- Nvidia outperformed expectations after recording EPS of $0.68 and $30 billion revenue in Q2.

- NVDA, alongside several AI tokens, declined despite the positive earnings report.

- Investors may have already priced in the higher than estimated report due to a rally in AI tokens last week.

Nvidia (NVDA) smashed nearly all estimated metrics in its Q2 earnings report released on Wednesday. The chip giant posted earnings per share (EPS) of $0.68, above expectations of $0.65, and revenues of $30 billion, beating expectations of $28.9 billion. As a result, its annual revenue growth now stands at 122%. The company also expects revenue of $32.5 billion in Q3, also above the estimate of $31.9 billion.

Nvidia investors react, AI tokens stay mum

Following the announcement, NVDA’s share price ironically declined briefly by almost 5% before experiencing a slight upward correction. NVDA trades at a 2% daily loss at the time of writing.

A similar trend is visible across several Artificial Intelligence (AI) tokens in the crypto market.

Considering Nvidia’s market dominance over the AI industry, its performance is seen as an indicator of the health and growth of companies/projects within the sector. As a result, most cryptocurrency investors use AI-related crypto tokens to gain leveraged exposure to Nvidia’s price performance.

In anticipation of a positive Nvidia Q2 earnings, AI-related cryptocurrencies surged last week, with some tokens posting up to a 60% gain. However, after the higher-than-estimated earnings report on Wednesday, AI tokens failed to rally, with the top 7 all trading in the red in the past 24 hours. It appears the tokens are mirroring similar moves in NVDA and Bitcoin (BTC).

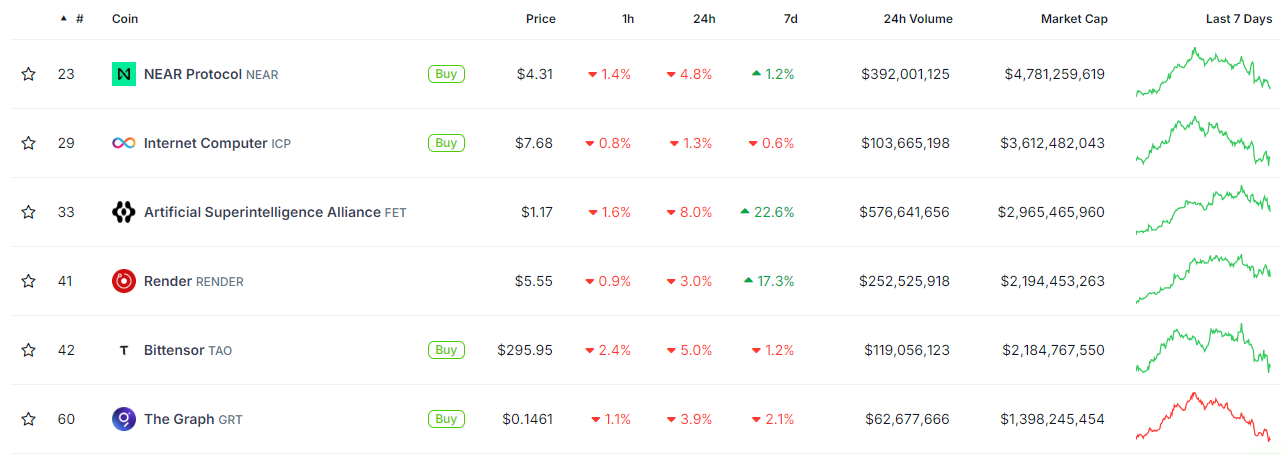

As indicated in the image below, the Near Protocol (NEAR), Internet Computer (ICP), Artificial Superintelligence (FET), RENDER and Bittensor (TAO) are all down on the day.

AI-related Cryptocurrencies

Another reason for their failure to rally on the back of Nvidia’s positive report may be that investors already priced in the higher-than-estimated earnings considering last week’s price surges within the sector.

With prices not seeing any huge exciting move, some community members believe a recovery is imminent in the coming days.