Trustnet examines the top quartile global funds with less than £250m in assets under management.

Investors tend to gravitate towards larger funds, but bigger is not always better when it comes to funds. Smaller funds run less money, so managers can be nimble and invest in stocks lower down the market capitalisation spectrum.

Larger funds, by contrast, are often unable to invest in smaller opportunities because they would be forced to either take an overly large stake in the company or establish a position that is too small to make a difference to the fund’s overall return.

But for investors after a smaller fund, it can be challenging to decide where to start because many of these are relatively under the radar. With this in mind, Trustnet examined the global funds with top quartile returns over the three years to the end of May 2025 but less than £250m in assets.

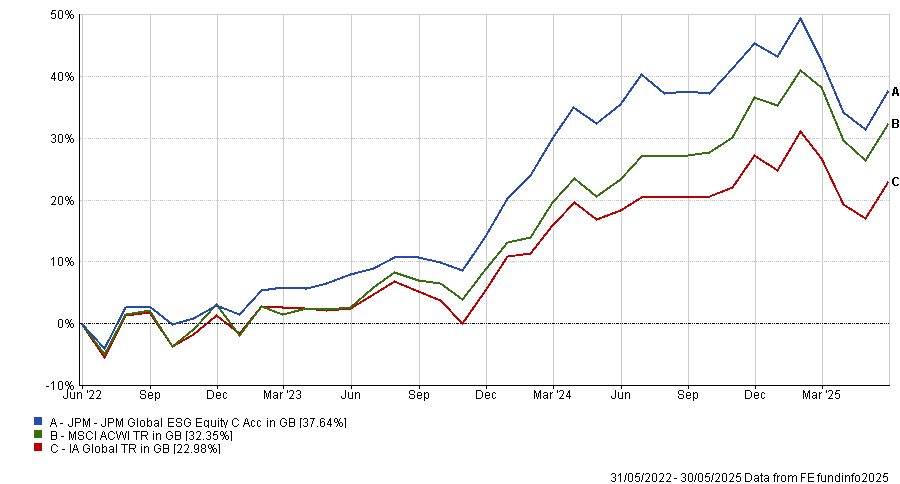

Based on these criteria, 38 global funds could be considered hidden gems, as seen in the table below.

Source: FE Analytics. Returns in sterling as of 31 May.

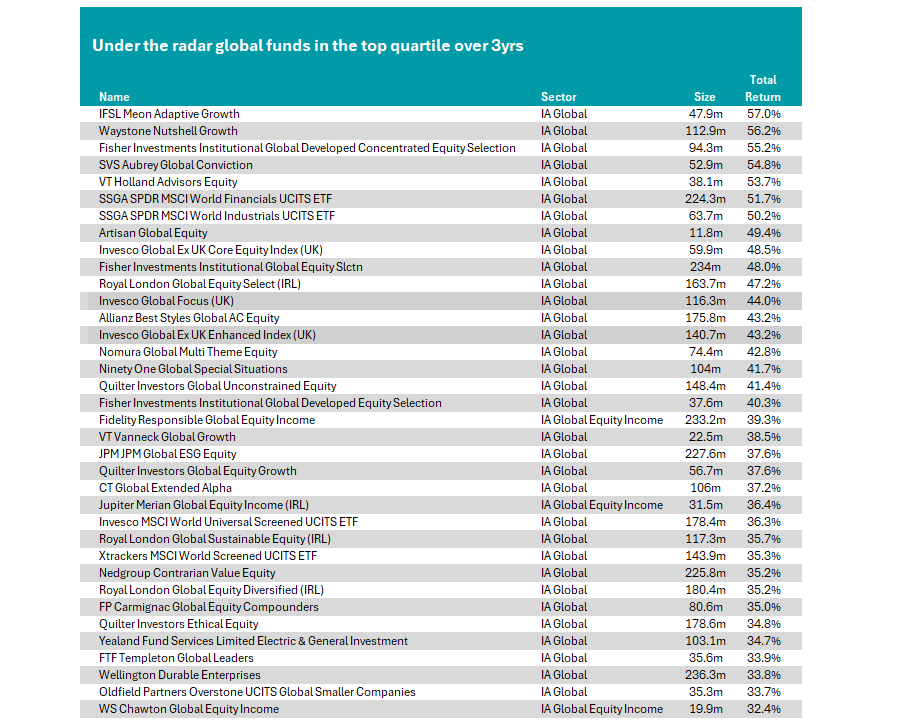

Heading up the chart is the IFSL Meon Adaptive Growth portfolio. Led by Robert Hale since 2022, it has delivered a total return of 57% over this period, compared with an average return of 23% from the IA Global sector.

Hale uses computer modelling to assess numerous financial measures of the companies and exchange-traded products to determine whether they should be included in the portfolio, although the manager “reserves the right to use their judgement to override the output of the computer model”.

The fund invests at least 80% of the portfolio in large-cap companies listed on any UK, USA and European stock markets, but it does not currently hold the likes of the Magnificent Seven (Alphabet, Amazon, Microsoft, Nvidia, Apple, Tesla and Meta), which have dominated the global market in recent years.

Instead, the fund’s top stock holdings are Berkshire Hathaway, Deutsche Boerse, RELX, Vistra Energy and Boston Scientific, alongside some cash and gold.

Reviewing last year’s performance, Hale said: “The performance of global stock markets continues to be dominated by stocks listed on United States markets.

“Large names such as Nvidia Corp continued to grab the headlines during the period, but the investment process has steered the [fund] away from exposure to such volatile situations, choosing to further diversify the portfolio that currently stands at around 53 individual company investments.”

Performance of the fund vs the sector over the past 3yrs

Source: FE Analytics.

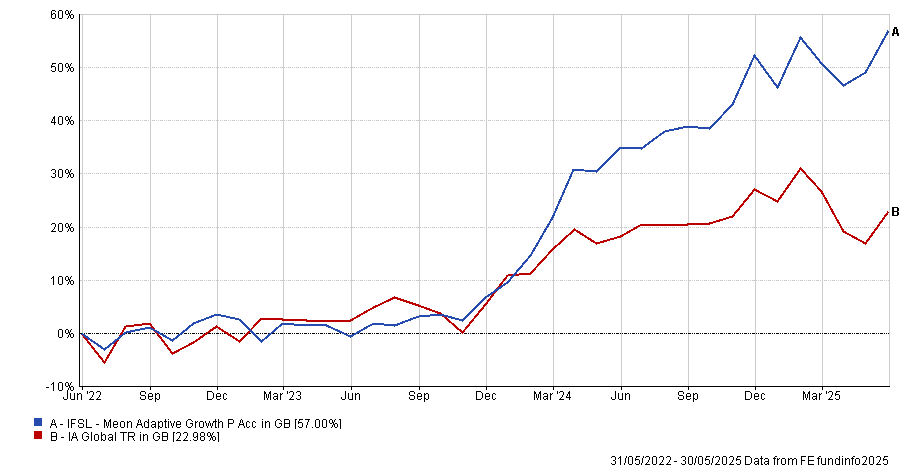

The Waystone Nutshell Growth fund comes in second with a total return of 56.2% over this period.

Despite having running over £100m, it is not entirely unheralded and is featured on FundCalibre’s elite radar. Analysts explained that due to manager Mark Ellis’ background as a trader at NatWest and Bear Steins, the portfolio takes a very different approach to its peers.

In contrast to many active managers, Ellis believes trading is not necessarily bad, with the team willing to make quick shifts in allocation in response to new information. While this does make it more volatile than the average peer, it also gives the fund a “rare combination of pragmatism and academic rigour” and, according to FundCalibre, exciting long-term potential.

This is another fund that puts quantitative analysis at the heart of its process, running a deep data extraction from 10,000 publicly listed companies, screening them on return on invested capital, profit margin and market cap, and using 50 financial and non-financial metrics to score the resultant universe.

FundCalibre said: “What makes this fund particularly interesting is its rare combination of pragmatism, given Mark’s trading background and academic rigour. The quant process is grounded in logical academic reasoning and the fund has delivered thus far. We like the fund’s nimbleness and its ability to quickly reposition.”

Performance of the fund vs the sector over the past 3yrs

Source: FE Analytics.

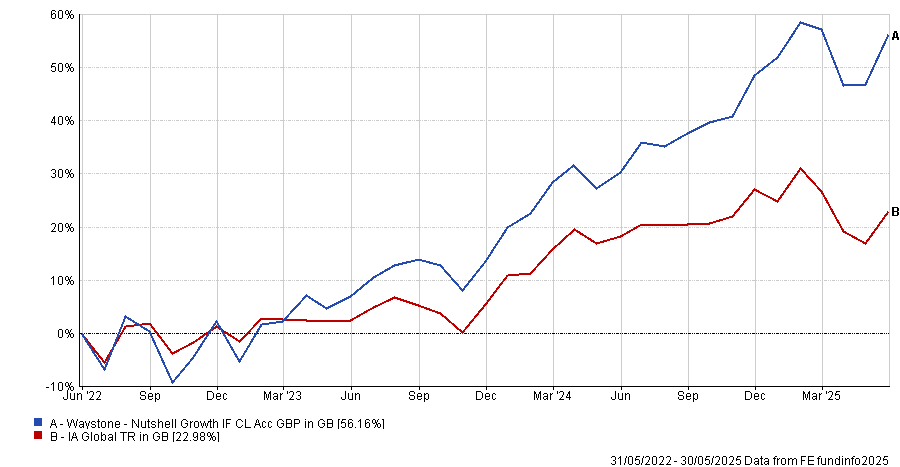

Elsewhere, large asset managers are home to a range of smaller funds, often run by highly experienced managers. For example, the JPM Global ESG Equity fund is led by Timothy Woodhouse and Joanna Crompton, two FE fundinfo Alpha Managers, who run several larger strategies at JP Morgan Asset Management.

It was a top-quartile performer in 2022, 2023 and 2024, due to high allocations towards Microsoft, Amazon and Nvidia. However, it has over 63% of the portfolio in the US, which has weighed on returns as investors have started rotating out of the US this year.

ESG strategies have also struggled with issues such as the US’ rollback of climate and diversity-related initiatives, high interest rates and the outperformance of areas like energy stocks.

Performance of the fund vs the sector over the past 3yrs

Source: FE Analytics.

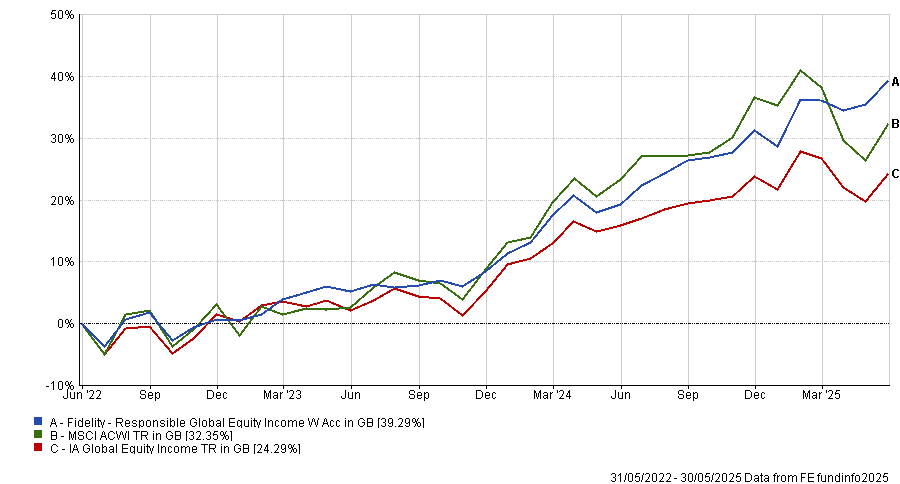

In the global equity income sector, the Fidelity Responsible Global Equity Income fund also qualified. This is another ESG-focused fund, aiming to invest at least 80% in companies with high ESG ratings or companies with “low but improving sustainability characteristics”.

Rather than the US, it favours European and UK companies such as Deutsche Boerse and Unilever. With just 33% exposure to the US, it is the sixth best-performing global equity fund so far this year.

It has also delivered top-quartile results more widely and is the best-performing global equity income fund in the sector over the past decade, returning 248.9%.

Performance of the fund vs the sector and benchmark over the past 3yrs

Source: FE Analytics.

Royal London also has a top-performing sustainable fund – the Royal London Global Sustainable Equity (IRL) fund, led by Alpha Manager Mike Fox. Over the past three years, it has delivered a top-quartile return; however, it slipped into the bottom 50% of the sector over the past year.

Two of its stablemates, Royal London Global Equity Diversified (IRL) and Royal London Global Equity Select (IRL), also delivered top-quartile results in this period. However, these strategies have new management teams who joined in November last year, following the departure of former head of equities Peter Rutter and his team.