News this week that the world’s second-biggest lithium miner – SQM – has begun laying off 5% of its Chilean workforce would not come as a surprise to those following the market for the battery raw material.

Battery lithium prices have been decimated since reaching a peak less than three years ago with prices slumping to $8,450 a tonne in June from above $80,000 in November 2022.

A wait and see approach on production cuts by lithium miners, particularly in China where government support keeps loss-making mines on life support, and slower than expected demand growth from the electric vehicle industry provides little prospect for a return to the boom years.

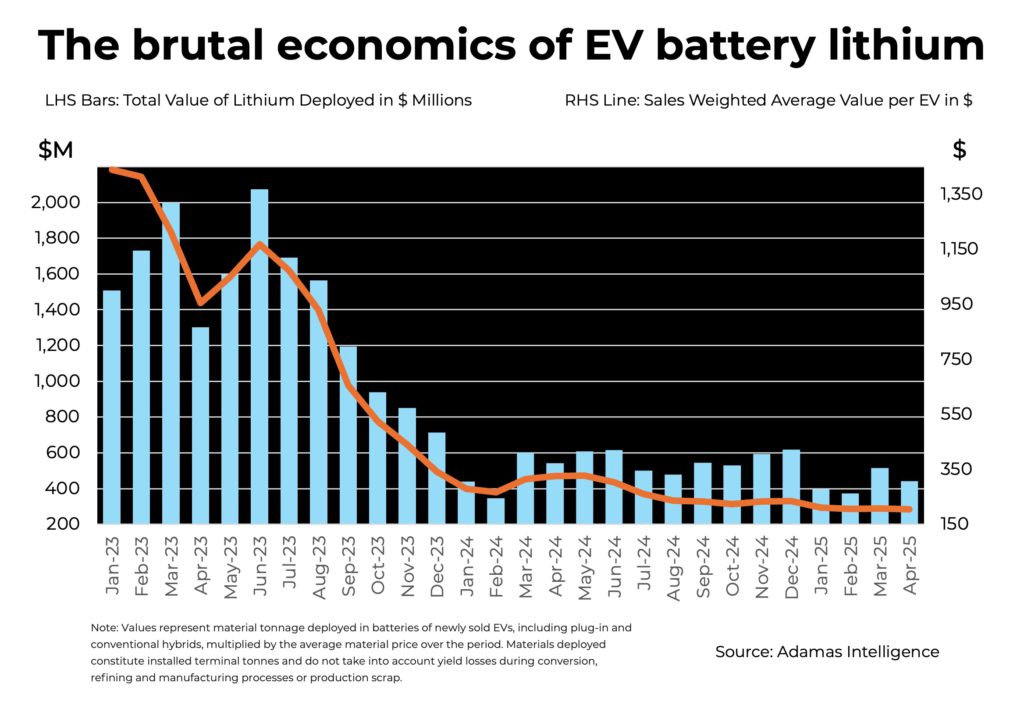

The value of terminal lithium tonnes deployed in EVs, including plug-in and conventional hybrids, sold around the world from January through May totalled $2.15 billion.

The extent of the slump is illustrated by the monthly EV battery nickel tally which is now higher than that of lithium, despite the significant move towards nickel-free batteries such as lithium iron phosphate chemistries and a cooling of nickel prices at the same time.

The value of the lithium contained in the batteries of EVs sold in December 2022 alone reached $3.2 billion despite the fact that global unit sales were a fraction of what it is now and shipments skewed towards hybrids which have inherently smaller batteries and therefore contained metal than full electric cars.

On a per EV basis the economics of lithium carbonate and hydroxide look even worse. From a peak of more than $1,900 per sales weighted average EV in December 2022, the installed lithium so far this year only averages just above $200 per vehicle.

For a fuller analysis of the battery metals market check out the latest issue of the Northern Miner print and digital editions.* Frik Els is Editor at Large for MINING.COM and Head of Adamas Inside, providing news and analysis based on Adamas Intelligence data.