Kantar Group has said it intends to sell its Kantar Media division to alternative investment firm H.I.G. Capital in a $1 billion transaction.

Kantar Media is a global leader in media measurement and analytics, providing audience research services in several European markets.

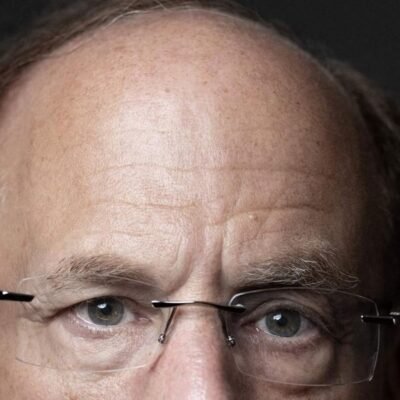

Kantar Media CEO, Patrick Béhar will continue to lead the business.

“Over a year ago, I joined Kantar Media from Sky to accelerate the transformation of Kantar Media into an agile, technology-centric company, shaping the measurement industry through advanced cross-media solutions. This transaction would give us the resources and support to further accelerate our growth trajectory and strengthen our position as the global leader in media measurement and analytics,” he said.

“We are excited to partner with Patrick and his talented team,” added Nishant Nayyar, Managing Director at H.I.G Capital. “Kantar Media has a long-standing reputation for delivering essential data and trusted insights to the global media industry. We are confident that as an independent business under the leadership of Patrick, the company will continue to thrive and lead the way in media measurement and analytics innovation”.

Chris Jansen, Kantar’s Chief Executive, added, “We set up Kantar Media to be operationally independent in 2023, to allow it to consolidate its global leadership position in audience measurement. Today’s proposed partnership announcement with H.I.G. Capital positions Kantar Media to continue its investments in technological and geographical leadership and we wish Patrick and his team the very best for the future. Following the proposed sale, Kantar will be even more focused on helping both global and local brands to grow through a unique combination of IP, data assets, and increasing the rapid deployment of AI. Kantar remains the world’s leading data and marketing analytics company.”

The transaction’s purchase price of approximately $1 billion is anticipated to be primarily paid in cash, along with certain non-cash consideration, including separation-related investments by H.I.G. Capital, and an earn-out.

It’s expected the proposed transaction is expected to close later this year, subject to customary legal and regulatory requirements, and employee consultation.