Mitali Dhoke

Aug 20, 2024 / Reading Time: Approx. 7 mins

Listen to Thematic Funds Become Market Leaders with Record-High AUM Growth

00:00 00:00

The Indian mutual funds industry, a cornerstone of the country’s financial ecosystem, has experienced significant evolution over recent years. With an increasing number of investors turning to mutual funds for wealth creation and financial planning, the industry has shown resilience and adaptability amid a dynamic economic environment.

As of mid-2024, several key trends and developments are shaping the current market scenario. The MF Industry’s AUM has grown from Rs 24.54 trillion as of July 31, 2019, to Rs 64.97 trillion as of July 31, 2024, a more than 2-fold increase in a span of 5 years. In the dynamic world of mutual funds, thematic funds have recently captured the spotlight, surpassing traditional categories to become the largest segment within the mutual fund industry.

[Read: Is It Wise to Invest in Sector & Thematic Funds And Small Cap Funds Now? Know Here]

This meteoric rise is underscored by a remarkable doubling of Assets Under Management (AUM) within a single year, signalling a significant shift in investor sentiment and market trends. This article delves into the factors behind the rise of Thematic Funds, their characteristics, advantages, risks, and implications for the broader investment landscape.

Understanding Thematic Funds

Thematic Funds are investment vehicles that focus on specific themes or trends rather than on broad market indices or sectors. Unlike traditional mutual funds that may invest across various sectors based on economic fundamentals or market conditions, thematic funds concentrate on particular ideas or trends that are expected to drive growth. These themes can range from technology and healthcare to sustainability and demographic changes.

1. Characteristics of Thematic Funds

-

Focused Investment Strategy: Thematic Funds typically invest in companies that are aligned with a specific theme. For instance, a fund centred around renewable energy will invest predominantly in companies engaged in solar, wind, or other renewable technologies.

-

Growth-oriented: These funds often target high-growth sectors or emerging trends. This focus on growth themes means that they can exhibit higher volatility but also offer the potential for substantial returns.

-

Innovation-driven: Thematic Funds are often associated with innovative sectors or disruptive technologies, such as artificial intelligence, electric vehicles, or biotechnology. This innovation-driven approach attracts investors looking for opportunities at the cutting edge of technological advancements.

2. Thematic Funds vs. Traditional Funds

Traditional mutual funds usually diversify across a broad range of stocks and bonds, aiming to provide steady returns based on market performance or specific sectors. In contrast, Thematic Funds take a more concentrated approach, investing heavily in companies that align with a particular trend or idea. This concentrated strategy can lead to significant performance differences compared to traditional funds, depending on the success of the underlying theme.

[Read: These Thematic Mutual Funds Offered Over 50% Returns In 1 Year. Should You Invest in Them?]

3. Surge in Popularity of Thematic Funds

The rapid rise of Thematic Funds is a testament to shifting investor preferences and market dynamics. Modern investors are increasingly seeking investment opportunities that align with their personal values and interests. Thematic Funds offer a way to invest in areas they are passionate about or believe will drive future growth. For instance, investors concerned about climate change may be drawn to funds focused on sustainable energy.

The proliferation of technology and the acceleration of digital transformation have played a significant role in the rise of thematic funds. As new technologies emerge, thematic funds can capitalise on these advancements by focusing on sectors like fintech, cybersecurity, or e-commerce. The ability to harness cutting-edge technology allows thematic funds to stay relevant and attractive to investors.

Economic shifts and global trends also drive the popularity of thematic funds. For example, the COVID-19 pandemic accelerated trends such as remote work and digital health, leading to increased interest in funds that focus on these areas. Thematic funds can quickly adapt to changing market conditions and capitalise on emerging trends, offering investors timely opportunities.

Moreover, the Modi 3.0 government has had a substantial impact on the Indian mutual funds industry, particularly in driving the surge in inflows into thematic funds. This administration’s focus on strategic economic reforms, infrastructure development, and sectoral growth has created a fertile environment for thematic investing.

The government’s push towards technology-driven growth, green energy initiatives, and digitisation aligns well with the objectives of thematic funds that target specific sectors poised for rapid expansion. As a result, investors are increasingly channelling their funds into these specialised areas to capitalise on the government’s policy directions and anticipated economic trends.

[Read: Power Your Portfolio: 5 Sector & Thematic Funds to Consider]

4. Rise in AUM of Thematic Funds

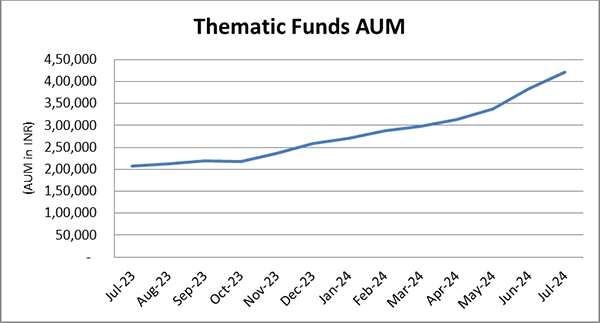

The doubling of AUM for Thematic Funds within a single year is a remarkable achievement. The sectoral and thematic fund category is now the largest active mutual fund space. Despite being considered the riskiest due to its reliance on specific sectors or themes, the category has achieved impressive growth, with AUM touching Rs 4.21 trillion in July 2024 from just Rs 2 trillion in July 2023.

Performance plays a pivotal role in this surge. Many thematic funds have reported strong returns, drawing in new investors and prompting existing ones to increase their stakes. This robust performance has created a momentum effect, fueling additional investments and further driving the expansion of thematic funds.

Graph 1: Dramatic Rise for Thematic Funds Doubled the AUM Within a Year

(Source: ACE MF, data collated by PersonalFN Research)

As of March 31, 2024, the total assets under management (AUM) for these funds reached Rs 2.97 lakh crore. During FY24, approximately 37 new fund offers from sectoral and thematic categories were launched, collectively raising Rs 25,493 crore.

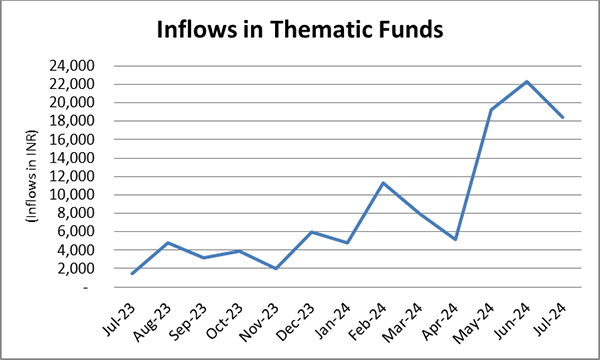

Graph 2: Thematic Funds Experienced Highest Inflows Over the Last One Year

(Source: ACE MF, data collated by PersonalFN Research)

In FY24, Sectoral and Thematic funds experienced their highest inflows in May and June, as well as in February, among all equity categories. In contrast, FY23 saw total inflows of Rs 23,731 crore into sectoral and thematic funds.

AMFI data reveals that out of the total inflow of Rs 46,137 crore into sectoral and thematic categories, nearly 55% came from New Fund Offers (NFOs) launched in FY24. Since the start of this year, thematic and sectoral funds have collectively garnered more than Rs 70,000 crore in investments. Within this, manufacturing funds have received the largest portion, accounting for 28% of the total inflows, which is approximately Rs 19,500 crore.

[Read: Why India is a ‘Bright Spot’ for Investing ]

To conclude…

The rise of Thematic Funds as the largest mutual fund category and the dramatic doubling of their AUM in just a year underscores a profound shift in investment strategies. Investors are increasingly drawn to thematic funds for their ability to target specific trends and innovations, offering a focused approach that aligns with their interests and values.

However, while thematic funds present significant opportunities, they also come with unique risks, such as high volatility and concentrated exposure. Investors must balance the potential for high returns with the inherent risks of sector-specific investments. As thematic funds continue to evolve and adapt to emerging trends, staying informed and discerning will be essential for navigating this dynamic segment of the mutual fund industry.

The future of thematic investing exhibits a positive outlook on continued innovation and growth, making it an exciting area to watch in the evolving financial landscape.

-New.png)

MITALI DHOKE is a Research Analyst at PersonalFN. She is an MBA (Finance) and a post-graduate in commerce (M. Com). She focuses primarily on covering articles around mutual funds including NFOs, financial planning and fixed-income products. Mitali holds an overall experience of 4 years in the financial services industry.

She also actively contributes towards content creation for PersonalFN’s social media platforms in the endeavour to educate investors and enhance their financial knowledge.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes.