Powerleague, the UK’s original and premier provider of commercial small-sided football, has been acquired by Broadsword Investment Management Ltd, a UK-based private equity firm focused on real estate-backed growth opportunities.

Under the new ownership, Powerleague’s existing management team will remain in place, supported by Broadsword to deliver an ambitious growth strategy.

Christian Rose, CEO of Powerleague, told TheBusinessdesk.com the business model was to shift Powerleague to offer sport for all ages, and that padel fits that ambition.

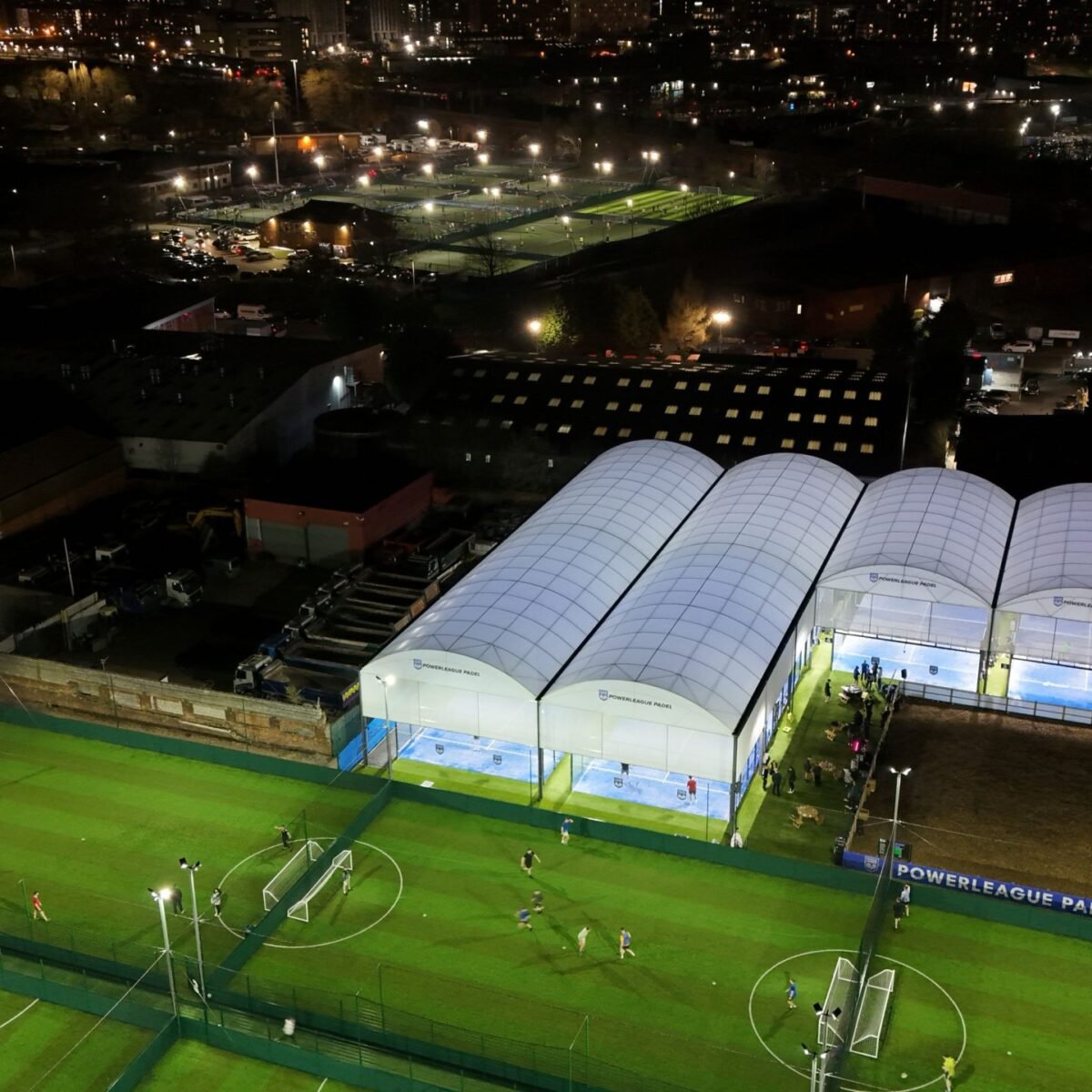

As part of its evolution into a football-first, leading multi-sport operator, Powerleague announced plans earlier this year to introduce padel to nearly half of its clubs nationwide, starting in Birmingham and London in 2024 and then Manchester this year. The business also recently invested in new sites in Stoke and Bradford, and is actively seeking sites in all major UK cities and towns.

The acquisition will accelerate a significant investment plan, including the development of brand-new Football and Padel Clubs within the next 24 months. Broadsword’s Investment will create 18 padel clubs within existing sites, delivering 76 courts by 2026 and making the sport accessible to over 200,000 players annually.

Powerleague has had a mixed corporate history, in 2002, after the business went into decline under new management, 3i approached Tottenham Hotspur F.C. Chief Executive Claude Littner to take over the executive role.

In 2003, Littner’s management buyout left 3i with a minority stake, and the the business listed on AIM.

In 2008 Powerleague took over the Soccerdome centres from Dave Whelan’s JJB Sports in a £17.4M deal, including the largest site next to the Trafford Centre, which has since been sold and razed to the ground. Powerleague was acquired by Patron Capital in December 2009 in a deal worth £42.5m.

Patron Capital installed a highly experienced new management team in 2018, led by current CEO Christian Rose, who described how the business went through a Conditional Voluntary Arrangement in 2019.

“We had to put the company through a CVA, which we did in early 2019, we got rid of some sites that were last making we’ve did a refinance and got the cash injection to focus on what’s really important, which is the customer, the customer proposition, and our colleagues to start investing and giving them belief.

“In large part, this period of sustained growth has coincided with re-investment in Powerleague’s 43 football centres. With a particular focus on brand-new pitches, club house upgrades and re-developed bar areas,” he said.

Sites cost around £1m to develop, and padel sites are outdoor, but covered, but sometimes planning permissions can take up to two years.

Rose says the business will continue to invest in its football clubs, with pitch regeneration and new site development central to its 2025 strategy. It is also expanding its third-party venue network in schools and leisure facilities to promote the benefits of sport and increase participation across UK communities.

“Our focus is getting people playing sport and having fun. The health benefits, mental and physical are hueg. 25% of kids in the UK are considered obese now, and it’s shocking, and male suicide rates are rocketing through the roof. Because I think sport has a real important part to play. I mean, you might have read in the press today that exercise is considered a miracle. If exercise was a pill, it would be called a miracle cure,” he said.

The company has a partnership deal with Nike and with padel supplier Babolat.

Rose added: “This is a hugely exciting moment for Powerleague. Partnering with Broadsword gives us the platform to accelerate our growth, invest in our clubs, and bring new sports like Padel to communities across the UK. While football remains at the heart of everything we do, we’re proud to be evolving into a true multi-sport operator. Our mission remains clear, to make sport more accessible, inclusive, and enjoyable for everyone.”

Daniel Sennett, Co-Founder and CEO of Broadsword, added: “We look forward to supporting the excellent management team in their efforts to build on the success of this world-class small-sided football business, as well as assisting them as they capitalise on the significant opportunity to grow into padel. With a national footprint and 9 million annual players, the opportunity for Powerleague to become a multi-sports operator is exciting. We are looking forward to going on that journey with Christian and his team.”

Powerleague had been owned by Patron Capital since December 2009, and the last set of results for the business show an increase of revenue of 14.5% and “EBITDA 8.3% higher than in the prior year.”

The business recorded turnover of £38.1m, but made a pre-tax loss of £4.26m, but claimed

The business also manages over 250 third-party venues that provide both football and netball.

Founded in 2024, Broadsword invests in companies with strong management teams and significant growth potential.