Aug 16, 2024

For a nation’s security and economic development, the defence sector plays an important role.

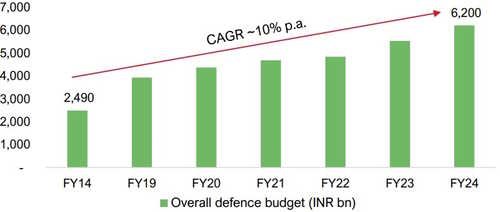

Currently, India is the fourth largest spender of defence, and in the last decade, we have seen a significant increase in the budget allocation towards the defence sector.

In the interim budget, allocation to the Ministry of Defence (MoD) was Rs 6.21 trillion for FY 2024-25, an increase of 4.7% from the previous year (on account of a lower revised estimate).

Graph 1: India’s Defence Budget

( Source: Aditya Birla Sun Life Nifty India Defence Index Fund investor presentation)

As a part of the government’s expenditure, defence stood at 13%, but as a percentage of GDP, it remained low at 2%.

Defence production in FY24 stood at Rs 747 billion versus over Rs 1 trillion in the previous fiscal year. That said, what is interesting is that private sector contribution to defence production has increased to Rs 164 billion or 22% of the defence production in FY24, from 19% in the previous years. With the Modi-led-NDA government’s “Make in India” initiative, defence production has got a major boost and so have defence exports. India’s defence exports touched a historic figure of nearly Rs 211 billion in FY24.

Graph 2: India’s Defence Exports

(Source: Aditya Birla Sun Life Nifty India Defence Index Fund investor presentation)

India’s defence minister, Mr. Rajnath Singh, has emphasised the MoD’s goal of significantly increasing the defence exports to Rs 500 billion and production to Rs 3 trillion by FY29.

Against this backdrop and exuding confidence in India’s sectors, several mutual fund houses in the recent past have launched defence funds—both actively managed and passively managed.

[Read: 6 Equity Mutual Funds to Benefit from India’s Defence Sector]

Aditya Birla Sun Life Mutual Fund too has now come up with, Aditya Birla Sun Life Nifty India Defence Index Fund (open for subscription from August 9, 2024, to August 23, 2024).

It is a passively managed open-ended Index Fund replicating the Nifty India Defence Total Return Index.

Around 95%-100% of its total assets will be invested in equity and equity-related securities constituting the Nifty India Defence Index. In the equity component, not more than 20% of the Scheme’s net assets would be invested in derivative instruments as permitted by the regulations.

Up to 5% will be invested in debt & money market instruments (including cash and cash equivalents). The investment in debt securities will be for liquidity purposes and of less than 1-year residual maturity. Up to 5% may be invested in structured obligations/credit enhancements.

Further, the Scheme may, to meet liquidity requirements, invest in units of money market/liquid schemes of Aditya Birla Sun Life Mutual Fund and/or any other mutual fund provided that aggregate inter-scheme investment made by all schemes under the same management or in schemes under the management of any other asset management company shall not exceed 5% of the net asset value of the mutual fund.

The Scheme will categorically not invest in repo/reverse repo in corporate debt securities, securitised debt, unrated debt securities, Credit Default Swaps, REITs, InVITS, overseas securities (including ADRs and GDRs), and not engage in short selling.

What is the Investment Objective?

The investment objective of the Scheme is to provide returns that, before expenses, correspond to the total returns of securities as represented by the Nifty India Defence Total Return Index, subject to tracking errors.

The Scheme does not guarantee/indicate any returns. There is no assurance or guarantee that the investment objective of the Scheme will be achieved.

What is the Investment Strategy?

The Aditya Birla Sun Life Nifty India Defence Index Fund will follow a passive investment strategy and will invest not less than 95% of its corpus in stocks comprising the underlying index and endeavour to track the benchmark index while minimizing the tracking error.

The investment strategy would revolve around reducing the tracking error to the least possible through regular rebalancing of the portfolio, taking into account the change in weights of stocks in the index as well as the incremental collections/redemptions in the Scheme.

The AMC, Aditya Birla Sun Life Mutual Fund does not make any judgments about the investment merit of Nifty India Defence Total Return Index nor will it attempt to apply any economic, financial or market analysis.

As regards, derivative, where one could see disproportionate gains as well as disproportionate losses, the execution of the strategy depends upon the ability of the fund manager to identify such opportunities. The Identification and execution of the strategies to be pursued by the fund manager involve uncertainty and the decision of the fund manager may not always be profitable. No assurance can be given that the fund manager will be able to identify or execute such strategies. The risks associated with the use of derivatives are different from or possibly greater than, the risks associated with investing directly in securities and other traditional investments.

The Scheme may also invest in cash/cash equivalent and debt/money market instruments including units of Liquid schemes, in compliance with Regulations to meet liquidity and expense requirements.

As regards, the portfolio turnover, given that the Scheme will follow a passive investment strategy, the endeavour will be to minimize portfolio turnover subject to the exigencies and needs of the scheme. Generally, as the scheme is open-ended, turnover will be confined to the rebalancing of the portfolio on account of new subscriptions, redemptions and changes in the composition of the Nifty India Defence Total Return Index– the benchmark of the Scheme.

About the Nifty India Defence Index

The Nifty India Defence Index aims to track the performance of the portfolio of stocks that broadly represent the Defence theme.

From the Nifty Total Market index, stocks forming part of eligible basic industries or those which obtain at least 10% of revenues from the defence industry are eligible to be included in the index and are chosen based on a 6-month average free-float market capitalisation.

The weight of the stocks in the index is based on their free-float market capitalization. Stock weights are capped at 20% each.

Table: Top Constituents of Nifty India Defence Index

(Source: NSE Indexogram Factsheet as of July 2024)

In other words, the Aditya Birla Sun Life Nifty India Defence Index Fund will allow you to have exposure to some of the heavyweight players of India’s defence sector, which includes capital goods and chemicals. Besides the large-cap companies, even certain mid-caps and small-cap companies are part of the Nifty India Defence Index.

Graph 3: Performance of Nifty India Defence Index

(Source: NSE Indexogram Factsheet as of July 2024)

Since its launch on January 19, 2022 (base date: April 2, 2018), the Nifty India Defence Index has clocked an appealing price return of 37.8% CAGR and total returns (which accounts for dividends) of 39.8% CAGR (as of July 31, 2024), thereby created wealth for investors.

Here’s what Mr. A. Balasubramanian, Managing Director & CEO, Aditya Birla Sun Life AMC Ltd, said at the launch of Aditya Birla Sun Life Nifty India Defence Index Fund:

“There is substantial market growth potential (for the defence sector), given the low-cost base, and companies in this sector are expected to gain higher market share as demand surges.”

Who Will Manage Aditya Birla Sun Life Nifty India Defence Index Fund?

Mr. Haresh Mehta and Mr. Pranav Gupta are the designated Fund Managers of the Scheme.

Haresh has over 17 years of experience in dealing with related activities. Before joining Aditya Birla Sun Life AMC Limited, he was associated with Baroda BNP Paribas Asset Management India Pvt. Ltd for over 4 years as a Dealer and Investment Support. He has also worked for over 11 years as a Trader in Institutional equities with First Global Stockbroking Pvt. Ltd. He is a commerce graduate (B.Com) and has done his MBA (International Business Management) from Sikkim Manipal University.

Pranav has over 4 years of experience in the capital market across segments such as derivative sales trading and Alternative Research. He joined Aditya Birla Sun Life Asset Management Company (ABSLAMC) in April 2022. Before that he was part of the Alternate Research and Strategy department at Centrum Broking Limited and has also worked with OHM Stock Broker Pvt. Ltd. He is an engineering graduate with a specialisation in Electrical Instrumentation (B.E. – Electrical Instrumentation) plus has done Master of Management Studies (MMS) with specialisation in Finance (MMS – Finance).

Both Haresh and Pranav, are currently managing various other index funds and equity-oriented Exchange Traded Funds (ETFs) at ABSLAMC.

How much is the Minimum Investment in Aditya Birla Sun Life Nifty India Defence Index Fund?

During the NFO period, i.e. from August 9, 2024, to August 23, 2024, the minimum lump sum investment in the Scheme is Rs 500/- and in multiples of Rs 100/- thereof. Similarly, for switch-in transactions, the minimum investment is Rs 500/- and in multiples of Rs 100/- thereof.

In the case of SIPs during the NFO period, the minimum instalment for monthly and weekly SIPs is Rs. 500/- and in multiples of Re. 1/- thereafter.

Both, the Direct Plan and Regular Plan for available for investments.

After the NFO period, the scheme will re-open for subscription within 5 business days from the date of allotment.

Who Should Consider Investing in Aditya Birla Sun Life Nifty India Defence Index Fund?

Favourable policy for defence production, the robust order book of defence companies, sales, decent margins, healthy demand for India’s defence exports due to geopolitical tensions, and improved analyst ratings, are factors that support investment in the defence sector/theme.

Having said that, the returns of Aditya Birla Sun Life Nifty India Defence Index Fund will be closely linked with that of the defence sector/theme. So, you, the investor, will be subject to concentration risk. Moreover, currently from a valuation for the sector do not look cheap with a Price-to-Equity (P/E) of 64x and Price-to-Book (P/Bv) of around 17x.

Hence, only those investors who have a longer investment horizon of 7-8 years or more and a very high-risk appetite, this Scheme would be suitable.

To know more about Aditya Birla Sun Life Nifty India Defence Index Fund, read the Scheme Information Document and Key Information Memorandum.

Happy Investing!