BEULAH, N.D. — A retired North Dakota coal mine is set to become the new home of a nickel processing plant.

Minnesota-based Talon Metals and Westmoreland Mining Co. signed an agreement Wednesday that gives Talon the sole rights to purchase 256 acres of the Beulah Mine along with 7 miles of a nearby rail line. The company hopes to have the facility operational by late 2028.

The 9,000-acre Beulah Mine was shut down by Westmoreland a few years ago after the company filed for bankruptcy in 2019. Today, the area is still home to numerous coal plants and mines, but the closure of Westmoreland and a few power plants has fueled anxiety among officials about the future of the region.

Thanks to an allocated $115 million from the 2021 federal Bipartisan Infrastructure Law, a huge planned private investment from Talon for the $365 million plant, and a push by the city’s economic development director, Beulah will be home to the second nickel processing plant in the country.

“It’s never done until it’s done and so there could always be issues, but when you start talking about national security and what it means to our country, there’s a lot of support behind this project,” said Granville Brinkman, Beulah’s economic development director.

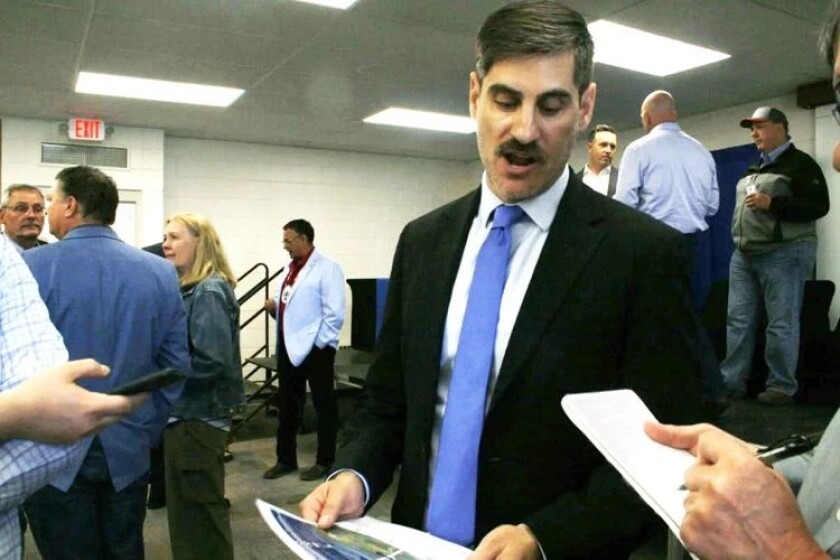

The signing ceremony took place in Beulah, where Gov. Kelly Armstrong and all three members of North Dakota’s congressional delegation spoke.

Joey Harris / The Bismarck Tribune

“We mourned the closing of Westmoreland Mine and the overseeing of that process. We knew what a big deal it was going to be to the community to lose that, and here we are,” said Rep. Julie Fedorchak, R-N.D., who prior to taking office in the U.S. House regulated coal mines as part of the state Public Service Commission.

Talon’s facility will primarily produce nickel concentrate, a key component in batteries. Talon has already entered into a contract to sell 75,000 metric tons of nickel, as well as other byproducts, to electric car manufacturer Tesla over six years.

Other minerals such as iron and copper are expected to be processed at the facility, too. The company is also looking into using the waste from mineral processing and with fly ash — waste from burning coal — to create cement.

Domestic extraction and processing of critical minerals such as nickel have become policy priorities among lawmakers and industry officials who are seeking to shore up supply chains. These minerals are key to numerous military technologies and are used for clean energy applications, too, such as the batteries needed for electric vehicles, and energy storage that helps the reliability of renewables.

The United States is heavily reliant on foreign countries for battery production and the critical minerals that batteries are made from. The project represents an effort to pursue more U.S.-based battery manufacturing under the 2021 infrastructure law. The legislation made $2.8 billion in federal dollars available for plants such as Talon’s.

To officially start building, Talon will need to meet state regulatory requirements at the PSC and the Department of Environmental Quality. Talon will also have to receive approval under the federal National Environmental Policy Act process because of the federal money that is involved.

The company faces a somewhat more challenging permitting process in Minnesota, where the nickel is set to come from. Its permit to extract nickel from the Tamarack Mine in the Iron Range has been in a scoping phase of an environmental review process at the Minnesota Department of Natural Resources for around two years.

Talon President Mike Kicis told the Tribune that the scoping phase does not have a set timeline, but the next step in environmental permitting does, and the company expects to be in that phase by the end of the year. He said that Minnesota state regulators have been impressed by the company’s efforts to revise its mining plan for Tamarack compared to a traditional mine.

Joey Harris / The Bismarck Tribune

“It’s an underground mine (where) the tunnel comes straight into a building … This (building) is about the size of a Super Target, the ore gets crushed, the trains come right into the building and out,” he said. The goal of this design is to limit air and water pollution.

Kicis said there are places in Canada where the company could source nickel if Tamarack falls through.

When asked if the project would have been possible without the federal money, Kicis said, “I think it would have been a real challenge.”

“China and some of those competitors out in the world, they’ve got endless capital, but having the markets we do that are free and open, sometimes you need a little bit of that stimulation to get people to believe that it can happen here,” he said.

Armstrong, who was North Dakota’s sole U.S. representative until last year, did not vote for the infrastructure law. Sens. John Hoeven and Kevin Cramer did. Armstrong praised the work of the company, past governors and the congressional delegation on Wednesday.

“It’s easy to beat up on the federal government, and sometimes it doesn’t even matter who’s in charge, but without the (Energy Department’s) help, some of these things wouldn’t exist,” he said.

Part of what drove Talon to bring the plant to North Dakota was how dry it is. One of the main concerns related to the mining plan is Tamarack’s proximity to wetlands and other bodies of water. Processing the ore in North Dakota reduces that footprint. The state’s business-friendly regulatory environment drew the company in, too.

Talon expects the plant to create around 150 full-time jobs once it is built. That could create a big influx for Beulah, where the population is just over 3,000.

“We just had our housing study done. We need 352 new single-family and multi-family homes, and we’re working with a local developer right now to take and develop and build 85 of them,” said Brinkman, the economic development director.

North Dakota state Rep. Bill Tviet, R-Hazen, said he was looking forward to the project moving forward. Hazen has a population of about 2,300.

“Some (of my constituents) are very excited; some don’t understand it. There’s a fear of the unknown, but the longer I’ve worked with this, the more I see this is going to be positive,” he said.

Getting more houses built will be important if the plans that lawmakers have for the area are seen through.

North Dakota’s lignite coal holds other critical minerals that could be mined and processed in-state, and the Legislature recently passed a regulatory framework aimed at getting a mining process to go forward.

Other projects related to Talon’s could also spring up, Hoeven told the Tribune.

“We’re already talking to other companies about coming in here. This thing has big potential,” he said.