TLDR:

- Bitcoin halving cycles are losing influence as supply shocks become less impactful.

- Spot Bitcoin ETFs open new institutional demand channels, driving structural changes.

- BTC trades around $104K with low volatility as investor sentiment remains cautiously bullish.

- Analysts suggest Bitcoin may enter a super cycle fueled by global adoption and tech upgrades.

Bitcoin may be entering a new era. For over a decade, its price movements followed a predictable four-year cycle tied to halving events. That pattern, however, appears to be changing as new market dynamics emerge.

Shifts in both supply pressure and institutional demand now suggest Bitcoin is leaving its old models behind. With the rise of ETFs and growing global adoption, investors are preparing for what some call the beginning of a “super cycle.”

Traditional Bitcoin Supply Dynamics Are Fading

For years, Bitcoin’s price reflected its programmed halving schedule. Each cycle reduced the amount of new BTC entering the market, creating periodic supply shocks.

Crypto analyst Kaleo explained that this disinflationary trend historically led to gradual price increases following initial post-halving sell pressure from miners.

However, he noted that each halving’s impact has weakened over time. As block rewards diminish and Bitcoin’s total supply expands, the influence of new issuance continues to drop.

Kaleo believes the model is approaching a point where more Bitcoin could be lost annually than mined, shifting the network toward a deflationary structure. This change may force miners to rely more on transaction fees than block subsidies for revenue.

Welcome to the super cycle (real).

_____________________________________For the past 16 years, Bitcoin’s price has been closely bounded to its supply dynamics defined by each halving.

This has led to a semi-predictable 4 year cycle:

– BTC inflation (new… pic.twitter.com/ZhgxcPchdO

— K A L E O (@CryptoKaleo) June 19, 2025

Beyond supply, Bitcoin’s demand profile is transforming. This is the first cycle with fully approved spot Bitcoin ETFs in the U.S., unlocking access to deep pools of traditional capital. Institutional adoption is also growing.

Entities such as Tesla, El Salvador, and GameStop have added Bitcoin to their balance sheets, building long-term reserves.

In the U.S., political winds are shifting too. Regulatory clarity under a pro-crypto administration could ease barriers for financial institutions.

Meanwhile, Bitcoin’s utility continues to evolve. This is with improvements in infrastructure, integration into decentralized apps, and wider retail acceptance across global markets.

Recent BTC Price Trends Reflect Growing Uncertainty

Despite these developments, Bitcoin’s current price performance remains muted.

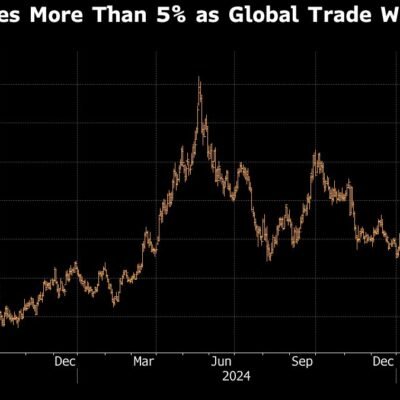

According to CoinGecko, BTC trades at $104,300, down 0.22% over the last 24 hours and 1.56% over the week. Market activity has dropped, with daily trading volume down over 40% to $18.2 billion.

Immediate support holds around $104,004 while resistance sits near $105,183.

Technical data from CoinCodex predicts a 5.79% rise in Bitcoin’s price by mid-July, targeting $110,288. With 60% of the past month closing in green and low volatility, the market shows modest bullish potential.

Bitcoin’s current positioning suggests a break from its long-standing halving-based cycle.

Kaleo warns that supply-side impacts alone no longer explain price behavior. Instead, a broader mix of institutional demand, technological maturity, and regulatory changes is shaping a more complex ecosystem.

If these elements continue aligning, Bitcoin could move into a phase defined less by fixed timelines and more by fundamental market participation.