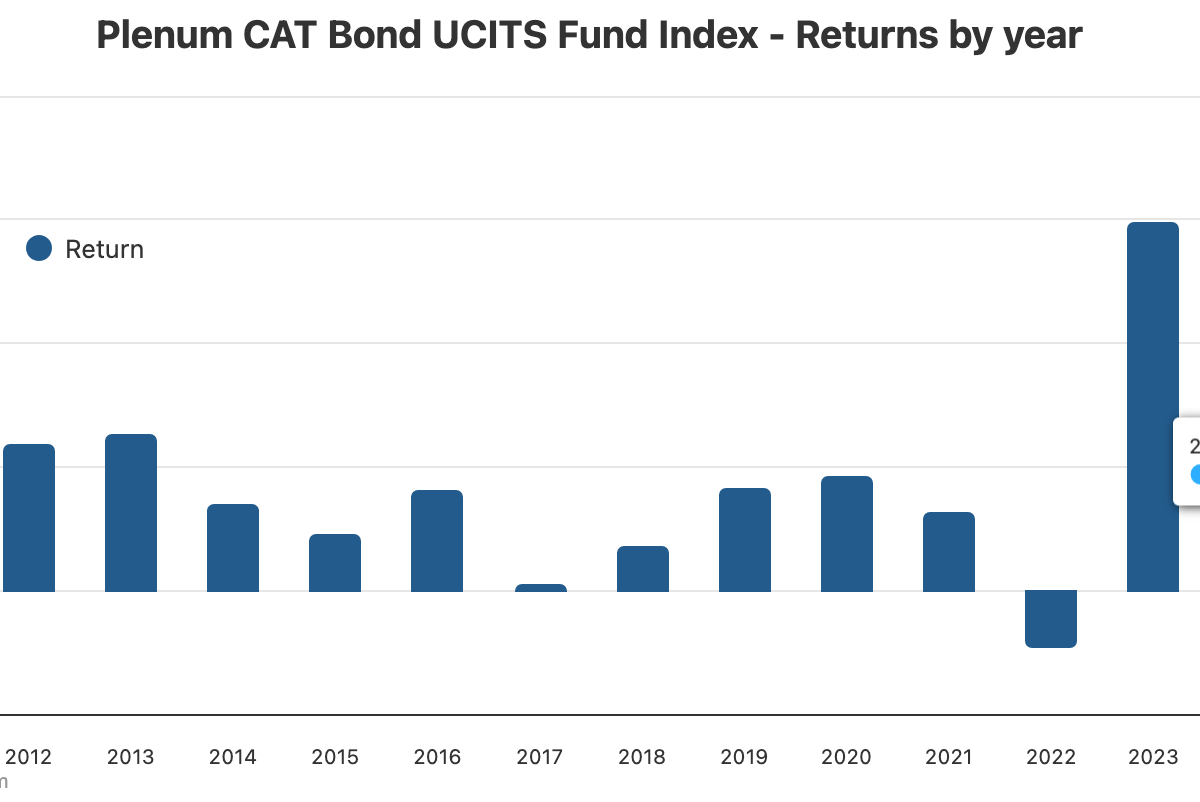

The cohort of lower-risk catastrophe bond funds structured in the UCITS format are still leading the way year-to-date in 2025, with an average 3.06% return to June 27th. But the higher-risk cohort of cat bond funds are now narrowing the gap, as impacts from wildfire and aggregate losses and mark-to-market adjustments move further into the past.

The latest data from the Plenum CAT Bond UCITS Fund Indices shows that June saw the average return across all the UCITS catastrophe bond funds rising to 0.58%, the best month of performance of 2025 so far for the Index.

Catastrophe bond funds were affected by mark-to-market and actual losses after the California wildfires, as well as further mark-downs and some losses to aggregate cat bond positions over the first-half of this year.

A number of aggregate cat bond positions recovered as well, with some further benefits from this likely to flow to the cat bond fund Index constituents once data is in for early July, we suspect. It’s understood that a number of cat bond positions that had been marked down in secondary pricing sheets did not reach their attachment points in the risk period to the end of the first-half, meaning some recovery is to be anticipated from these.

Remember that, 2025 started with UCITS cat bond funds averaging a 0.40% return for the month of January on the initial effects of the wildfires in California, after which performance dropped to 0.32% return for the month of February, as some cat bond positions’ wildfire related mark-downs accelerated during that month.

March then saw the sector recovering somewhat, delivering an average return of 0.56% and taking the first-quarter performance for the Plenum CAT Bond UCITS Fund Indices to 1.38%. But April saw returns depressed by mark-downs to certain positions, resulting in a 0.28% return for the segment.

For May, a positive 0.52% return across the UCITS catastrophe bond fund segment lifted the average year-to May 3oth return to 2.34%.

Now, with the data to June 27th available, the latest month of record shows an average UCITS cat bond fund return of 0.58%, which has lifted the year-to-date average return to 2.94%.

The lower-risk cohort of UCITS cat bond funds has fared better still, averaging 0.59% for the last month and 3.06% year-to June 27th, according to the Index.

The higher-risk cohort is narrowing the gap though, with a 0.57% return for the last month and now 2.81% year-to-date.

On a capital-weighted basis, the Plenum CAT Bond Fund Indices delivered a 0.65% return for the last month and now stands at 2.56% year-to-date.

The average twelve-month return for this Index of UCITS catastrophe bond funds stood at 11.69% as of June 27th, with 11.58% for the lower-risk cohort, 11.76% for the higher-risk cat bond funds and a capital-weighted 11.62%.

That rolling 12-month return has fallen slightly from the 12% it reached after May.

Analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

Analyse catastrophe bond market yields over time using this chart.