Global investment-sale activity suggests that commercial real estate turned a corner in the second quarter of the year. Deal volume was effectively unchanged from a year earlier, and price declines have generally moderated and even halted in some regions. The changes in the second quarter suggest that we are emerging from one of the many shocks that the market has dealt with in recent years.

A series of shocks

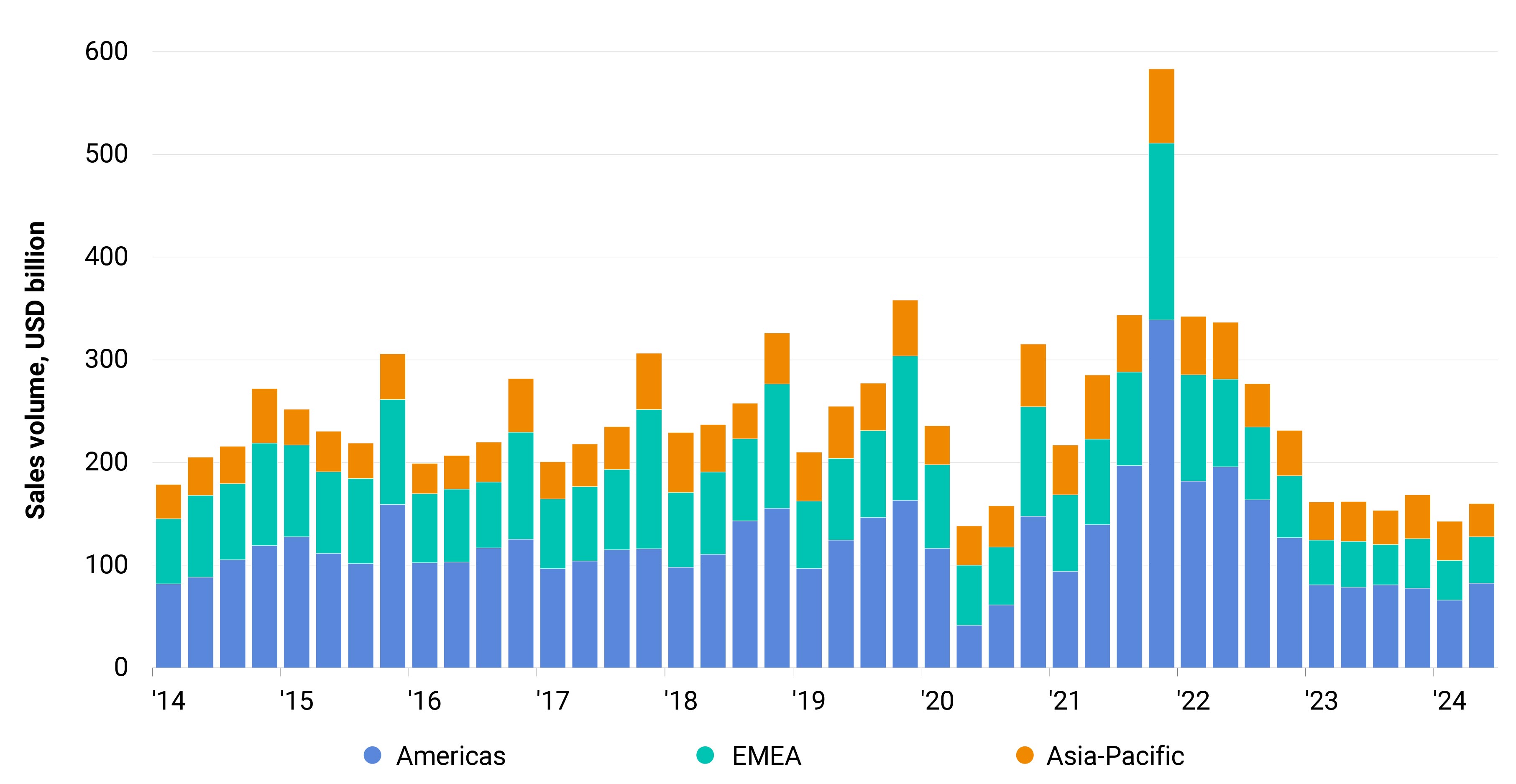

The COVID-19 shock of 2020 continues to roll through commercial-property markets globally, in a series of waves four years from the initial storm. The shock in 2020 impacted market fundamentals, pressuring property income. The rapid decline in interest rates that followed the shock to the real side of the economy was a wave lifting asset values and pushing global sales volume up to almost USD 600 billion in the fourth quarter of 2021. A wave of higher interest rates came crashing down and pushed sales volume to a quarterly average of only USD 158 billion over the last six quarters.

That third shock of higher rates savaged commercial-property prices globally. Values of commercial-real-estate assets fell as investors reassessed the cost of capital and rates of return in other asset classes. This third repricing shock seems to be at or approaching an end.

Sales on par with 2023 in second quarter

Global investment sales were down only 1% from a year earlier in the second quarter — effectively flat. The Americas led the improvement, registering 5% higher deal activity in the quarter. Europe, the Middle East and Africa (EMEA) posted a 1% pace of growth, while Asia-Pacific still fell but at a reduced rate compared to the initial waves of volume declines in 2022.

A preliminary look at our global commercial-property price indexes (CPPI) suggests that as the declines in deal volume have moderated, so too has the retreat in prices. Price drops were still being seen in major markets worldwide in the second quarter, but fewer markets are experiencing an acceleration of these declines.

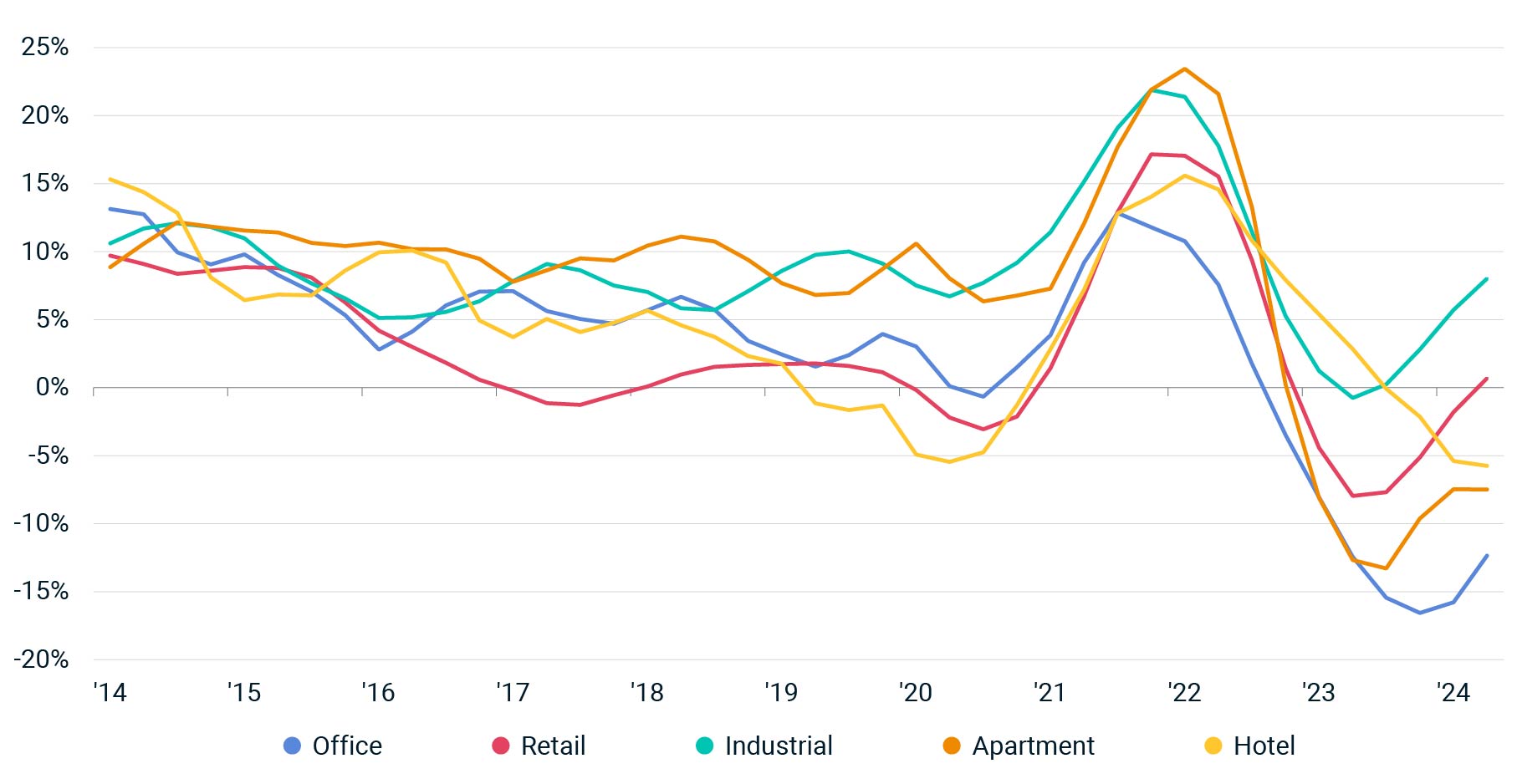

CPPI data for the U.S., which is finalized before global indexes, shows a moderation in price declines across most major property types. The industrial market weathered the interest-rate shock to pricing easily, with only modest drops in 2023, before surging into 2024 on the basis of healthy income growth and strong investor interest in the asset type.

The office market faces stronger headwinds on both of those measures, but even there, the sharpest declines for U.S. offices came in late 2023, with the decreases moderating through midyear 2024. The overall composite index across property types for the U.S. was flat in the second quarter relative to a year earlier.

US property-price declines have moderated

If price declines are stabilizing, does it mean that all the storms from 2020 are in the past and smooth sailing is ahead? Not necessarily, as there are always other challenges on the horizon. In early August, fears over U.S. job growth led to concerns about a hard landing for the global economy. Such a hard landing would likely again erode demand for real estate but possibly drive lower interest rates and mortgage rates, perhaps allowing some property owners to refinance expensive loans. Still, the global commercial-real-estate markets have endured a difficult period and there were glimmers of good news in the second quarter.