Actively-managed investment funds sometimes get a bad rap. And that’s fair enough – many are pretty average. Yet there are great products out there that could be worth considering as part of a diversified portfolio. Here’s one British fund that has returned nearly twice that of the FTSE 100 index over the last three years.

The product in focus today is the VT Holland Advisors Equity Fund. It’s run by Andrew Hollingworth whose firm, Holland Advisors, is based in Surrey.

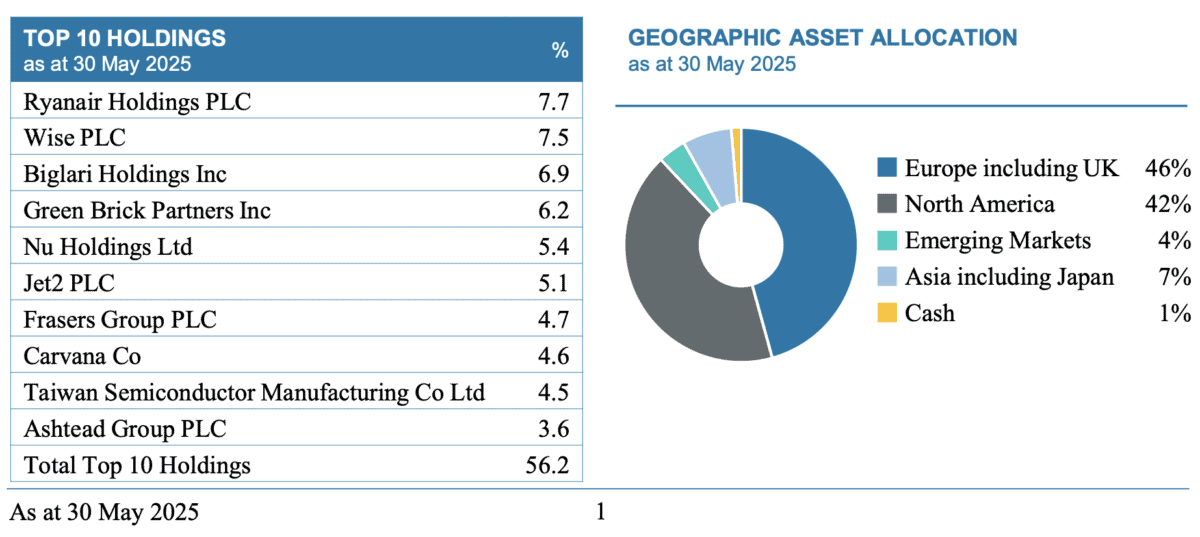

This is a global equity fund, meaning that it can invest in stocks listed internationally. However, it has a strong focus on the UK market today – the latest factsheet (for May) showed a 46% allocation to Europe including the UK.

In terms of performance, the fund returned 54.6% for the three-year period to the end of May. That compares to a return of 29.4% for the FTSE 100.

What I like about this fund is that it offers something unique. When you look at the investment style and holdings, you quickly realise that this is very different to your average investment fund.

For a start, it’s unconstrained. In other words, the fund manager has the freedom to invest wherever he sees an opportunity and make big bets on individual companies if he wants to.

It’s also a high-conviction ‘concentrated’ fund. At the end of May, it only held 27 stocks.

Where things get really interesting, however, is Hollingworth’s specific area of focus. Essentially, he’s trying to identify powerful compounding businesses that are run by aligned owner-managers, and invest in them (for the long term) when they’re unloved and undervalued.

In many ways, it’s a similar approach to that of Warren Buffett. Ultimately, you could say the style combines growth, quality, and value investing.

One particular business model the fund manager is attracted to is what’s known as ‘scale economies shared’. This is where a company reduces fees for customers as it grows in size.

A stock in the fund at present (7.5% of the portfolio at the end of May) that has this kind of business model is Wise (LSE: WISE). It’s one of the world’s top international money transfer businesses.

As this founder-led company has become bigger over the years it has reduced its fees for customers. As a result, those fees are significantly lower than those of a lot of competitors today.

This provides a competitive advantage and keeps customers locked in. And it has helped the company generate huge growth in recent years (revenues have nearly tripled over the last three years).