Yacktman Focused Fund (Trades, Portfolio) recently submitted its N-PORT filing for the first quarter of 2025, shedding light on its strategic investment decisions during this period. Managed by Yacktman Asset Management (Trades, Portfolio), the fund is renowned for its pursuit of long-term capital appreciation, with a secondary focus on current income. As a non-diversified fund, it primarily invests in common stocks of both domestic and foreign companies, regardless of size, with a preference for those that pay dividends. The investment team, known for its objectivity, patience, and diligence, bases its decisions on the intrinsic merits of individual securities rather than market forecasts. Yacktman employs a disciplined strategy, seeking growth companies at attractive valuations, effectively blending “growth” and “value” investing principles. The fund typically targets companies with strong business models, shareholder-oriented management, and low purchase prices.

Yacktman Focused Fund (Trades, Portfolio) completely exited two holdings in the first quarter of 2025, as detailed below:

Yacktman Focused Fund (Trades, Portfolio) also reduced its position in 25 stocks. The most significant changes include:

-

Reduced Bollore SE (XPAR:BOL) by 5,200,000 shares, resulting in a -10.46% decrease in shares and a -1.19% impact on the portfolio. The stock traded at an average price of 5.74 during the quarter and has returned -11.72% over the past 3 months and -13.80% year-to-date.

-

Reduced EOG Resources Inc (NYSE:EOG) by 200,000 shares, resulting in a -50% reduction in shares and a -0.92% impact on the portfolio. The stock traded at an average price of $128.69 during the quarter and has returned -20.15% over the past 3 months and -11.56% year-to-date.

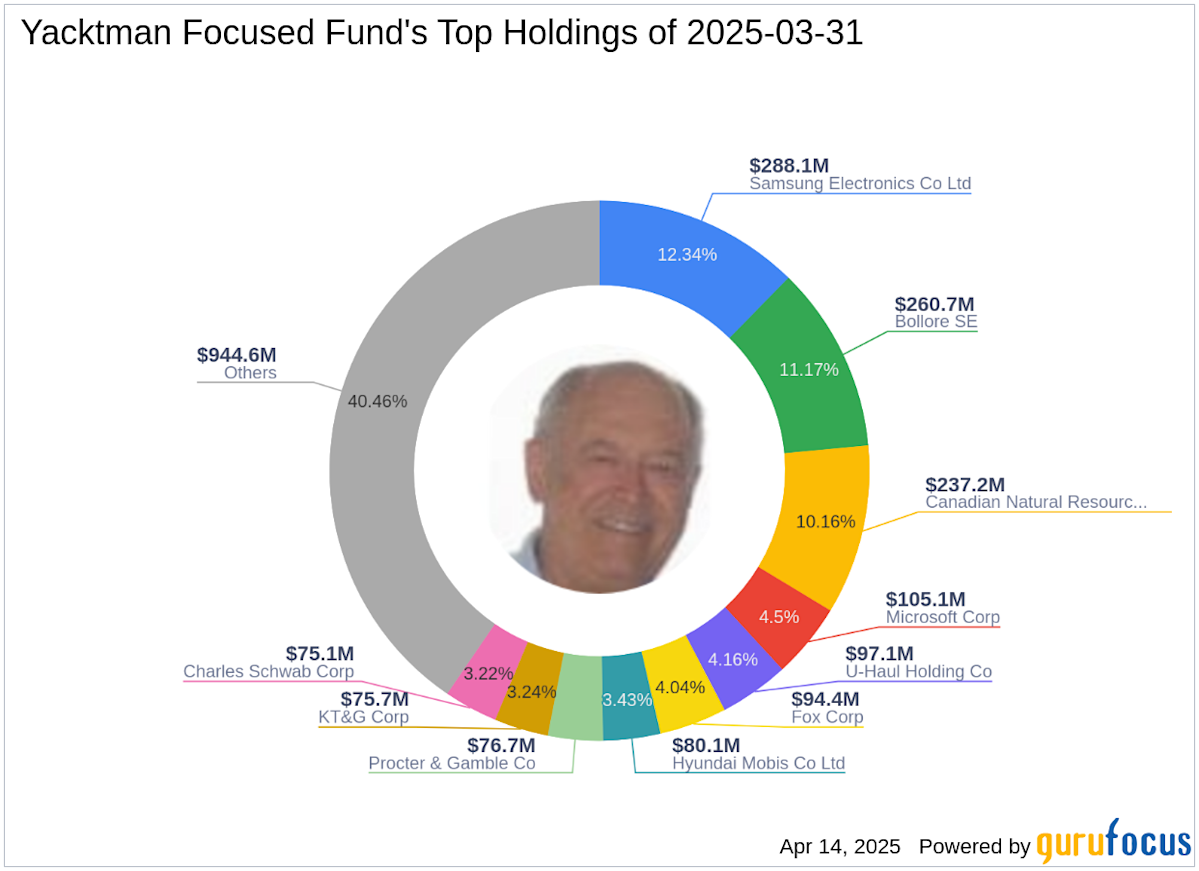

At the end of the first quarter of 2025, Yacktman Focused Fund (Trades, Portfolio)’s portfolio comprised 39 stocks. The top holdings included 12.34% in Samsung Electronics Co Ltd (XKRX:005935), 11.17% in Bollore SE (XPAR:BOL), 10.16% in Canadian Natural Resources Ltd (NYSE:CNQ), 4.5% in Microsoft Corp (NASDAQ:MSFT), and 4.16% in U-Haul Holding Co (NYSE:UHAL.B).