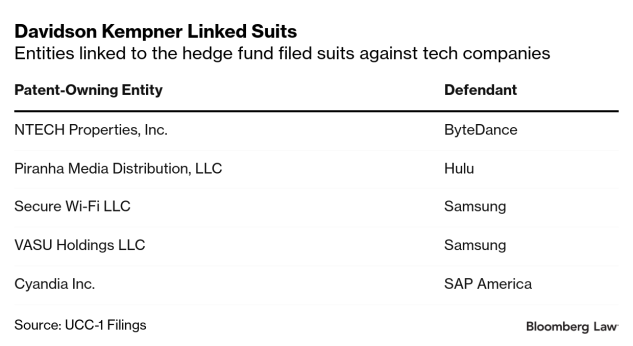

Audio Pod isn’t the only patent-owning entity with ties to Davidson Kempner, public filings show. Davidson Kempner is linked to five other patent-owning entities that have sued major technology companies including Samsung, Hulu, and TikTok owner ByteDance.

The patent holders are NTECH Properties, Cyandia, Inc, Piranha Media Distribution, Secure Wi-Fi LLC, and Vasu Holdings.

Instead of having a fund dedicated to litigation finance, some investment managers direct portions of their credit or alternatives fund toward litigation.

BlackRock revealed in SEC filings last year that it may use part of its credit fund to provide capital to plaintiffs and law firms. The financing is non-recourse, the company said, meaning it risks a complete loss if the cases it backs fail.

Investment firm Cliffwater has a piece of funder Gramercy’s deal with UK law firm Pogust Goodhead according to a 2024 report. Gramercy announced in 2023 that it provided a $552.5 million loan to Pogust Goodhead, claiming at the time that it was the largest loan of its kind. At least $14 million of that came from Cliffwater, which contributed via two separate securities.

“A lot of these larger funds have gotten into litigation finance sort of opportunistically,” said Berrebi. “They’re not necessarily seeking it out, but it has come across their desk or they know somebody who’s doing it.”

Testing Mass Tort Waters

The mass tort market has been a huge target for litigation finance, with other capital sources also getting behind the suits.

Michael Kelley, a partner at Parker Poe who advises on funding deals, says he’s seen institutional capital enter the space to provide dedicated marketing financing to mass tort law firms. Marketing is used to find clients for various torts by advertising on television, radio, and social media. He said they will invest alongside others or alone and provide smaller amounts, between $10 and 20 million. The capital is spread among different law firms and cases.

“It allows natural diversification, it allows them to get exposure into the mass tort space,” said Kelley. “It’s been a way for certain institutional investors to dip their toe in the US mass tort market.”

Dedicated litigation funders were initially territorial, but have warmed up, Kelley said.

“We had some of the big traditional litigation funders out there who are regularly doing these large mass tort loans sort of say, ‘no we’re not gonna let anybody in the door,’” he said. “Then we explain to them that, well, think about it. You’re not paying for this marketing.”

Ellington Capital, which has $13.8 billion in assets under management, was revealed as a funder of a law firm involved in the Johnson & Johnson talcum powder litigation last year.

Alabama’s Beasley Allen sued Smith Law Firm and Porter Malouf last year, alleging that the firms owe it more than $1 million in litigation expenses related to the J&J case. Beasley Allen also says Smith Law and its founder Robert Allen Smith pushed clients to vote in favor of a controversial settlement deal because of pressure to pay off a large debt—”perhaps as high as $240 million”—to its outside litigation funder.

Law firms and funders have faced issues with delays in payouts from long-running mass tort cases. The result has been more refinancing in the market. Kelley says other types of capital in the market could help with these issues.

“There is an opportunity in the industry for long-dated capital to come in, help certain of the lenders and funders who’ve been in it for a while to take some risk off the table,” he said.