Stock image.

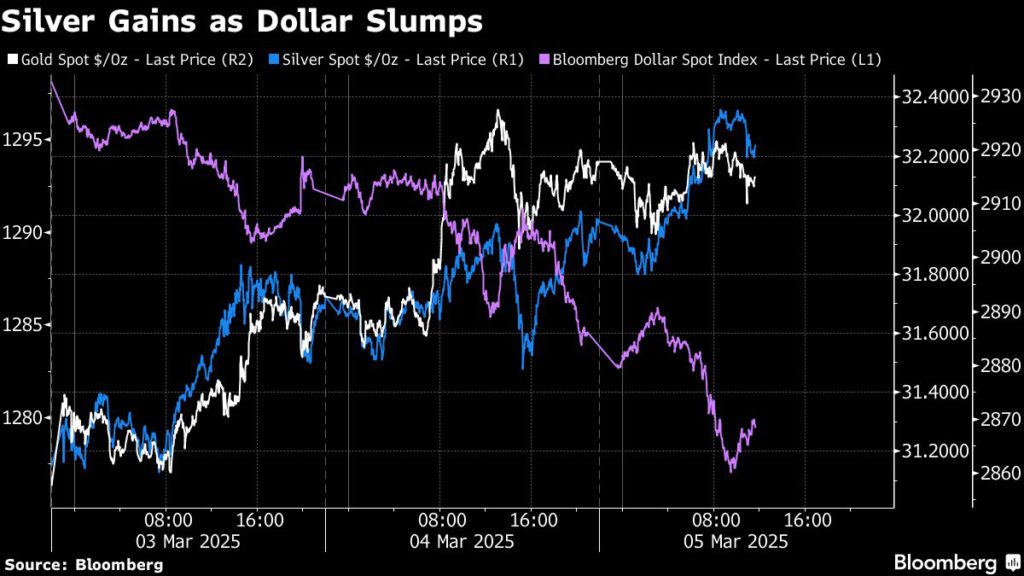

Silver climbed to a one-week high as concerns about a global trade war fanned haven demand and the dollar weakened. Gold also advanced.

Silver gained as much as 1.9%, rising for a third day. A gauge of the dollar hit the lowest in about three months, as the euro strengthened amid Germany’s plan to boost spending and loosen borrowing restrictions. A weaker greenback benefits precious metals, making them more affordable for buyers in other currencies.

Traders are also keeping a close eye on how trade tariffs affect the global economy. President Donald Trump on Tuesday warned Americans that there could be economic discomfort as a result of levies as he defended his policies to remake the US economy. Any pickup in inflation and hit to global growth could bolster the appeal of gold and silver as a store of value.

The US put 25% tariffs on most goods from Canada and Mexico and doubled tariffs on China to 20%. Still, Commerce Secretary Howard Lutnick said Wednesday Trump is set to announce changes to the tariffs on Canada and Mexico he slapped on earlier this week, with potential relief for automobiles and other sectors.

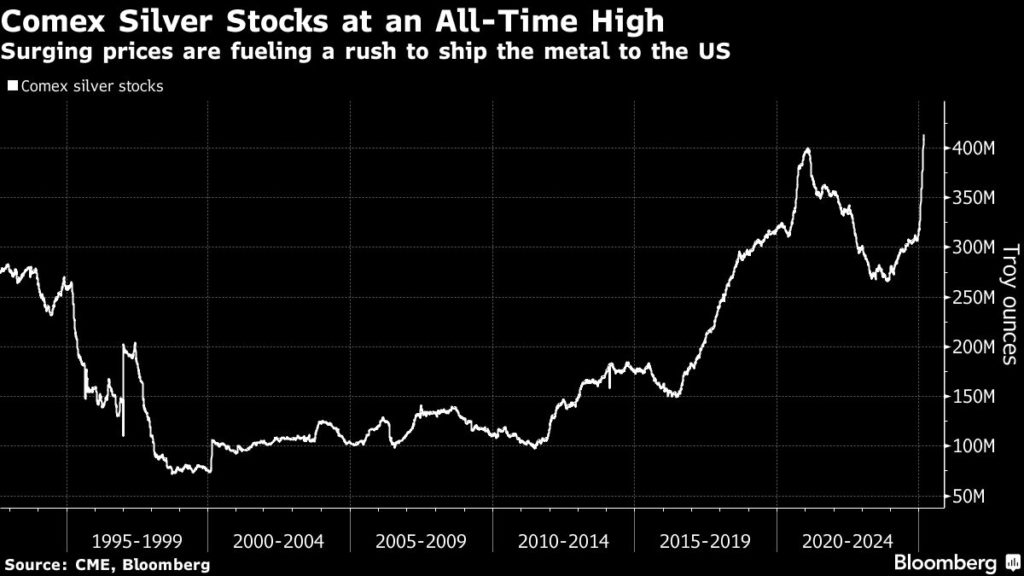

Unlike gold, a huge chunk of silver demand comes from industrial applications. Demand has exceeded supply for several years, and although there’s still a large amount of above-ground stockpiles, a number of market commentators have pointed to possible tightness in availability in the London spot market, the dominant trading hub.

Roughly 100 million ounces of silver have flowed into US exchange warehouses in recent months as tariff fears created a lucrative premium for traders who could ship metal in.

The “tidal wave” of silver risks pushing freely available silver in the London spot market below a critical threshold needed for the market to function, Daniel Ghali, a senior commodity strategist at TD Securities, recently wrote in a note.

Spot silver rose 1.8% to $32.57 an ounce as of 11:25 a.m. in New York. The Bloomberg Dollar Spot Index fell 0.9%. Gold and platinum advanced, while palladium fell.

(By Sybilla Gross and Jack Ryan)