- Meta has reportedly agreed to acquire a 49% stake in the data labeling startup Scale AI for $15 billion.

- The deal, which has not been finalized, could solidify Meta’s position in the AI space by labeling massive amounts of user data.

- AI tokens such as AIOZ and AKT extend gains, reflecting positive sentiment in the broader cryptocurrency market.

Meta Platforms Inc (NASDAQ: META) is reported to have agreed to pay $15 billion toward the acquisition of a 49% stake in the data labeling startup Scale AI. Based on reports emerging on Tuesday, Meta could strengthen its position in the artificial intelligence (AI) sector, currently dominated by other Big Tech companies, including OpenAI, Nvidia and Microsoft.

Crypto tokens that intersect AI and blockchain technology, including AIOZ Network (AIOZ) and Akash Network (AKT), are sustaining gains accrued following the breakout on Monday, underpinned by positive sentiment in the broader cryptocurrency market.

Meta sets eyes on Scale AI with a $15 billion deal

The Mark Zuckerberg-led Meta is expected to gain significant influence in the AI sector if the company finalizes a potential $15 billion deal for a 49% stake in Scale AI, a San Francisco-based company.

According to multiple reports by Baha Breaking News and Proactive, which cited two unnamed individuals familiar with the matter, the deal values Scale AI at $30 billion.

Scale AI is an American company based in San Francisco, California, that focuses on providing data labeling and model evaluation services to build applications for artificial intelligence.

Alexandr Wang, the CEO of Scale AI, is expected to assume a top role within Meta’s newly revamped AI research lab, designed with a focus on ‘superintelligence,’ as reported by The New York Times.

Meta is on a mission to cement its position as a leader in the AI space, building on its AI platform, which currently boasts over 1 billion monthly users. The company is expected to allocate $72 billion to AI-related expenditures, with infrastructure accounting for the lion’s share of the budget.

Meanwhile, projects in the cryptocurrency industry, advancing the intersection between artificial intelligence and blockchain technology, boast a cumulative market value of $30 billion.

Leading tokens within this niche sector include Bittensor (TAO), valued at $3.8 billion, Internet Computer (ICP) and Near Protocol (NEAR), each valued at $3.2 billion.

AIOZ Network and Akash Network steady recovery

Akash Network, a crypto project spearheading the shift to cloud computing by leveraging the power of blockchain technology, is up over 5%, trading at around $1.41 at the time of writing.

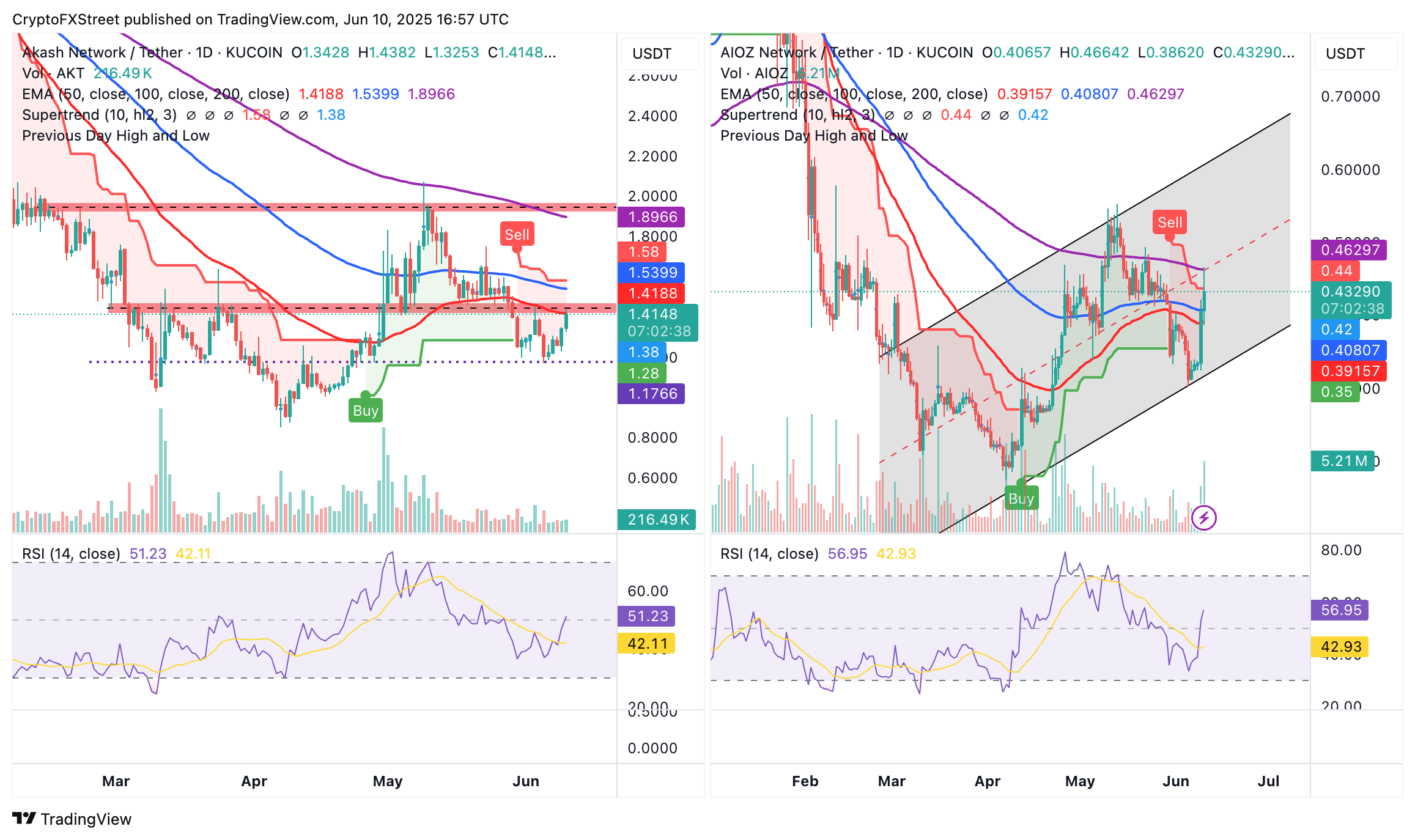

The bullish outlook, as observed in the chart below, follows a steady recovery from the support level at $1.17, which was tested on Thursday.

The Relative Strength Index (RSI) lifts above the 50 midline, solidifying the bulls’ influence on AKT. A continued RSI movement toward the overbought region would signal strong bullish momentum, increasing the probability of AKT breaking the resistance highlighted by the 50-day Exponential Moving Average (EMA), marked in red at around $1.41.

Such a move could see traders expand their bullish scope to the next key supply area at around $2.00.

AKT/USDT and AIOZ/USDT daily charts

On the other hand, AIOZ’s price sits significantly above support provided by the 100-day EMA at approximately $0.40. At the same time, it extends intraday gains of over 5% to exchange hands at $0.43 at the time of writing. The RSI underpins the bullish outlook as it ascends above the 50 neutral line, heading toward the overbought territory.

A break above the ascending channel’s middle boundary resistance and the subsequent 200-day EMA, currently holding at $0.46, would imply that the bullish structure is strengthening and increasing the chances of a breakout to the seller congestion zones at $0.60 and $0.80.