Sorapop

Introduction:

This article is for income investors and retirees or soon-to-be retirees. There are two groups of people: one who believes in the importance of regular dividends and income stream, while there are others who believe that income can be raised by selling a fraction of your shares any time you need it. Obviously, we are in the first camp. Moreover, we think you won’t be able to find many people who can sell shares to raise income successfully on a long-term basis.

Sure, if your investment capital is very large compared to your lifestyle, then raising income by selling shares may be appropriate. For example, if your annual expenses are less than 1% of your investment capital, you may not care much for a regular income. However, apart from such situations, we believe most folks should adopt some form of income method to generate a regular stream of income.

When Income Takes a Central Role (Rather Than Growth)?

When you approach retirement years, there is a change in the investing mindset. You are no longer interested in growth strategies that can multiply your capital. You are more interested in raising a stable and reliable income stream that can pay the bills without stress. Basically, there comes a time for most folks when the investing goals suddenly flip from “growth first, income maybe” to “income first, and growth second.” If you are in that transition, the most important question to ask would be how much income you need in retirement.

How To Budget For Income and Expenses In Retirement

Basically, for a comfortable retirement, income should match expenses. If you are already at a stage where you plan to start withdrawing from social security or are fortunate enough to have some kind of pension, your need for investment income goes down by that much. Obviously, expenses can vary from person to person, based on the place of living and if you are carrying any debt into retirement (including the house mortgage). It is always ideal to be debt-free before retirement, though many people like to carry a house mortgage, especially if their mortgage rate is very low. Most estimates from financial planners point out that your expenses are likely to be in the range of 70% to 80% of your pre-retirement income. Though it can vary greatly from individual to individual, we tend to think that it may be much less than those general estimates.

The expenses that you will eliminate or see reductions in retirement:

- Contributions to retirement funds

- House mortgage payment (if you decide to pay off the mortgage before retirement)

- Reduced expenses on commute and other work-related expenses

- Likely reduction in federal and state taxes

- Likely no more tuition and living expenses for kids.

The expenses that may see an increase in retirement:

- Medical expenses, especially if not eligible for Medicare yet.

- Increased expenses on travel and/or hobbies.

Individual Stocks vs. Funds

Once we have tackled the question of expenses in retirement and know exactly how much income per month we need in retirement, the next question would be how and where to invest your retirement savings to be able to generate the required income and still be able to provide enough growth to meet and beat inflation.

So, how should you invest? It depends upon the size of your retirement capital and the amount of income you need every month.

The required Income %age = 100* (Income per year/ Retirement Savings Capital)

If the income percentage is 4% or less, it may make a lot of sense to invest in individual stocks. Sure, you can add some funds, such as ETFs (Exchange-Traded funds), for extra diversification if needed.

If the income percentage is greater than 4%, then it may be better to hold some high-income funds and ETFs. There are certainly many advantages to funds in addition to providing high income. The most important ones are instant diversification and simplicity in managing your investments. The minus is the annual fees that certainly add up over the years.

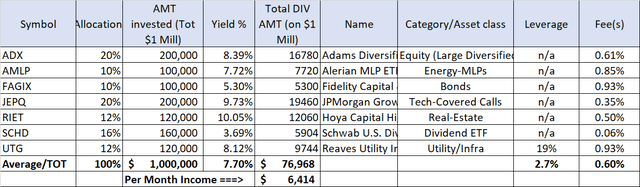

Here is our recommended portfolio for a relatively reliable source of income. This portfolio should generate close to $6,400 a month (or $77,000 a year). If these funds are acquired opportunistically, income can go even higher.

The 7-Funds Portfolio:

- Adams Diversified Equity Fund (ADX)

- Alerian MLP ETF (AMLP)

- Fidelity Capital & Income Fund No Load (FAGIX)

- JPMorgan Nasdaq Equity Premium Income ETF (JEPQ)

- Hoya Capital High Dividend Yield ETF (RIET)

- Schwab U.S. Dividend Equity ETF (SCHD)

- Reaves Utility Income Trust (UTG).

Table-1: 7-Funds Income Portfolio

Portfolio Analysis

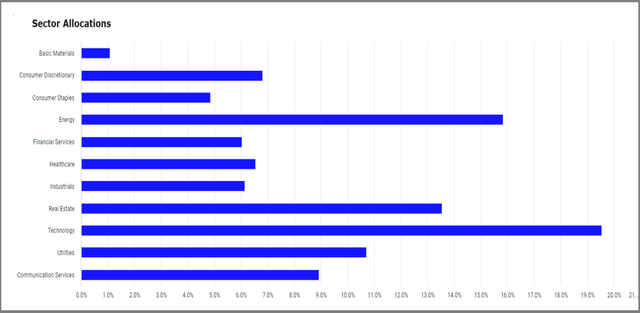

We can use any of the portfolio analyzers like Morningstar X-ray or Portfolio Visualizer to see how the various sectors are represented. This is what we got:

Chart-1: Sector Allocations

The technology sector appears to be overrepresented, but that is because of JEPQ, which also sells call options on the underlying portfolio. So the net effect will be something much less than 20%. Furthermore, the energy sector is about 15%, out of which 2/3rd is represented by the mid-stream MLPs (due to AMLP), and the rest should be from regular energy companies such as Chevron and Exxon Mobil.

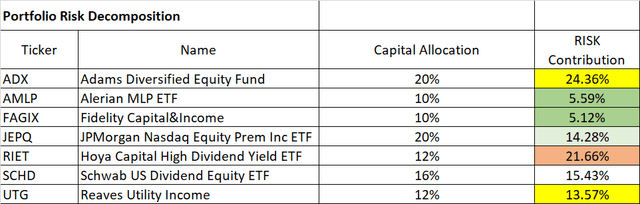

Table-1A: Portfolio Risk Decomposition

In the above table, we can also see that maximum volatility and risk are coming from Hoya Capital, i.e., 21% risk contribution with 12% allocation and 16% portfolio income. Obviously, nothing comes for free, so to elevate our income, we will have to tolerate a higher level of risk. We also notice that despite high-growth technology stocks in JEPQ, the risk contribution is actually less than the allocation. However, please note that due to the short history of JEPQ and RIET, the risk analysis may have limited utility.

Individual Funds In More Details:

- ADX (Adams Diversified Equity Fund)

ADX is a closed-end fund that invests largely in domestic U.S. listed stocks. According to the fund, it seeks to deliver superior total returns over time by investing in a broadly diversified equity portfolio of high-quality, large-cap companies. The fund was incepted nearly a century ago, in 1929. So, this fund has a very long history and has survived the great depression and many more recessions. The fund’s main objectives are reasonable income on an annual basis, preservation of capital, and seeking long-term capital appreciation. Until recently, the fund was committed to providing 6% of income, mostly distributed at the end of the year. However, all that changed for the better when the fund recently announced that it would now distribute 8% of the NAV (for the year) and that too on a quarterly basis in nearly equal amounts. This has resulted in a narrowing of the discount from a level of -14% to the current -8% in the last several months.

Some of its top holdings include Microsoft (MSFT), Apple (AAPL), NVIDIA (NVDA), Amazon (AMZN), Alphabet (GOOGL), JPMorgan Chase (JPM), and Eli Lilly (LLY).

We think this is a quality fund with a management record that has proved itself over the years. This should provide nearly 8% of income without interruptions for many years to come.

AMLP invests in MLPs (Master Limited Partnerships) in the energy sector. Most of these MLPs are engaged in the mid-stream energy business with investments in large infrastructure in the form of pipelines, storage, and processing facilities. They carry out essential activities such as moving and storing hydrocarbons such as oil and natural gas.

Why hold an MLP-based ETF with an expense ratio of 0.85% rather than holding individual MLPs? It is basically for two reasons; first, you will have to hold many MLPs (possibly 3-5 of them) to be able to diversify enough to avoid single company risk. Secondly, the more important factor is that you may want to avoid the headache of filing K-1 (partnership income) at tax time. Even though AMLP charges a relatively high fee, it simplifies the process of owning several top MLPs and providing you with dividend income rather than partnership income.

The ETF is based on the Alerian MLP Infrastructure Index. The underlying index and the ETF are both capitalization-weighted, which means the larger companies will have a greater share of the fund’s assets. Having larger companies in greater proportions usually results in lower volatility. Even though these companies are not involved in the exploration or production of commodities, they still tend to get impacted somewhat when Oil & Gas prices are in a downturn, as we had seen in 2014-2016 and 2020. That said, despite the green energy push by most governments, the demand for Oil & Gas is going to stay strong for the foreseeable future.

The fund currently yields roughly 7.5% and has roughly $8.6 billion in assets.

The top six holdings account for over 75% of the assets, and the top 10 (all MLPs) account for 96% of the assets. Some top holdings are Plains All American Pipeline (PAA), Western Midstream Partners (WES), Energy Transfer (ET), MPLX LP (MPLX), Enterprise Products Partners (EPD), and Sunoco (SUN).

- FAGIX (Fidelity Capital & Income Fund No Load)

Plenty of retirees want to keep some allocations to bonds. Sure, bonds can provide lower volatility in some fixed income, but they also come with a big drawback, which is a lack of capital growth. However, the fund selected here for bond representation has been able to provide decent growth along with fixed income. We are talking about Fidelity’s mutual fund FAGIX. This fund falls under the “High-yield” Bond category. Its official benchmark is “ICE BofA US High Yield Constrained Index.” However, it is not all bonds; it has a history of some decent allocation (roughly 15-20%) to equities as well. It has been managed by the same manager, Mark Notkin, since 2003. The fund has a five-star rating by Morningstar, likely due to its solid long-term performance record in its category. The fund has a long history and has provided an annualized growth of 9.38% since its inception in 1977, which is solid for a bond-centric fund. Furthermore, since Jan. 1985, the fund has returned 9.02% (annualized) until Jul. 2024 compared to 11.5% of the S&P 500.

The recent performance (except the last year) is not that stellar, as it was a difficult period for bonds. For the last 1, 3, 5, and 10-year periods, it has returned 11.79%, 3.51%, 6.70%, and 6.22%, respectively, and outperformed its benchmark for each of the periods. It yields roughly 5.3%, with a 30-day SEC yield even higher at 5.60%. However, it must be kept in mind that this is a bond-centric fund, and its total returns are likely to be inferior to those of stocks. However, we are keeping a 10% allocation for retirees who need some diversification in bonds. More conservative investors could increase the allocation.

- UTG (Reaves Utility Income Trust)

Since we are forming a hands-off portfolio for retirees or income investors, we may like to provide some allocation to utility and infrastructure sectors. In our view, UTG is one of the best quality Utility closed-end funds out there. It offers consistent and reliable dividends and nearly matches the returns of the S&P 500, though only on a long-term basis. A recent couple of years have been tough for most income-focused assets, more so for utilities. But that is likely to change in 2024 and 2025 as interest rates start easing. Moreover, we get nearly 8% income while we wait for recovery.

Some top holdings are Constellation Energy (CEG), Public Service Enterprise Group (PEG), Deutsche Telekom AG ADR (OTCQX:DTEGY), PPL Corporation (PPL), CenterPoint Energy (CNP), NiSource (NI), Talen Energy (TLN), and CMS Energy (CMS).

- JEPQ (JPMorgan Nasdaq Equity Premium Income ETF)

JEPQ is an income-focused ETF offered by JPMorgan (JPM). This fund is fairly new, as it was launched in May 2022. Its sister fund, JPMorgan Equity Premium Income ETF (JEPI), though, has a slightly longer history since 2020. The fund JEPQ is invested in large-cap growth U.S. listed stocks that are part of the Nasdaq index. Obviously, these growth stocks are not known for much income, so the fund uses a covered call strategy on the index to generate high income. It aims to get a significant portion of the total returns of the Nasdaq index with lower volatility. One of the primary objectives of the fund is to deliver a monthly income stream from the option premiums and stock dividends. It writes monthly covered calls on the Nasdaq Index using weekly tranches with OTM (out-of-money) strikes, which allows it to capture a reasonable (but not all) of the upside while earning decent premiums to generate income. The fund uses a rather complex approach of using ELNs (Equity-Linked-Notes) instead of writing actual calls. The ELNs that the fund invests in are derivative instruments that are designed to offer the economic benefits/loss of the covered calls written on the Nasdaq index.

The current forward distribution yield is 9.73%, while the 30-day SEC yield is at 9.45%. As we would expect, some top holdings in the ETF are large technology stocks, for example, Apple, Microsoft, NVIDIA, Amazon, Alphabet, Meta Platforms (META), and Broadcom (AVGO).

Since it is an option-based product, in a bull market, the investor is likely to forego some of the upside of the underlying stocks, so overall, the returns will likely lag the index. But, at the same time, it is also designed to offer some protection during a down market. Another plus point is that by investing in JEPQ, we are getting exposure to many high-quality large-cap Nasdaq-100 stocks, while it commits roughly 20% of net assets to ELNs to generate income.

- SCHD (Schwab U.S. Dividend Equity ETF)

SCHD is probably one of the most popular dividend ETFs among retirees and income investors. So, what is so special about it? The answer is simple: it provides a relatively high yield and a history of double-digit dividend growth in the past ten years. It currently pays a current yield of 3.69%.

The dividend growth has been outstanding at 12.80% and 11.70% during the last 5 and 10 years, respectively. This kind of growth could turn the initial yield of 3.69% into over 11% yield on a cost basis in 10 years.

Moreover, investors are comforted by the fact that the fund invests in some of the largest and blue-chip companies. It is fairly diversified, with roughly 100 holdings. It is much more balanced in various sectors of the economy compared to the S&P 500, which is currently overweight in technology stocks. In terms of total returns, SCHD has provided an annualized return of 11.7% (from Aug. 2014 to Jul. 2024) compared with 13.0% from the S&P 500. That is expected because SCHD has only 9% exposure to technology stocks while the S&P 500 has nearly 32%, and we know that technology stocks have been on a tear for the last two years.

However, we must keep in mind that the stock market had plenty of good years during the past ten years, and it is a big question mark in every investor’s mind whether the next 10 years will be as good as the last 10. Even then, barring any black-swan events, based on SCHD’s history, we can be somewhat assured of a worry-free investment for the next five years, if not a decade.

Some top holdings of SCHD are Lockheed Martin (LMT), AbbVie (ABBV), Home Depot (HD), BlackRock (BLK), Amgen Inc. (AMGN), Bristol-Myers Squibb (BMY), and Coca-Cola Company (KO).

Note: SCHD’s dividend payout can vary every quarter based on its underlying holdings. On SCHD’s website, it mentions the trailing yield at 3.63% but the 30-day SEC yield at 3.69%.

- RIET (Hoya Capital High Dividend Yield ETF)

We believe that no portfolio is complete without some exposure to real estate. It may be debatable how much exposure you should have to real estate, though, and that is more of a subjective question. However, if we were to look for a fund that invests in real estate companies, it is difficult to find a good fund with significant income. For example, the most popular ETFs pay much lower in income compared to many of the individual REIT companies. Two of the large ETFs, Vanguard Real Estate Index Fund ETF Shares (VNQ) and iShares U.S. Real Estate ETF (IYR), pay only 3.9% and 2.7% yield, respectively.

That relatively low yield may be a result of how these ETFs are composed. They consist of hundreds of companies, good, average, and bad ones as well. Moreover, the larger the company’s market capitalization, the more weightage it is likely to get in the fund.

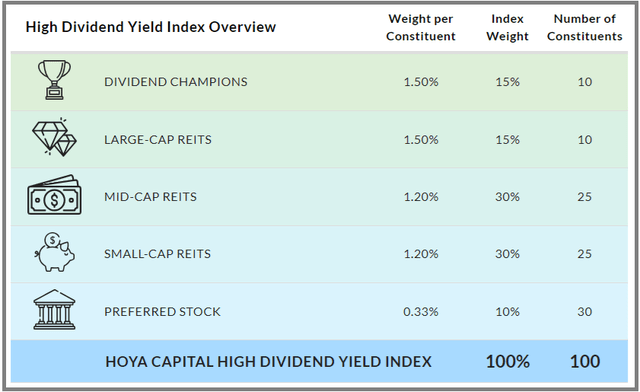

However, one fund that stands out in this context and is formed differently than the large popular ETFs is the Hoya Capital High Dividend Yield ETF. The fund is relatively new (launched in 2021) and fairly small in market capitalization (only about $76 million). It is also managed by one of the popular authors (by the same name – Hoya Capital) in the REIT space on Seeking Alpha. The fund is based on an index with the same name, “Hoya Capital High Dividend Yield Index,” which is essentially a real-estate index. The below image depicts the structure of the fund and its underlying index.

Chart-2:

The main attraction of the fund is its high yield of nearly 10%, that too from a real estate fund. Secondly, the dividend is paid on a monthly basis. The fund is relatively new, so there is not much history behind it to prove its record. But we can look at the holdings and try to analyze them. It holds nearly 100 positions and is reconstituted every six months based on its investment strategy. The top 10 positions appear to be all well-known large-cap REITs, but their weightage is uniform at 1.5%, so the top 10 make up only about 15% of the total assets. This allows other companies that are mid-cap and small-cap to represent significant weightage in the fund. However, the fund also holds mREITs (mortgage REITs) to the extent of roughly 25%. Even though that helps the fund to provide a high yield, it also adds to the risk. However, we should keep in mind that our allocation to the fund is only 12%, so exposure to mREITs in our portfolio will be limited to about 3%, which is quite low and possibly worth the risk in exchange for a high yield.

Another factor in favor of a real-estate fund is that we are already at the peak of high interest rates, and they will only go lower from here. A September Fed rate cut is widely expected, and the only question is how fast the Fed will go about cutting the rates after the first cut. This bodes very well for real-estate funds, including Hoya Capital, so this may be the ideal time to add some exposure to this fund.

Likely Risks with the Portfolio:

Here are some risks with the above portfolio that the investors should be aware of:

- Even though the portfolio is well diversified with exposure to different equity asset classes, there is no downside protection. In all likelihood, it will have draw-downs similar to those of the S&P 500 during any big correction. However, there is a difference in that this portfolio will likely continue to provide nearly the same level of income, and that should help ride any such correction.

- At least some funds in the above portfolio may be overvalued at this time. One way to mitigate this risk is to buy in multiple installments using the dollar-cost average method.

- Sensitivity to Interest Rates: This portfolio has many securities that are highly sensitive to the direction of interest rates. The market has priced in the expectations of at least four or five rate cuts in 2024 and 2005. However, if that somehow does not materialize or gets delayed due to sticky inflation or any other reason, some funds in this portfolio will likely underperform.

- Market risk: Obviously, there is a market risk with any such portfolio, especially this has very high exposure to equities. If the broader market were to enter into a prolonged downturn, this portfolio would perform in line with the market. In certain situations, it may even perform worse. To mitigate this risk and allow a faster recovery, the investor should withdraw less income during the down market years and possibly more during the bull years.

- Unexpected situations may arise as the future is always unpredictable, and the portfolio may not perform as we expect. The only way to mitigate this risk would be to monitor these funds at least periodically and make sure that nothing has changed fundamentally.

Concluding Thoughts:

We have presented a nearly complete portfolio that includes wide diversification and exposure to dividend stocks, growth and technology stocks, utility and infrastructure sector, real estate, fixed income (bonds), and mid-stream partnership companies. Besides exposures to broad sectors and assets, it can generate a very high yield of 7.7% (on average). The portfolio has only two closed-end funds, with only one of them with some leverage. The other five funds are ETFs with no leverage.

Though we have defined the allocations with a wide audience in mind, an individual investor could change the allocations to suit their individual needs and risk tolerance.