In the current economic landscape, Sweden’s Riksbank has reduced borrowing costs, signaling a favorable environment for growth companies. As we explore top Swedish growth stocks with high insider ownership, it’s essential to consider how insider confidence and strategic positioning can enhance a company’s potential in such an evolving market.

Top 10 Growth Companies With High Insider Ownership In Sweden

|

Name |

Insider Ownership |

Earnings Growth |

|

CTT Systems (OM:CTT) |

16.9% |

24.8% |

|

Truecaller (OM:TRUE B) |

29.5% |

21.6% |

|

Fortnox (OM:FNOX) |

21.1% |

22.6% |

|

Biovica International (OM:BIOVIC B) |

18.8% |

73.8% |

|

Magle Chemoswed Holding (OM:MAGLE) |

14.9% |

72.2% |

|

Yubico (OM:YUBICO) |

37.5% |

43.7% |

|

BioArctic (OM:BIOA B) |

34% |

102.8% |

|

KebNi (OM:KEBNI B) |

37.8% |

86.1% |

|

Calliditas Therapeutics (OM:CALTX) |

12.7% |

51.9% |

|

InCoax Networks (OM:INCOAX) |

19% |

115.5% |

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★★☆

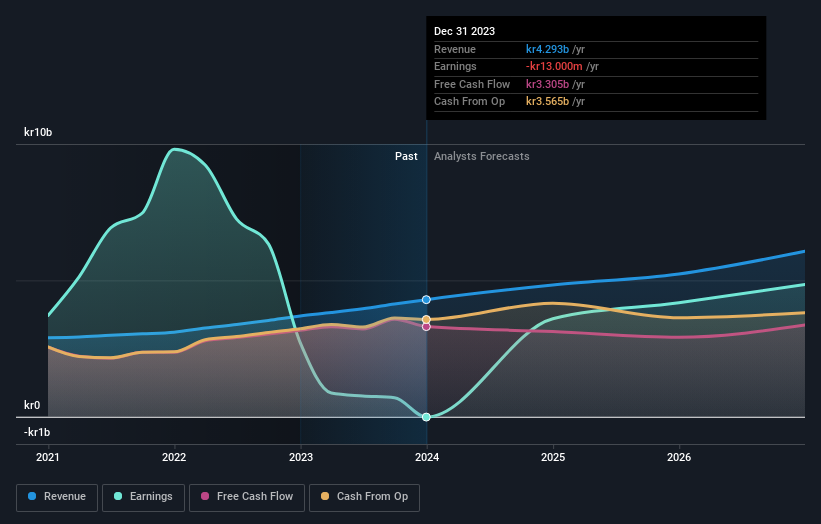

Overview: EQT AB (publ) is a global private equity firm specializing in private capital and real asset segments, with a market cap of SEK411.83 billion.

Operations: EQT AB (publ) generates revenue from three main segments: Central (€37.20 million), Real Assets (€878.70 million), and Private Capital (€1.28 billion).

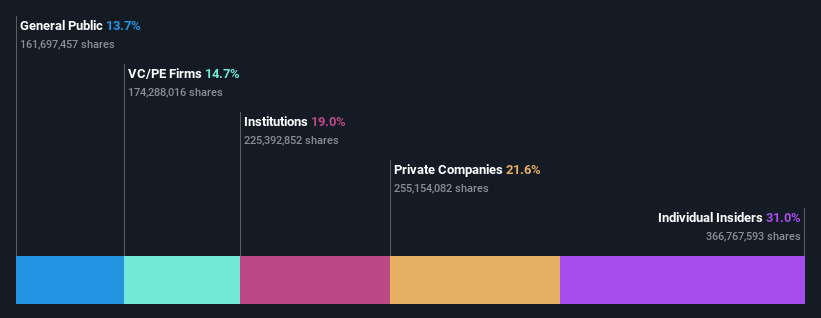

Insider Ownership: 30.9%

Earnings Growth Forecast: 56.8% p.a.

EQT AB (publ) is a growth company in Sweden with significant insider ownership. The firm’s earnings are forecast to grow significantly at 56.8% annually over the next three years, outpacing the Swedish market’s 16.1%. Recent M&A activity includes potential bids for Compass Education and Aavas Financiers, indicating strategic expansion efforts. Additionally, EQT announced a share repurchase program to adjust its capital structure and support acquisitions. Despite no substantial insider buying recently, EQT remains focused on high-growth opportunities in various sectors.

Simply Wall St Growth Rating: ★★★★☆☆

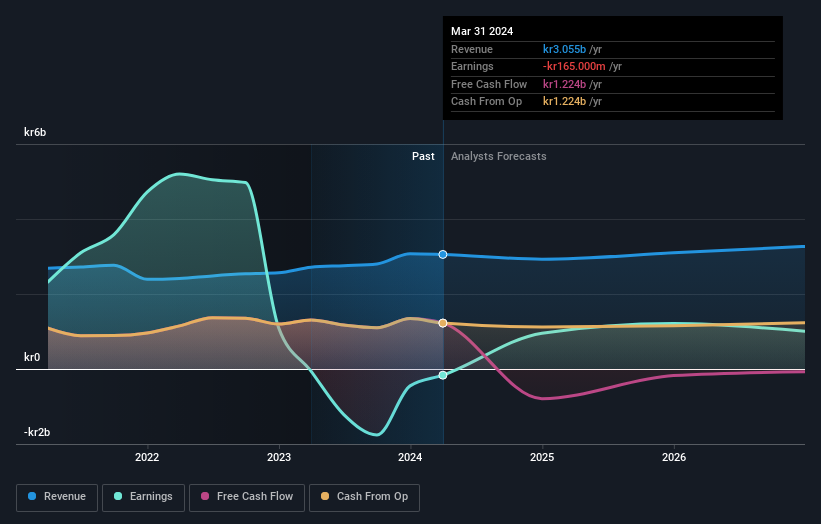

Overview: AB Sagax (publ) is a property company operating in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market cap of SEK99.28 billion.

Operations: Revenue from rental real estate in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries totals SEK4.63 billion.

Insider Ownership: 28.6%

Earnings Growth Forecast: 30.7% p.a.

AB Sagax, a Swedish growth company with high insider ownership, has shown impressive earnings growth of 196.5% over the past year and is forecast to grow its earnings by 30.7% annually over the next three years, outpacing the Swedish market’s 16.1%. Despite shareholders facing dilution in the past year and debt not being well covered by operating cash flow, recent guidance expects profit from property management to reach SEK 4.3 billion for 2024.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wallenstam AB (publ) is a property company operating in Sweden with a market cap of SEK 36.73 billion.

Operations: Wallenstam generates revenue from its operations in Stockholm (SEK 938 million) and Gothenburg (SEK 1.94 billion).

Insider Ownership: 35%

Earnings Growth Forecast: 53.6% p.a.

Wallenstam AB, with significant insider ownership, has shown a strong recovery in financial performance, reporting a net income of SEK 74 million for Q2 2024 compared to a net loss of SEK 218 million the previous year. Despite forecasted revenue growth being modest at 3.2% annually, earnings are expected to grow significantly by 53.6% per year over the next three years. Recent initiatives include sustainable property developments attracting new tenants and enhancing environmental credentials.

Key Takeaways

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:EQT OM:SAGA A and OM:WALL B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com