In today’s fluctuating economic environment, a growing number of wealthy individuals are turning to raw land as a smart investment strategy. Wayne Turner, a seasoned real estate broker, recently shed light on this trend in his latest video, exploring the reasons behind this strategic move and how it can benefit investors of all levels.

Why Raw Land?

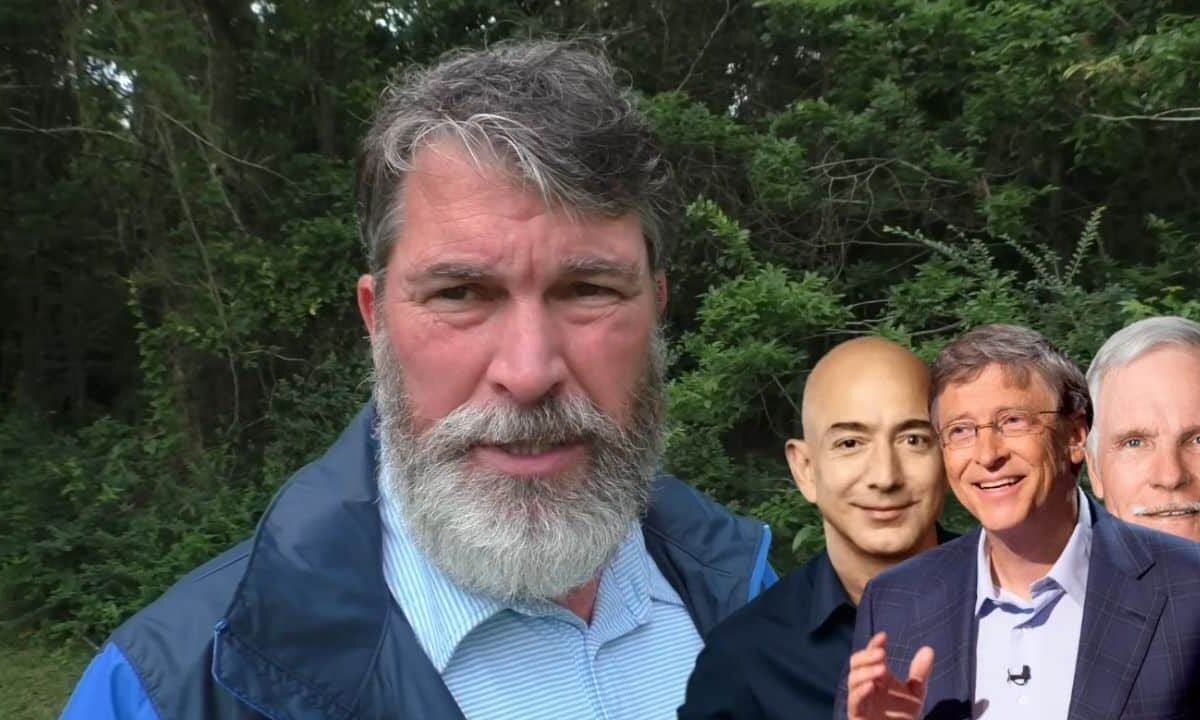

According to Turner, more people are buying raw land in the United States than ever before, and it’s not just the ultra-wealthy who are making these investments. Average individuals, concerned about the stability of their other assets, are also diversifying their portfolios by purchasing land. However, it’s hard to ignore that big names like Bill Gates, Jeff Bezos, and Ted Turner are leading the pack in land acquisition. These moguls have collectively amassed millions of acres, signaling a significant shift in investment trends.

Limited Supply, High Demand

The primary reason behind this land-buying spree, Turner explains, is the simple fact that “they’re not making any more land.” Unlike other assets, the availability of land is finite, which makes it inherently valuable. As the population grows and the demand for food, housing, and other resources increases, the value of land is likely to rise. Turner points out that land is now valued similarly to gold and silver, both of which are at their peak values.

Versatility of Land Use

Turner highlights the various ways land can be utilized, making it a versatile investment. Whether it’s for timber, ranching, farming, grazing, or even mining, land offers multiple revenue streams. A new trend Turner mentions is the concept of “land BNB,” where investors buy small tracts of land and rent them out for camping and outdoor activities, catering to the increasing number of people seeking to escape the hustle and bustle of city life.

A Safe Haven from Market Volatility

One of the most appealing aspects of investing in land, Turner notes, is that it operates independently of the stock market. Land isn’t traded on the stock market, which means it’s not subject to the same volatility as stocks, bonds, or mutual funds. With inflation on the rise and traditional investments struggling to keep up, more fund managers are advising clients to include land in their portfolios as a stable, long-term investment.

The Dark Side of Land Investment

Despite its many advantages, Turner acknowledges that there is a downside to owning raw land: it doesn’t generate passive income. Unlike rental properties or dividend-paying stocks, raw land doesn’t provide an immediate return on investment. However, Turner argues that the potential for long-term appreciation, along with the flexibility to use the land for various purposes, more than compensates for this drawback.

Tax Benefits and Investment Incentives

Turner also touches on the tax benefits associated with land ownership. Investors can deduct the interest paid on loans used to purchase land, which can provide significant tax savings. While the specifics should be discussed with a CPA, Turner emphasizes that these tax advantages make land an even more attractive investment option.

The Future of Land Investment

As the world’s population continues to grow and the availability of land decreases, Turner believes we may be witnessing another land rush in the United States. He suggests that the consistent and stable value of land, combined with increasing demand, will drive up property values in the coming years, making now the ideal time to invest.

“Small Percentage of Overall Holdings”

People in the comments shared their thoughts: “Back in the day, when I purchased my first land and home to live-in; that was Miami in the early 1990s, first mortgages with rates of 8 to 9% and 9% to 10% were typical. People will have to accept the possibility that we won’t ever return to 3%. If sellers must sell, home prices will have to decline, and lower evaluations will follow. Pretty sure I’m not alone in my chain of thoughts.”

Another person added: “These big land owners you mentioned also have something else in common, their land holdings are a small percentage of their overall holdings so while the size of holdings are large it’s relatively small in investment percentage of wealth.”

A Smart Move for Savvy Investors

Turner’s insights into the growing trend of land investment make it clear why so many wealthy individuals are buying raw land. Whether you’re looking to diversify your portfolio, hedge against market volatility, or simply invest in a tangible asset with long-term potential, raw land offers a unique and profitable opportunity. As Turner puts it, “Perhaps we’re seeing another rush on land right here in the United States.”

Finite Nature of Land

What are your thoughts? How does the finite nature of land compare to other investment options in terms of long-term value and security? In what ways can average investors participate in the raw land market, and what should they consider before making a purchase? Could the increasing trend of land ownership among the wealthy exacerbate inequality in property ownership and access?

Explore the full insights by viewing the video on Wayne Turner’s YouTube channel here.