Bitcoin has surged over the last year, helped by U.S. president Donald Trump’s prediction that “massive” bitcoin and crypto investment is coming.

The bitcoin price, up around 50% since plummeting to April lows, has found a floor at $100,000 despite a surprise “big risk” recently emerging.

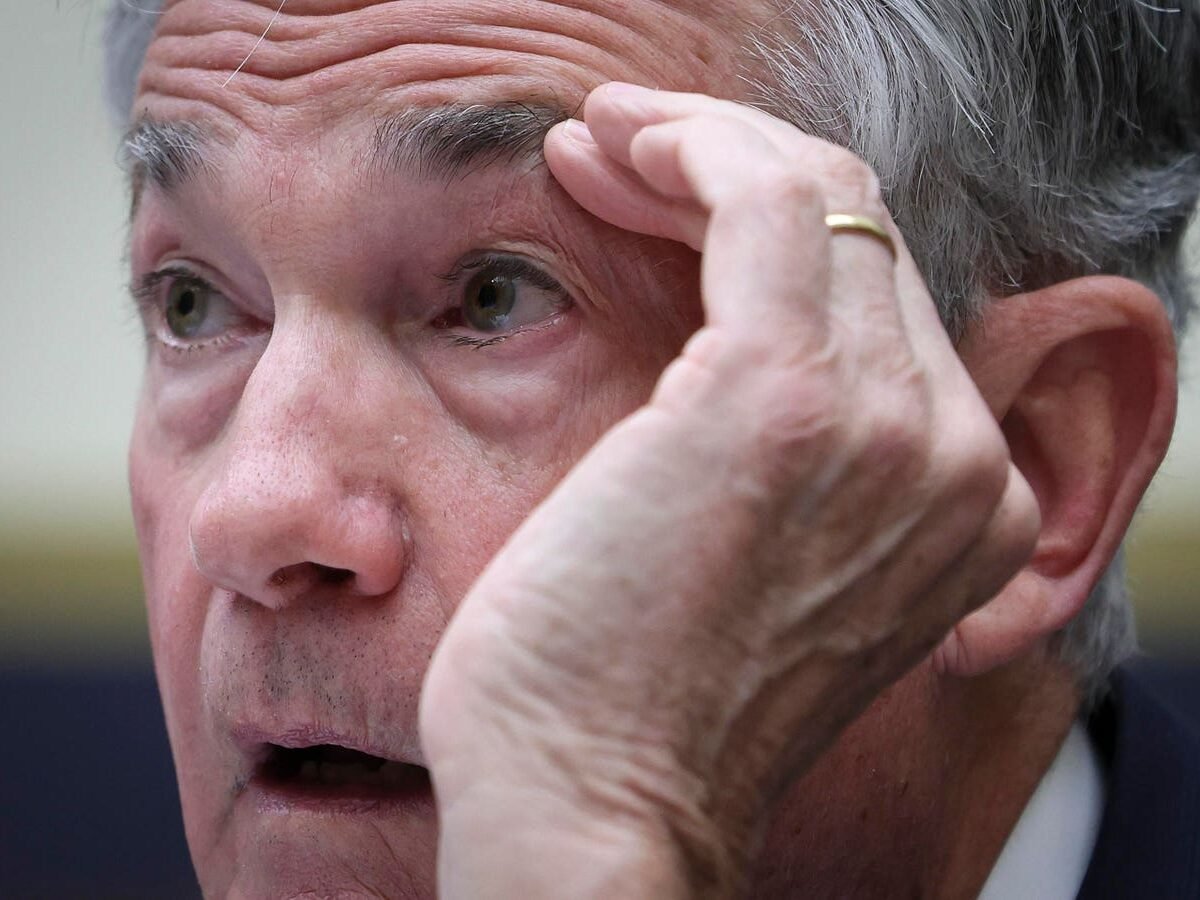

Now, after the U.S. Senate passed a crypto bill predicted to “unleash trillions,” the bitcoin price is braced for a Federal Reserve earthquake after Trump renewed his attack on chair Jerome Powell over interest rates as U.S. debt tops $37 trillion.

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

Federal Reserve chair Jerome Powell is under fire from U.S. president Donald Trump—with the bitcoin … More

“I don’t know why the board doesn’t override (Powell),” Trump posted to his Truth Social account in a lengthy message in which he branded Powell a “moron” and heavily criticized Fed policy that he claims is costing the U.S. $1 trillion per year in interest payments. “Maybe, just maybe, I’ll have to change my mind about firing him? But regardless, his term ends shortly.”

U.S. debt has skyrocketed in recent years following huge government spending through the Covid-era and lockdowns, with interest rates that were rapidly hiked to rein in inflation adding to the cost of servicing the ballooning $37 trillion U.S. debt pile.

Earlier this month, Trump confirmed a decision on the next Federal Reserve chair will be coming out “ very soon,” after earlier warning he was considering firing Powell if rates weren’t brought down.

Trump also called Powell a “numbskull,” adding: “I fully understand that my strong criticism of him makes it more difficult for him to do what he should be doing, lowering rates, but I’ve tried it all different ways. I’ve been nice, I’ve been neutral, and I’ve been nasty, and nice and neutral didn’t work!”

This week, the Fed kept interest rates on hold again after kicking of a reduction cycle in September that’s been put on pause due to fears Trump’s global trade tariffs could see a return of inflation.

However, Fed governor Christopher Waller has said he doesn’t expect Trump’s tariffs to drive inflation higher so policymakers should be looking to lower interest rates as early as July.

“If you’re starting to worry about the downside risk [to the] labor market, move now, don’t wait,” Waller told CNBC. The futures market currently puts the chances of a Fed rate cut in July at just 10%, according to CME FedWatch.

Lower interest rates are generally believed to be supportive of risk assets like bitcoin, crypto and high-growth technology stocks as money more easily flows though the economic system, with bitcoin price and crypto analysts predicting a bitcoin price boom if the Fed moves to rapidly reduce rates.

Sign up now for CryptoCodex—A free, daily newsletter for the crypto-curious

The bitcoin price has rocketed higher over the last year, with U.S. president Donald Trump boosting … More

The “dot plot from the Federal Reserve was somewhat of a relief, with projections of two rate cuts this year alleviating fears of no more cuts at all in 2025,” Elliot Johnson, chief executive of the Bitcoin Treasury Corporation, said in emailed comments.

“But beyond this short-term noise, there are even more reasons to be optimistic. Bitcoin’s recent strength isn’t only a testament to its resilience or its growing appeal as a safe-haven asset, but also its growing importance as an alternative to the devaluing U.S. dollar and a legitimate long-term treasury asset.”

Others have pointed to bitcoin’s price performance through recent market volatility as helping to establish it as a safe-haven similar to gold.

“As confidence in a perfectly engineered “soft landing” wanes, and as global financial currents diverge, bitcoin’s fundamental properties—its scarcity, decentralization, and neutrality—make it an increasingly relevant and compelling asset for investors navigating an uncertain future,” David Hernandez, crypto investment specialist at 21Shares, said via email.

“Bitcoin has firmly cemented itself above $100,000, and its resilience amid geopolitical shocks demonstrates its widespread adoption and developing investment case.”