Investors abandon Fundsmith and flock to passive global equity funds.

Fundsmith Equity suffered the most outflows of any fund in the IA Global sector during the first half of this year, as investors pulled £832m from Terry Smith’s flagship strategy.

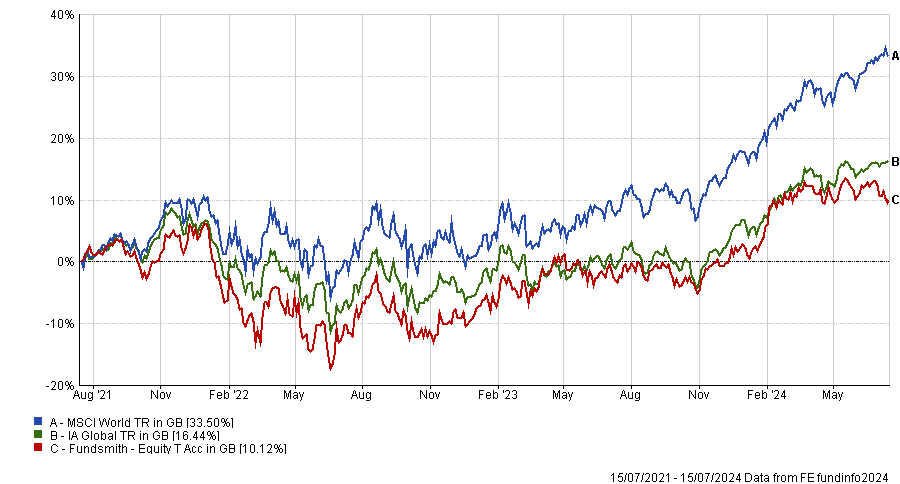

The fund has endured a spate of poor relative performance, falling behind the MSCI World index for the past three years, landing it in Bestinvest’s Spot the Dog list for the first time. Smith attributed his fallow run to the market’s concentration and his decision not to invest in Nvidia.

Performance of fund vs sector and MSCI World over 3yrs

Source: FE Analytics

Yet what the £25bn fund lost in flows, it more than made up in returns, which swelled its coffers by £2.2bn during the first half of this year.

Furthermore, Fundsmith Equity’s long-term performance has been spectacular. It returned 311% for the decade to 12 July 2024, almost double the IA Global sector average of 162%. Despite this year’s outflows, it remains popular with many retail investors and was the sixth most-bought fund on interactive investor’s platform in June.

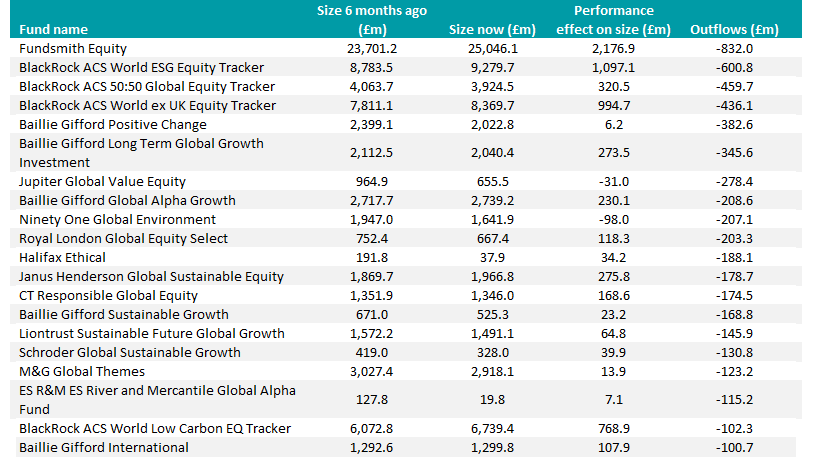

Elsewhere, investors abandoned sustainable investment strategies in their droves. BlackRock ACS World ESG Equity Tracker, Baillie Gifford Positive Change and Ninety One Global Environment all lost more than £200m in outflows.

Performance of funds vs sector and MSCI ACWI over 3yrs

Source: FE Analytics

Meanwhile, Janus Henderson Global Sustainable Equity, CT Responsible Global Equity, Baillie Gifford Sustainable Growth, Liontrust Sustainable Future Global Growth and Schroder Global Sustainable Growth suffered outflows of £120m to £180m.

Performance of funds vs sector over 3yrs

Source: FE Analytics

Sustainable investment strategies have had a tough couple of years. Many of the growth-oriented companies in which they invest underperformed as interest rates were rapidly hiked in 2022.

Traditional energy, aerospace and defence stocks surged in reaction to Russia’s invasion of Ukraine and rising geopolitical tensions – areas where most sustainable strategies have scant exposure.

Then last year and this year, equity market performance was dominated by a handful of US tech giants. Some funds following environmental, social and governance (ESG) guidelines invest in a few of the ‘Magnificent Seven’, whereas others believe their relationships with stakeholders don’t pass muster.

Funds in the IA Global sector shedding more than £100m in 1H 2024

Source: FE Analytics

The aforementioned outflows were dwarfed by inflows as UK-based retail investors ploughed £7.6bn into global equity funds during the first half of this year, according to Calastone.

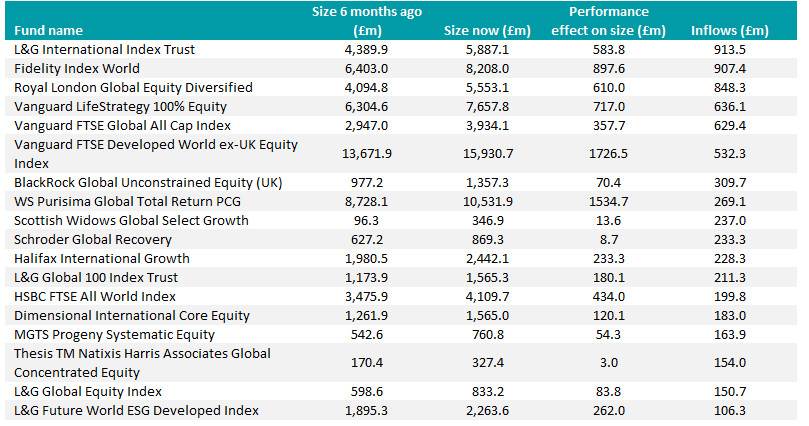

They showed a marked preference for cheap passive strategies. Of the five funds in the IA Global sector receiving the most inflows during the first half of this year, four were passively managed.

L&G International Index Trust led the way, raking in £913m of inflows, followed by Fidelity Index World, gaining £907m.

Three Vanguard funds each gained more than £500m of inflows, as the table below shows: Vanguard LifeStrategy 100% Equity, Vanguard FTSE Global All Cap Index and Vanguard FTSE Developed World ex-UK Equity Index.

This reflects a year in which global equity benchmarks (and strategies closely tracking them) have been exceptionally hard to beat. The most popular indices’ largest exposures – to US equities and mega-cap tech stocks – have delivered the greatest returns.

Funds in the IA Global sector attracting more than £100m in 1H 2024

Source: FE Analytics

The only actively managed fund to rival the passive giants in popularity was Royal London Global Equity Diversified, which raked in £848m of inflows. The fund’s performance is top-quartile over one, three and five years.

However, the strategy’s long-standing fund managers, Peter Rutter, James Clarke and Will Kenney, have left to start their own investment boutique, backed by Australia’s Pinnacle Investment Management Group. Rutter was Royal London Asset Management’s (RLAM) head of equities.

RLAM’s chief investment officer Piers Hillier has taken over the Global Equity Diversified fund, with Matt Burgess deputising.

Despite the change to its managers, the fund’s size has actually grown from £4.9bn when Rutter and his team’s departure was announced at the end of April to £5.6bn today.

Other popular actively managed strategies include Schroder Global Recovery, Scottish Widows Global Select Growth, Purisima Global Total Return and Harris Associates Global Concentrated Equity.

The most and least popular global equity income funds

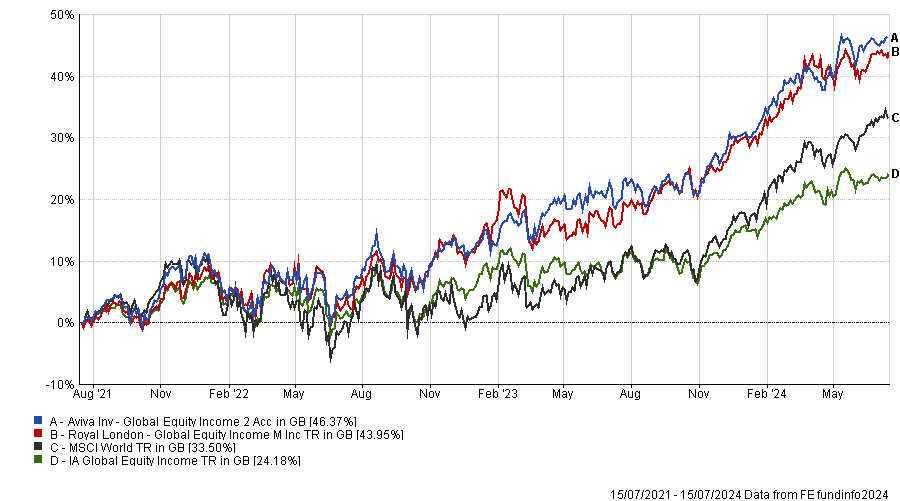

Investors backed the top performers in the IA Global Equity Income sector, with the two highest-returning funds in the sector over three years also the only ones to rake in more than £200m in inflows so far this year.

Aviva Investors Global Equity Income enjoyed inflows of £250m, almost doubling its size to £582m. It is managed by FE fundinfo Alpha Manager Richard Saldana and Matt Kirby.

Performance of funds vs sector and MSCI World over 3yrs

Source: FE Analytics

The £1.2bn Royal London Global Equity Income fund attracted £218m this year although its manager, Nico de Walden, has joined other former members of RLAM’s global equity team at Pinnacle.

Richard Marwood, head of RLAM’s equity income team, has taken over the fund together with Hillier and Burgess.

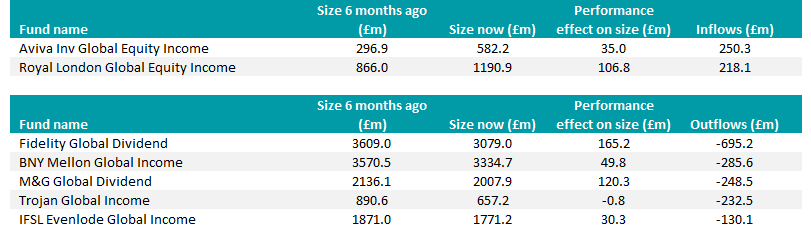

Funds in the IA Global Equity Income sector attracting or shedding more than £100m in 1H 2024

Source: FE Analytics

On the other side of the fence, four funds shed more than £250m: Fidelity Global Dividend (outflows of £695m), BNY Mellon Global Income (£286m), M&G Global Dividend (£248.5m) and Trojan Global Income (£232.5m).

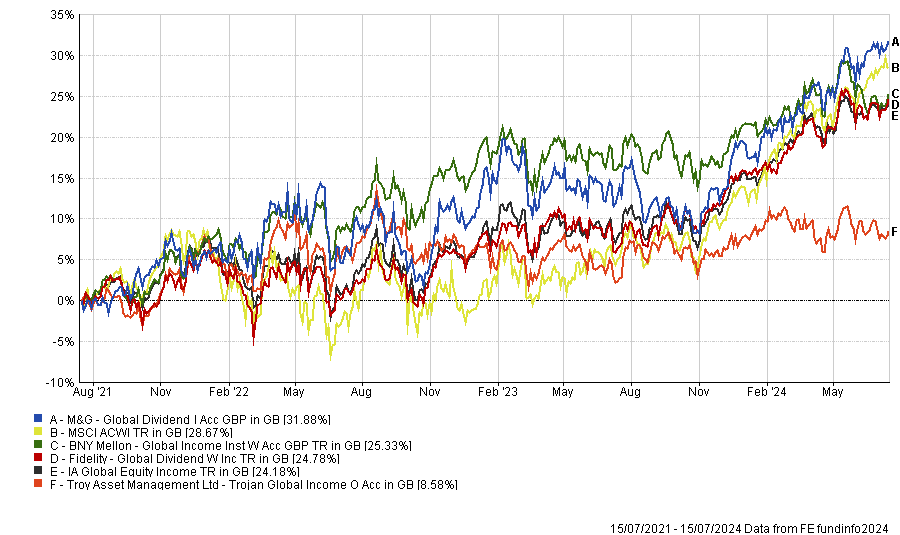

Performance of funds vs sector and MSCI World over 3yrs

Source: FE Analytics

M&G Global Dividend was the only one of these funds to outperform the MSCI ACWI over three years, as the chart above shows, although three of the four strategies beat their sector average.