- Bitcoin dropped 4% on Friday as core PCE inflation data sparked marketwide sell-off.

- Core PCE in February rose to 2.8% from expectations of 2.7%.

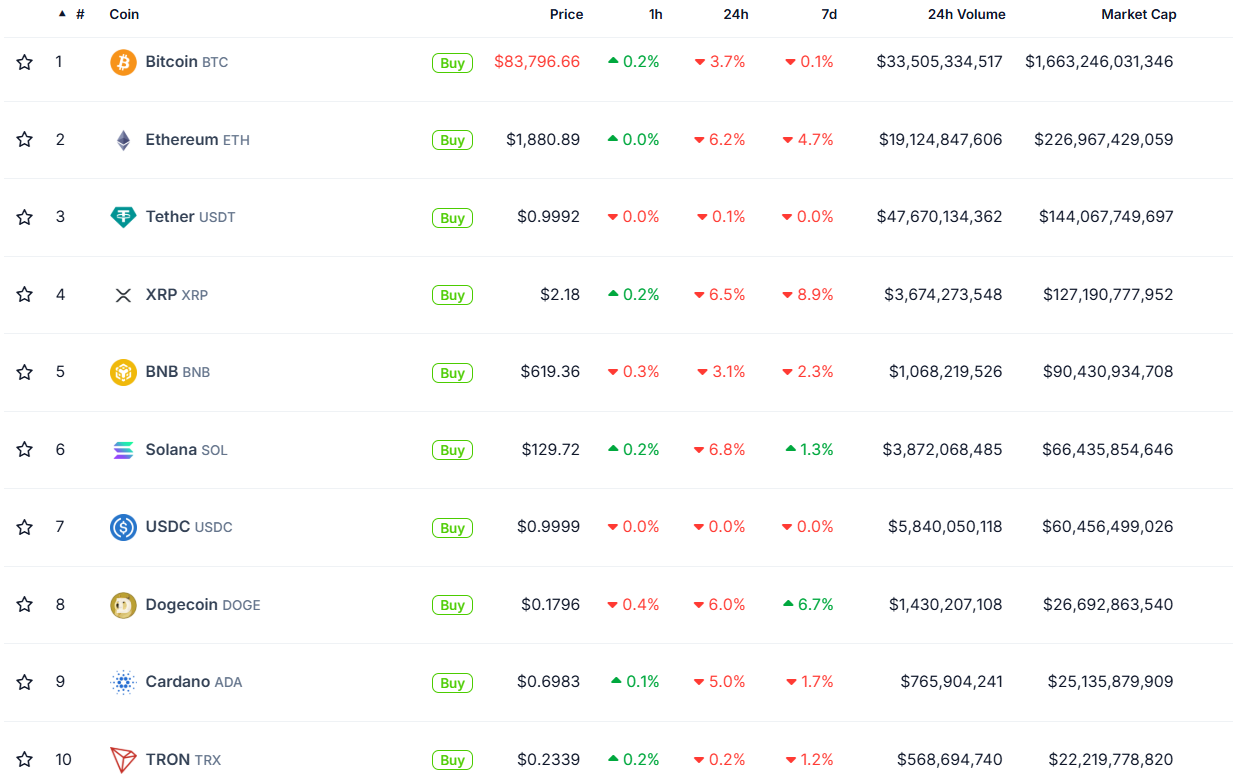

- Top altcoins Ethereum, XRP and Solana also shed gains seen earlier in the week with both crypto and stock markets experiencing a correction.

Bitcoin (BTC) and the crypto market declined on Friday following a rise in February’s core Personal Consumption Expenditure (PCE) data — the Federal Reserve’s (Fed) preferred inflation indicator.

Crypto, stocks decline as inflation data spread fear in the market

The crypto market witnessed a correction on Friday as macroeconomic data stirred panic among investors. The United States (US) core PCE Price Index, which excludes volatile food and energy prices, rose 2.8% YoY in February, above market expectations of 2.7%.

The combination of high inflation data and President Donald Trump’s tariff threats sparked major losses across the crypto market with Bitcoin plunging 4% below $84,000.

Data from Glassnode reveals that most of the recent selling activity and realized losses in the Bitcoin market largely stem from Short-Term Holders (STH) — investors who have held their BTC for less than 155 days.

This follows a surge in long-term inflation expectations to a high of 4.1% for the first time since 1993. Year-to-date inflation expectations also surged to 5% from 2.6% in the past three months since the beginning of Trump’s tariff announcements, per the latest survey from the University of Michigan.

“Tariff front-running has led to a $300+ BILLION trade deficit in 2 months and consumer sentiment has collapsed,” The Kobeissi Letter stated on X.

The panic in crypto highlights its growing correlation to the stock market, which also saw notable declines after the February PCE data announcement. The S&P 500 is down nearly 2%, wiping over $1 trillion from its market cap. Likewise, the NASDAQ 100 plunged by over 2% on the day.

“The share of consumers expecting higher stock prices over the next 12 months fell 9.3 points in March, to 37.4%, the lowest in a year. This also marks the largest monthly decline since March 2020,” added the Kobeissi Letter.

Altcoins were not spared from the crypto bloodbath, with Ethereum (ETH), XRP, Solana (SOL) and Dogecoin (DOGE) wiping out gains seen earlier in the week.

Top cryptos. Source: CoinGecko

Likewise, several major crypto sectors also saw losses, including the artificial intelligence (AI) sector, which has declined over 7% since the market meltdown. Top AI tokens NEAR, Bittensor and Render have declined 10.8%, 10% and 8%, respectively, at the time of publication.

Other sectors witnessing losses include the meme coin and the real-world asset (RWA) sectors, seeing losses of 8% and 5%, respectively.