Navigating the vast and often complex world of mutual funds can be challenging. However, the bl.portfolio Star Track Mutual Fund Ratings simplifies this process with a clear, data-driven approach. This comprehensive rating system evaluates and ranks mutual funds based on long-term performance and risk metrics, assigning star ratings from 1 to 5—where 5 denotes the highest level of consistent performance.

The ratings are derived from an in-depth analysis of each fund’s historical performance, measured in terms of both returns and risk. Returns are assessed using rolling returns, which help identify schemes that have delivered relatively stable performance across different market cycles. Risk, on the other hand, is evaluated using the Sortino ratio, a metric that focuses specifically on downside risk—how a fund performs during market downturns.

Among the various categories of mutual funds, midcap mutual funds stand out for their long-term growth potential. These funds invest primarily in medium-sized companies—typically those ranked 101 to 250 by market capitalization. While midcap funds often outperform their large-cap counterparts over the long term, they also tend to be more volatile. As such, they are best suited for investors with a long-term investment horizon, say 7-10 years and a higher tolerance for risk.

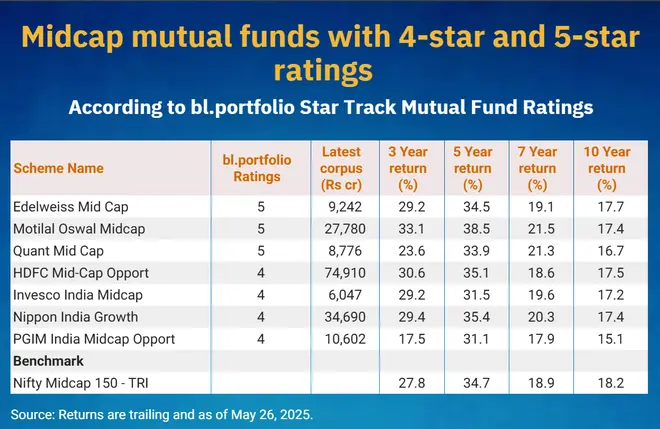

Below are the midcap mutual funds that have earned four- and five-star ratings according to the bl.portfolio Star Track Mutual Fund Ratings.

Published on May 28, 2025