Conservative hybrid funds represent the only segment within the hybrid category experiencing steady net outflows, totalling ₹682 crore during the past two years. This declining investor interest primarily stems from the change in taxation of debt-oriented funds in the 2023 Budget, which eliminated capital gains tax benefits and indexation advantages for funds with equity allocation below 35 per cent, a criterion encompassing this category. Consequently, any profits from these funds are now taxed according to the investor’s applicable income tax slab.

Despite this, several schemes from this category remain attractive options for risk-averse investors. They have consistently delivered strong long-term returns. Even with the modified tax regulations, returns exceed inflation rates while maintaining comparatively low risk levels. Kotak Debt Hybrid Fund is one such example, demonstrating good performance over the long term.

As required by regulations, conservative hybrid funds invest predominantly in debt instruments, with a smaller allocation to equities. Typically, they allocate 75–90 per cent to debt and 10–25 per cent to equities, offering reduced risk and consistent returns.

Large-cap orientation

The equity component of the Kotak Debt Hybrid Fund operates with a multi-cap strategy, generally maintaining 20–24 per cent in equities, with a preference for large-cap stocks constituting 70–80 per cent of the equity portfolio. It encompasses approximately 40 to 50 stocks, ensuring diversification, and follows a growth at a reasonable price approach with significant emphasis on corporate governance.

The overall equity portfolio construction demonstrates a distinctly domestic orientation, prioritising companies deriving the majority of their revenues from within India. The fund currently favours large-cap banking, technology, rural-driven discretionary consumption and selective areas in telecom and power. Conversely, the fund avoids sectors with substantial global exposure, particularly commodities.

Although mid- and small-cap stocks comprise a smaller portion of the portfolio, their inclusion is based on healthy earnings outlooks, consistent past performance, and strength within their respective sectors. Throughout the past five years, the fund has maintained a balanced allocation between mid- and small-cap segments, with their combined exposure ranging from 5 to 11 per cent of the total portfolio.

Active duration play

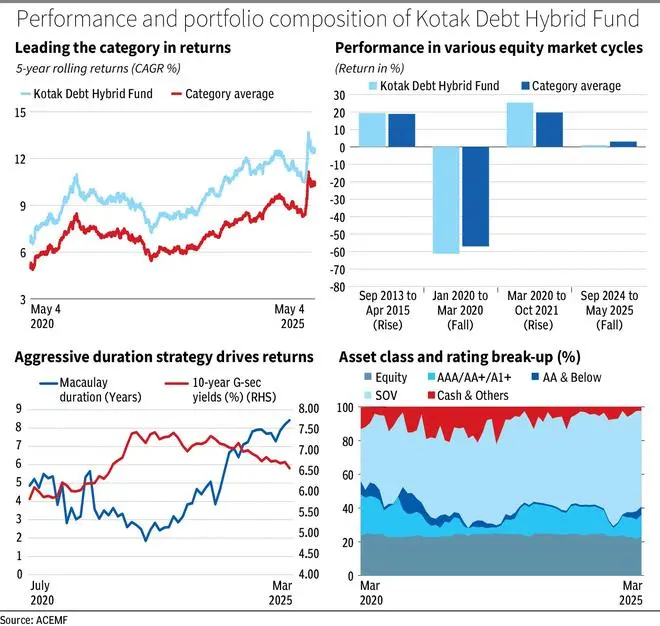

Kotak Debt Hybrid Fund distinguishes itself among peers through aggressive duration calls. Its approach to debt investment combines long-term strategic positioning with tactical adjustments, emphasising liquidity and yield curve positioning while minimising exposure to credit risk and accrual strategy.

Currently, the fund maintains a relatively high Macaulay Duration of approximately eight years, and the average maturity of 12 years. This extended duration reflects the fund’s macroeconomic perspective that the RBI may continue reducing interest rates. According to the fund manager, the reinvestment risk is the main concern at this point, which makes shorter-duration investments less attractive amid easing liquidity conditions.

The fund has consistently held about half its portfolio in G-Secs over the past five years, offering greater liquidity and flexibility for swift repositioning than corporate bonds. G-Secs enable swift tactical adjustments with minimal impact costs, whereas corporate bonds necessitate longer-term positioning due to higher bid-ask spreads and impact costs. In a bet on falling rates, the fund currently favours 30-year G-Secs, offering about 40 bps spread over 10-year bonds, with 20–30 per cent of the portfolio allocated there in the past couple of months.

Corporate bond exposure has ranged from 5–31 per cent over five years, with minimal short-duration and non-AAA holdings. About 5 per cent is in AA-rated securities, including UP Power Corp, Bharti Telecom, and Telangana State Industrial Infrastructure Corp.

The fund anticipates yield curve flattening and potential spread compression in corporate bonds as liquidity increases. Looking ahead, the fund manager indicates they will progressively reduce G-Sec exposure and increase corporate bond allocation, particularly in the 5-7 year segment where spreads appear attractive. The fund features a debt portfolio yield to maturity (YTM) of 7.1 per cent as of March 31, 2025, slightly below the category average of 7.2 per cent.

Performance

Kotak Debt Hybrid Fund has exhibited above average returns in most equity and interest rate cycles. Its aggressive duration strategies, however, result in heightened return volatility.

For instance, the fund delivered a 25 per cent return in the year after Covid pandemic, outperforming the 19 per cent category average driven by select sector bets in auto, retail, and private banks and a timely duration call. However, it lagged during the September 2024 correction, returning 1 per cent versus the category’s 3 per cent, as peers with lower equity exposure such as Nippon India Hybrid Bond and Parag Parikh Conservative Hybrid fared better.

Analysis of 5-year rolling returns over the last 10 years reveals that the fund generated an annualised return of 9.7 per cent, surpassing the category average of 7.3 per cent. Its 5-year returns have varied considerably, from a minimum of 6.5 per cent to a maximum of 13.7 per cent.

The fund’s expense ratio for the regular plan is 1.7 per cent, marginally below the category average of 1.9 per cent, while the direct plan’s expense ratio stands at 0.45 per cent, significantly below the category average of 0.93 per cent.

This fund aims to achieve returns exceeding typical debt investments over the given investment horizon. It may be appropriate for investors with low to moderate risk profiles who fall into lower tax brackets and desire modest exposure to equities.

Published on May 10, 2025