Torsten Asmus

Most investments are at least somewhat cyclical. While there are some companies that have recession-resistant business models, most markets will go through different phases depending on various factors.

With inflation levels having been elevated for much of the last 3 years, prices still high, and interest rates at levels not seen in 22 years, many dividend investors are having a harder time finding solid and consistent income. A form of new investment that has become increasingly common over the last several years are covered call funds focused on making regular monthly payouts.

One fund that recently came to market within the last year that uses covered calls to generate income is the Defiance Nasdaq 100 Enhanced Options Income ETF (NASDAQ:QQQY). This exchange-traded fund sells put options that at-the-money to 5 percent in-the-money to make monthly payouts. The fund invests money received from selling options in low-risk income-generating financial instruments such as government bonds.

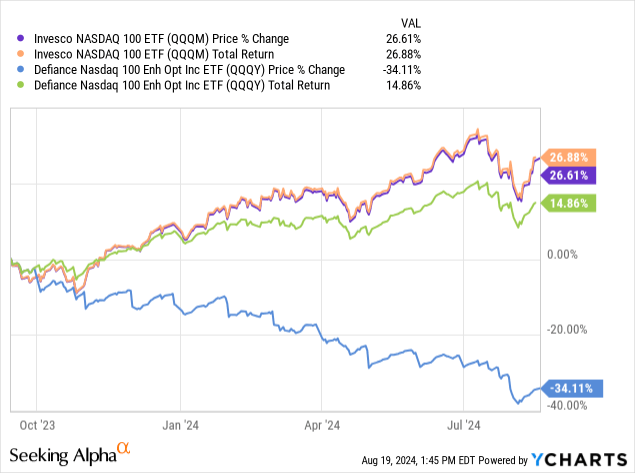

QQQY has offered investors total returns of 14.86% since the fund’s inception in September of 2023. The Nasdaq 100 index that this fund invests in has offered investors a total return of 26.88% during this same time frame.

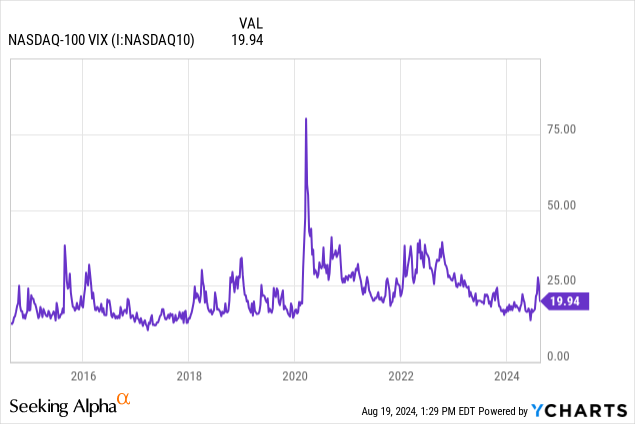

I initiated coverage of the Defiance Nasdaq 100 Enhanced Options Income ETF in April of this year, and I rated the fund a buy. I am upgrading my coverage of this exchange-traded fund to a strong buy today. The main factor that determines the monthly income QQQY can pay out is the implied volatility premiums in the puts options that this fund sells monthly.

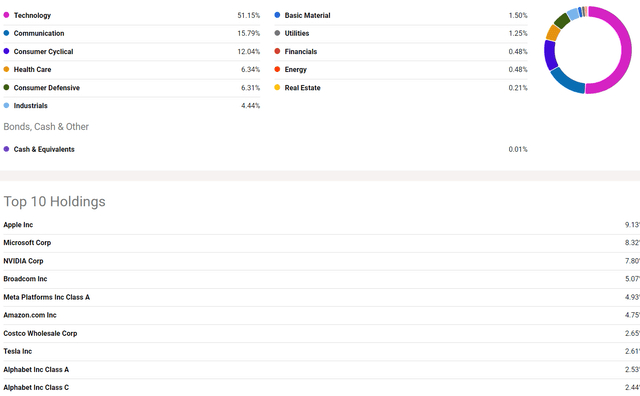

QQQY HAS an expense ratio of .99% and the fund has $201.5 million in assets under management. The ETF has a 30-day SEC yield of 4.58%. While the Nasdaq 100 can obviously experience elevated levels of volatility, the index is not likely to sell-off hard for multiple reasons. Many of the largest holdings of this index are companies that have proven to be only moderately cyclical such as Microsoft (MSFT), Amazon (AMZN), and Costco (COST). No one holding of this index is also more than 9 percent of the fund, and the Nasdaq 100 also has significant communication, health care, and consumer defensive holdings as well. This is a well-diversified index that has only moderate exposure to more cyclical industrial and consumer-based companies, the Nasdaq 100 is not likely to experience excessive levels of volatility in the current economic environment.

A Chart of the holdings of the Nasdaq 100 (Seeking Alpha)

Still, even though this is a well-diversified fund, the Nasdaq 100 is likely to experience elevated levels of volatility moving forward. The VIX has been near a 10-year low for some time before starting to rise recently as the markets have become more volatile with increasing signs that consumer spending levels that comprise nearly 70 percent of US GDP are beginning to weaken significantly. The Nasdaq 100 index should also hold up fairly well even in a weak market for multiple reasons if volatility levels increase.

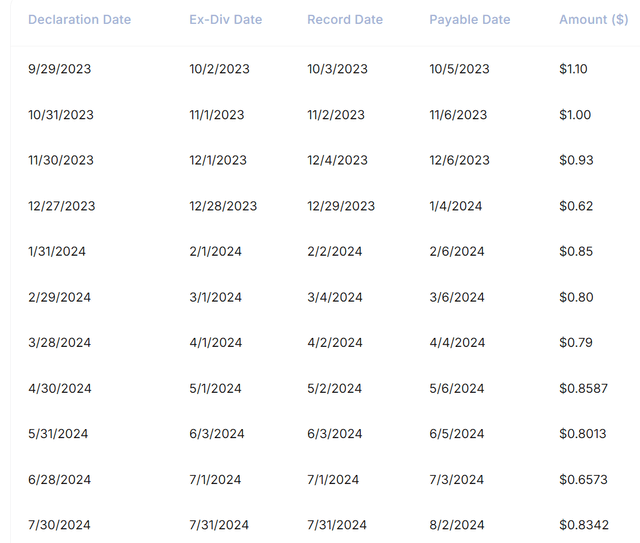

QQQY’s monthly payouts have ranged widely from as low as $.62 a share in January of 2023, to as high as $1.10 a share in October of 2023. The implied volatility levels in the monthly put options this fund sells have a significant impact on the regular payouts QQQY can make, and put options tend to be more volatile than call options.

A List of QQQY’s Monthly Payouts (defianceetfs.com)

QQQY’s goal is to be able to return pay at least .25% of income per day to investors.

All investments have risks, and this fund uses a higher-risk options strategy since downside potential is unlimited when the ETF shorts puts, while upside gains are capped since the exchange-traded fund can only make as much money per month on the options strategy as the value of the put options sold. This fund is likely to continue to underperform the Nasdaq 100 the ETF focuses on as well as the broader indexes, and QQQY has experienced a net asset value decline of nearly 34% in the last eleven months since the fund’s inception.

QQQY has one of the first funds to focus on selling put options rather than calls to generate income, and this ETF’s strategy should offer investors consistent and significant income without when volatility levels are elevated. This fund will also likely perform ideally when volatility levels are rising, but not at a point where the risk to the principal is excessive, and these are the current conditions that exist in markets today. While this fund will be for investors comfortable with an above-average risk profile, this ETF should offer solid and consistent income in the current investing environment for some time.