The Federal Reserve, as most of us know, was established in 1913. What did the US monetary system look like before then? Of course there were gold and silver coins. But, mostly people used paper banknotes, issued by private commercial banks. In 1913, 7,404 private banks issued their own banknotes – all of them convertible to gold coin on demand. To this was added the United States Treasury itself, whose Treasury Gold Certificates (a form of banknote) was the most popular among the myriad options available in those days.

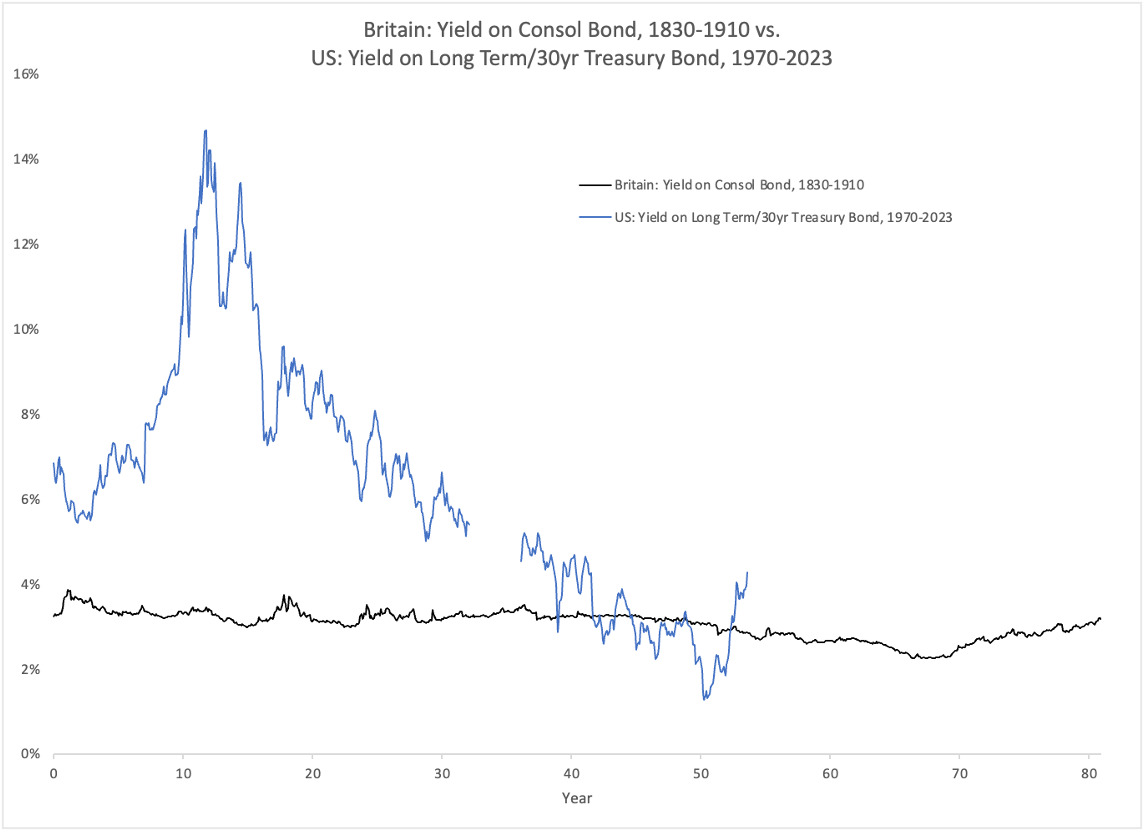

Britain’s gold-based government bonds had low and stable yields for many decades.

Today, the idea of issuing private banknotes is not very popular. People would rather have a digital solution of some kind – such as Kinesis, Lode, Glint, or the United Precious Metals Association, which today provide digital gold transaction platforms. These seem very innovative, but actually they are not much different than the private banknote systems of 130 years ago. The most popular digital platforms today are not based on gold, but on dollars. Among these are the “crypto stablecoins,” with USD Tether (USDT) and USDC the most popular. Tether’s “money supply” or “coins outstanding” has risen from about $2 billion in 2019 to over $150 billion today.

For a number of years, the primary use of these USD stablecoins was as a trading platform on crypto exchanges. This allowed traders to bypass the regular USD banking system. But, more recently, they have become increasingly popular as a method of payment for regular trade, or purchasing of goods and services. Now Walmart, Amazon and other big operators are actively setting up their own USD stablecoin systems. Among other advantages, this is expected to save these retailers billions in transaction fees. This process was recently smoothed by the passage of the GENIUS Act (“Guiding and Establishing National Innovation for U.S. Stablecoins”) by the US Senate.

The main advantage of a USD stablecoin is that it integrates seamlessly with the USD-based monetary economy of today. The main disadvantage is that its value is fixed to the dollar; and that value can be expected to decline over time, slowly or quickly.

A better solution, and the one that the US used in 1913, is multiple private issuers of gold-based stablecoins. This solution came about after the American government’s own fiat currency, the Continental Dollar, was devalued into hyperinflation in the 1780s. The government made coins, but it did not make banknotes. This was left entirely to the private market.

For now, stablecoins based on gold – including Tether’s own offering, Tether Gold – are not very popular. They look like USD Tether in 2019. But, in time, eventually “something happens” and people go looking for a better monetary alternative. Today, this is most likely in countries in Africa or Latin America, that suffer chronic currency depreciation and even hyperinflation. It is not hard to imagine that even the US might find itself in a similar situation, and not that far from now.

Some kind of gold-based payment system, possibly a “bank checking account based on gold,” or possibly a crypto-based stablecoin — is a necessary foundation for the issuance of debt based on gold. Already, people like economist Judy Shelton are recommending at least a small issuance of government debt on a gold basis. Basically, you borrow 1000 kilograms of gold, and pay it back with interest. Of course this won’t be in the form of gold coins and bars sent via Federal Express. This borrowing and paying would take place on some kind of gold-based payment platform, that is entirely digital. This “payment platform” would probably have some means of converting “digital gold” to gold coins or bars. But, of course, nobody would do that, except in some kind of crisis.

Why would anyone issue debt based in gold? Because, maybe that is the only form of debt that people are willing to buy. Who wants to lend money and get paid back in a depreciating currency? Basically, the interest rate would be a lot lower. In the 19th century, the best government debt regularly traded around 3.5% for maturities of 10 years or more. 3.5% is not too far from the 10yr Treasury yield today. So, there is no obvious incentive today to issue debt in gold, except as a kind of experiment. But, it is not hard to imagine a situation where nobody can issue debt in a junk currency, except at very high interest rates, short maturities (1 year or less), and small size. This is common today, in those countries with a history of currency abuse. The US itself might get a similar reputation, just as it had in 1789 – when the collapse of the Continental Dollar made everyone swear off government fiat currencies for multiple generations.

For now, the common acceptance of USD stablecoins is the entry drug for the real thing – private currencies based on gold.