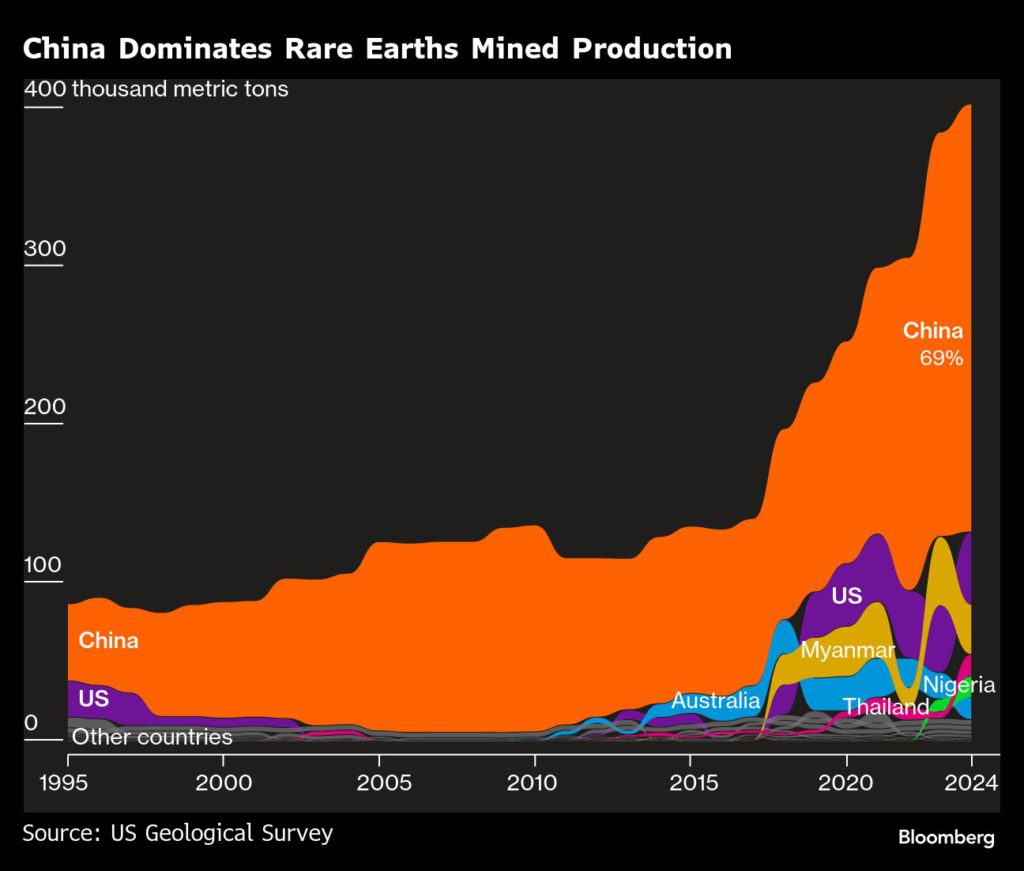

From fighter planes to nuclear reactor rods and smartphones, rare earth minerals are vital to a wide array of products. As geopolitical and trade tensions rise, China’s dominance of both mining and processing means these niche metals have become a cudgel to use against opponents.

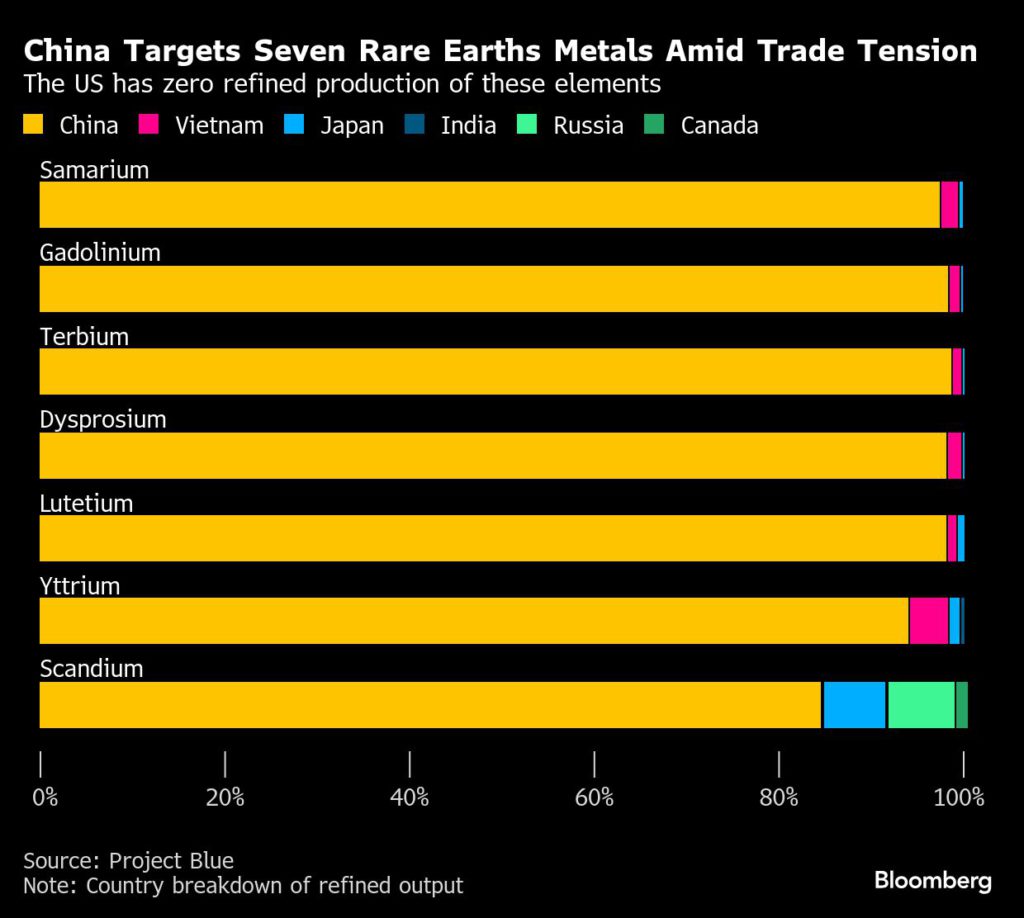

In response to punitive tariffs imposed by Washington, Beijing earlier this month added seven rare earths to its export control list. While the metals actually occur fairly commonly in the Earth’s crust, they are not frequently found in concentrated deposits. They can also require a multistep process to isolate individual elements — and China controls not only mining, but the vast majority of global refining capacity.

The US, meanwhile, has almost no processing ability for the targeted metals, according to data from consultancy Project Blue.

Beijing has said that it is establishing controls because the metals are used in advanced technologies and for powerful magnets, and so are considered dual-use items — meaning materials with civilian but also military applications.

“These products and elements directly impact the development of key technologies and supporting industries in other major markets,” said David Merriman, Project Blue’s research director. “This improves China’s leverage in any negotiations.”

Here are some of the main applications for the seven metals — out of 17 on the commonly accepted list of rare earths — that are now on Beijing’s restricted list.

Terbium

This soft, silvery metal can be found in light bulbs, while it also enables the vibrant colors on smartphone screens, according to the Royal Society of Chemistry. Terbium adds temperature resiliency to magnets used in aircraft, submarines and missiles. It’s “one of the hardest elements to source,” as it makes up less than 1% of the total rare earth content in most deposits, the US Department of Defense has said.

China exports as much as 85% of its terbium to Japan, while other destinations include South Korea and the US, which takes around 5%, according to Bloomberg calculations based on Chinese customs data.

Yttrium

Yttrium is used to treat liver cancer, and in the production of lasers for dental and medical surgeries. It also increases the strength of alloys, and its resistance to heat and shocks means its ideal for high-temperature superconductors.

Yttrium has been mined as a product at the Mountain Pass Mine in California, but concentrates are exported for processing as there’s no fully commercial separation facility in the US. Around 93% of US imports of yttrium compounds came from China in the four years through 2023, according to the US Geological Survey.

Dysprosium

The name of this bright metal is derived from the Greek for hard to obtain.

Resistant to high temperatures, dysprosium is mainly used in alloys for magnets deployed in motors or generators. It’s particularly important for the clean-energy transition as the magnets are used in wind turbines and electrical vehicles. A form of dysprosium can also be used in nuclear reactor control rods as it readily absorbs neutrons.

China ships over half of its dysprosium to Japan, and about a 10th to South Korea, while just 0.1% of that goes to the US. Australia’s Lynas Rare Earths Ltd. is expected to expand its plant in Malaysia to produce dysprosium and terbium by June.

Gadolinium

If you ever had an MRI scan, you may well have received an injection of a gadolinium-based dye, which reacts with magnetic forces to improve visibility of the body’s organs in medical imaging.

Gadolinium is also effective in enhancing the performance of alloys. Adding small amounts of the mineral can improve the resistance to high temperatures and oxidation, helpful for metals used to make magnets, electronic components and data storage disks.

Its neutron-absorbing capability also makes it an ingredient for the core of nuclear reactors.

Lutetium

This is a hard and dense metal, unlike most of the rest of the elements being targeted.

Lutetium is used a chemical catalyst fluid in oil refiners. The US buys almost all of its supply of the metal from China, which also exports a small amount to Japan.

Samarium

Samarium-cobalt alloys are on a US list of critical metals for potential stockpiling.

Once commonly found in headphones, it’s used in super magnets that are in turbines and cars, as well as having wider defense applications, because it can remain magnetic at higher temperatures. Samarium also goes into optical lasers and nuclear reactors.

Scandium

The metal is named after Scandinavia because it was first discovered in the Northern European region. Scandium can be extracted from mine tailings, or as a by-product of mining for uranium or other metals.

Baseball bats and bicycle frames may contain traces of scandium. Given its low density and high melting point, the metal is also used to make components for fighter planes. Its radioactive properties also makes it ideal as a tracer in oil refining, or in underground pipes for detecting leaks.

Scandium was last produced in the US more than 50 years ago, according to the USGS. For scandium and yttrium combined, the country now takes 14% of China’s exports, according to customs data, while Japan is the biggest buyer. In the European Union, there’s also no current production of scandium, but a project will be commissioned next year.

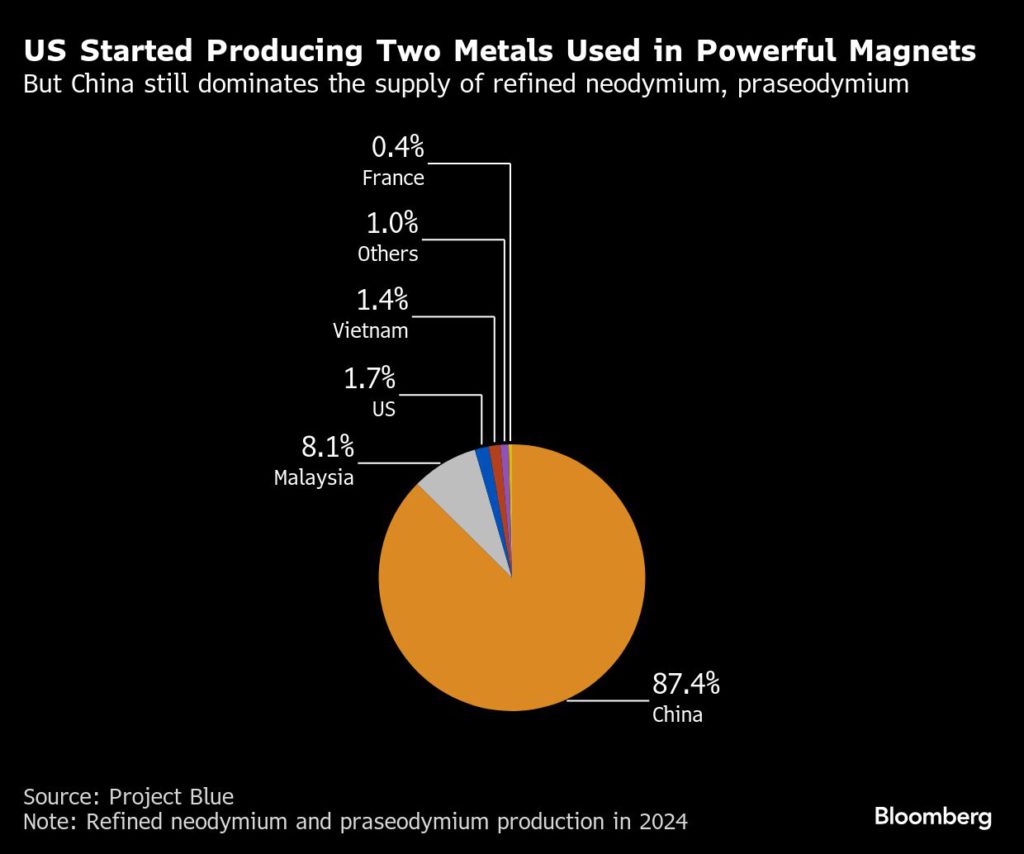

Off the list: Neodymium, Praseodymium

Neodymium and praseodymium are not being targeted in this round of trade salvos. These two metals, however, are by far the most common rare-earth elements because of their important roles in making permanent magnet motors.

Neodymium and praseodymium convert the electricity stored in a battery into motion — to rotate the wheels of an electric vehicle, for instance. They can also work in the opposite direction to turn motion into electricity, such as from the spinning of wind turbine blades.

MP Materials reopened Mountain Pass in California’s Mojave Desert in 2018, the only operational rare earths mine in the country which now has refining capabilities. Last year, the US produced 1,130 tons of refined neodymium-praseodymium, according to Project Blue.

That compares to more than 58,300 tons produced in China.