After relentlessly selling in the equity cash market, foreign portfolio investors (FPIs) have finally gotten into buying mode over the past couple of weeks. This has resulted in a quick rally across the broader markets, apart from the frontline indices.

At the depth of the correction, large-cap price-earnings multiples had fallen below 20 times, giving valuation comfort in several pockets.

While mid and small-cap PE multiples continue to be elevated, there are several stocks in these segments that corrected 30-50 per cent in the last 5-6 months, thus giving entry opportunities for investors.

The rupee has appreciated against the dollar from 87-plus levels to sub-86 to the dollar in recent weeks. India’s GDP growth and inflation continue to be comfortable.

However, global uncertainties still persist. The Trump regime would commence levying of reciprocal tariffs from April. China’s growth outlook is still not very clear, though stimulus measures have been announced. The disruption due to large-scale adoption of AI in the industry worldwide is also a key factor.

A phased approach to taking exposure to equities, with debt to balance the portfolio is important for retail investors with modest risk appetites.

Therefore, investing via aggressive hybrid funds to ensure participation in market rallies, while keeping downsides protected reasonably via debt may be suitable.

Kotak Equity Hybrid (Kotak Balance earlier), which has a track record of over 25 years, may be a good choice for investors with a five-plus year timeframe.

The fund has a consistent track record of delivering above-average risk-adjusted returns over medium to long term.

Investors can take exposure via SIPs or even via small lumpsums as asset allocation is decided by the fund manager, making the entry point less relevant.

Sturdy performance

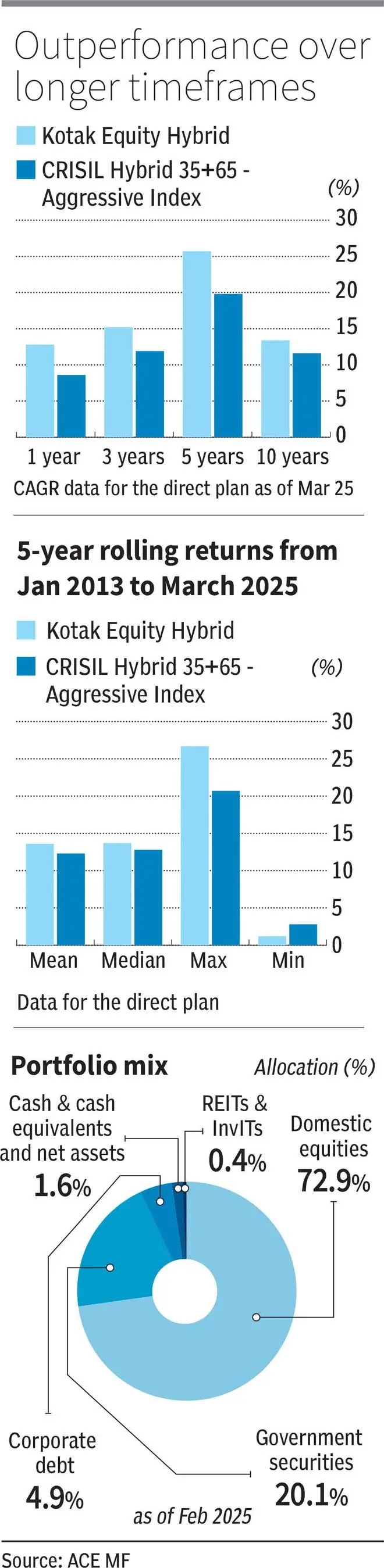

The Kotak Equity Hybrid fund is benchmarked to the Nifty 50 Hybrid Composite Debt 65:35 Index TRI. Since data for this benchmark is not readily available, we have taken the CRISIL Hybrid 35+65 – Aggressive Index for comparison.

When 5-year rolling returns over January 2013 to March 2025 are considered, the fund has delivered a mean performance of 13.6 per cent annually. The CRISIL Hybrid 35+65 – Aggressive Index has given mean returns of 12.3 per cent over the same timeframe and the aforementioned rolling period.

The Kotak Equity Hybrid fund has outperformed CRISIL Hybrid 35+65 – Aggressive Index nearly 75 per cent of the times on 5-year rolling returns during January 2013 to March 2025.

The fund has given more than 12 per cent returns 71 per cent of the times and in excess of 10 per cent almost 82 per cent of the time.

An SIP every month in the fund for 10 years would have delivered annualised returns (XIRR) of 15.4 per cent, which icompares favourably with even most equity funds over this timeframe. If an SIP had been done in CRISIL Hybrid 35+65 – Aggressive Index over the same period, the returns would have been 12.8 per cent.

All data mentioned here pertain to the direct plan of Kotak Equity Hybrid fund.

Smart portfolio mix

The fund keeps the equity exposure in the portfolio in the 71-75 per cent range, depending on market conditions. It avoids going any deeper into equities to maintain a relatively safer portfolio.

Kotak Equity Hybrid takes a multi-cap approach to investing in equities, though large-caps dominate the holdings. Small and mid-cap exposure can go up to 30 per cent of the portfolio holdings. Exposure to individual stocks is restricted to less than 4 per cent.

In the debt portion, the holdings are dominated by the presence of government securities. More than 20 per cent of the portfolio is in sovereign instruments. Apart from g-secs, the fund also holds securities of financially stronger State governments.

Bonds of public sector companies and state utilities also figure in small proportions in the portfolio.

So, the portfolio faces almost no credit risk by virtue of the dominance of sovereign holdings.

The fund has increased its average maturity profile over the past few years. As yields of longer-term securities plummeted 45-50 basis points over the past year or so, the fund has increased its average maturity to 18.95 years. The Macaulay duration and modified duration are reasonable, at 8.87 years and 8.55 years, respectively.

Overall, the fund is well-positioned to give optimal risk-adjusted performance over the long term.

Saving in the fund towards specific goals would work better for investors.