- Global cryptocurrency market capitalization plunged below $1 trillion for the first time in 12 days.

- The crypto market declined 6% in the last 24 hours, wiping over $64.5 billion in aggregate value.

- Real-Word Asset (RWA)-based projects Mantra, Bittensor and DeXe posted considerable gains on Monday, defying the market crash.

- The CEO of Mantra suggests that Trump’s regulation policies could accelerate the mainstream adoption of RWAs.

Bitcoin Market Updates: Bitcoin price plunges to 12-day low despite MicroStrategy $1.1B purchase

- Bitcoin (BTC) traded as low as $97,777 on Monday, its lowest level since January 15.

Bitcoin price action (BTCUSDT | Binance) | January 27

Bitcoin price action (BTCUSDT | Binance) | January 27

- Michael Saylor-led MicroStrategy added another $1.1 billion worth of BTC, but the news failed to lift market sentiment considerably, with BTC price posting 7% intraday losses at press time.

Crypto Market Liquidations, January 26, 2025 | Source: Coinglass

Crypto Market Liquidations, January 26, 2025 | Source: Coinglass

- In the derivatives markets, Bitcoin traders lost over $320 million, while total crypto market liquidations exceeded $960 billion.

Altcoin market updates: Last week’s top gainers plunge as AI sector wobbles

United States (US) President Donald Trump’s inauguration introduced bullish tailwinds into the crypto markets last week.

As crypto traders selectively shifted capital to maximize gains from the varying market narratives around Trump’s presidency, certain projects quickly attracted speculative demand.

However, events surrounding China’s threats to US dominance of the global AI sector triggered market shocks. Amid the crypto market crash on Monday, last week’s top performers suffered significant losses as traders moved to cash in on prior profits.

Following Ripple executives’ appearance at Trump’s Mar-a-Lago dinner in early January, XRP rallied to a 7-year high, surpassing $3.

This surge was driven by speculation about potential regulatory clarity under the new administration. However, market sentiment shifted on Monday, leading to a 3.5% decline, with XRP trading at $2.91 at press time.

The launch of the official Trump memecoins, $TRUMP and $MELANIA, on the Solana blockchain generated significant demand, propelling SOL to an all-time high of $295 around the inauguration.

Traders exited both memecoins rapidly on Monday, with $TRUMP declining by 10% and $MELANIA by 6%, as SOL experienced a daily loss of 6%.

Ethereum performed well last week, buoyed by founder Vitalik Buterin’s active media presence.

Buterin advocated for the release of Tornado Cash founders following Trump’s pardon of Silk Road founder Ross Ulbricht.

Additionally, Trump-backed World Liberty Finance’s public purchases of ETH around the inauguration lifted market sentiment. However, Ethereum faced a 4.85% decline on Monday, exacerbated by continuous sell-offs from the Ethereum Foundation, despite Buterin’s earlier hints at a hiatus.

Chart of the day: Mantra chain CEO weighs Trump’s impact on RWA sector as OM defies market crash

The cryptocurrency market crash on Monday wiped out over $65 billion in capital, with derivatives liquidations exceeding $950 million. Despite this bearish backdrop, a few altcoins managed to defy the odds, posting gains amid the broader market downturn.

Real-World Asset (RWA)-based projects such as Mantra (OM), Bittensor (TAO) and DeXe (DEXE) emerged as standout performers.

Bittensor (TAO) rose 4.7% on Monday benefiting from increased media chatter around decentralized artificial intelligence (AI) networks. DeXe, a decentralized social trading platform, also saw a modest 4.2% gain on Monday.

Mantra chain (OM), a Layer-1 blockchain project specializing in Real-World Asset (RWA) tokenization, was also among the standout performers, defying the broader market dip, to post a 2.8% price uptick.

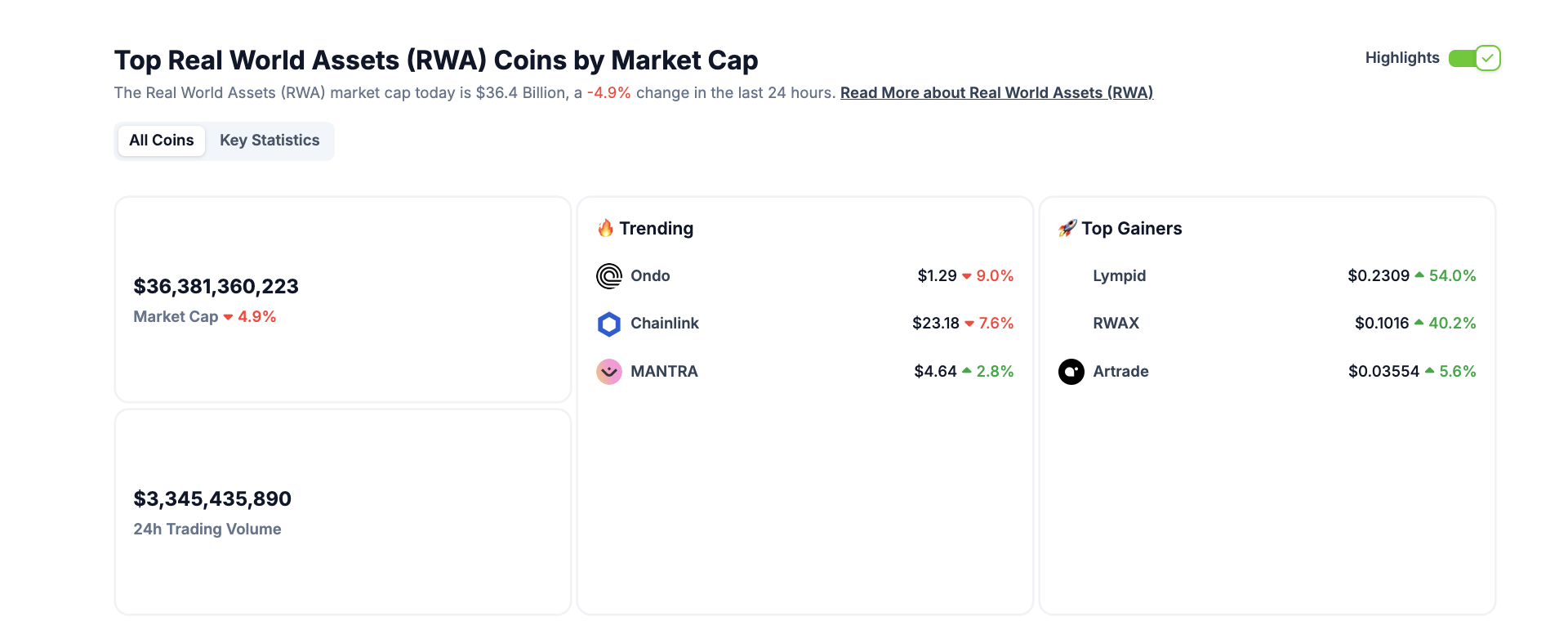

Real World Asset (RWA) Sector Performance | January 27, 2025 | Source: Coingecko

Real World Asset (RWA) Sector Performance | January 27, 2025 | Source: Coingecko

With a market cap of $4.3 billion, OM’s latest price uptick, puts it ahead of Ondo Finance as the second-largest RWA sector project, behind only Chainlink (LINK).

In an exclusive interview with FXStreet, Mantra chain CEO John Patrick Mullin, gave in-depth insights into how Trump’s regulatory policies could accelerate the growth of the RWA sector in 2025 and beyond.

Q. Amid the recent $900M BTC liquidations and market volatility, what factors are driving the current rally in tokens like Mantra and others in the RWA space?

“The RWA sector is gaining momentum as investors perceive blockchain versions of their assets as more stable and liquid during periods of market volatility.”

Q. With the growing speculation around Donald Trump’s moves to exert political influence on the crypto industry, which of his proposed policies do you foresee could accelerate mainstream adoption of RWA tokenization? Any potential risks that might arise from a proposed policy approach?

“President Trump’s executive order focuses on driving innovation and development in the digital assets space. Key policies like ensuring public blockchain networks are accessed lawfully and providing regulatory clarity with robust, progressive frameworks could significantly accelerate the mainstream adoption of real-world assets (RWAs) on the MANTRA Chain.”

Q. Are there specific policy adjustments or regulatory frameworks you’d like to see from the incoming administration to foster growth and innovation in the RWA sector?

“Yes, the incoming administration can foster growth in the RWA sector by implementing a balanced and forward-looking regulatory framework.”

– Mantra chain CEO John Patrick Mullin, January 2025.

Crypto news updates:

- Ripple obtains money transmitter licenses in Texas and New York

Ripple has secured Money Transmitter Licenses (MTLs) in New York and Texas, enabling the firm to offer more streamlined cross-border payment solutions.

According to a press release on Monday, Ripple now holds over 50 US MTLs and more than 60 global regulatory approvals, including significant credentials like a New York BitLicense, a Limited Purpose Trust Company Charter and Singapore’s Major Payment Institution License.

“We’re continuing to see more interest from financial institutions to crypto businesses that want to unlock the benefits of crypto and blockchain for faster, cost-efficient and 24/7 cross-border payments,”

– Joanie Xie, Managing Director of North America at Ripple.

Ripple’s payments business processed $70 billion in transaction volume over the past year, doubling its activity with a strong North American customer base.

- Russian power grid titan eyes Bitcoin mining ventures

Rosseti, Russia’s largest power grid operator, is considering entering the cryptocurrency mining sector by utilizing its underutilized power centers, according to a report by state news agency TASS. The company aims to coordinate the deployment of mining infrastructure across the country, leveraging its extensive network to support the growth of Russia’s crypto-mining industry. Rosseti views this initiative as an opportunity to increase tariff revenue and tax contributions while promoting economic development.

- Fake DeepSeek token hits $48M market cap amid AI app hype

A Solana-based token falsely linked to the Chinese AI app DeepSeek briefly reached a $48 million market capitalization on Monday, with trading volumes surpassing $150 million, according to Birdeye.

Blockchain records show the token was created on January 4. Its valuation has since dropped to $30 million, though it remains held by over 22,000 wallets. Attempts to associate the token with DeepSeek’s official X account and website have been debunked.

A second fraudulent token capitalizing on the DeepSeek craze achieved a $13 million market cap. DeepSeek has officially denied any connection to these tokens and issued warnings about potential scams, urging users to verify authenticity before investing