Out of 506 schemes, 233 invested in equities, taking advantage of positive domestic macroeconomic trends and favorable valuations.

Fund managers of actively managed equity mutual funds adopted divergent strategies in March 2025 driven by varying market outlooks and fund mandates. Of 506 active equity mutual fund schemes, 233 chose to redeploy cash into equities, while the remaining either held or increased their cash positions in anticipation of market volatility.

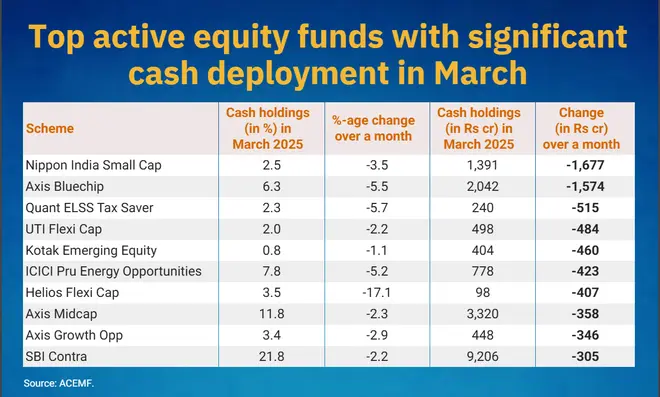

Among the more aggressive movers were schemes such as Nippon India Small Cap, Axis Bluechip, Quant ELSS, UTI Flexi Cap, and Kotak Emerging Equity. These funds seized the opportunity presented by improved domestic macroeconomic indicators, attractive valuations following earlier market corrections, and a resurgence in investor sentiment. Additionally, sectoral shifts—particularly into manufacturing, infrastructure, and financials—offered further avenues for deploying idle cash.

Conversely, several funds, including Parag Parikh Flexi Cap, Motilal Oswal Midcap, SBI Focused Equity, and HDFC Flexi Cap, adopted a more cautious approach. These schemes opted to maintain elevated cash levels to navigate ongoing uncertainties, preferring to preserve liquidity and await more favourable entry points.

Here are the top active equity funds that redeployed the cash significantly into the market in March. Source: ACEMF.

Published on April 15, 2025