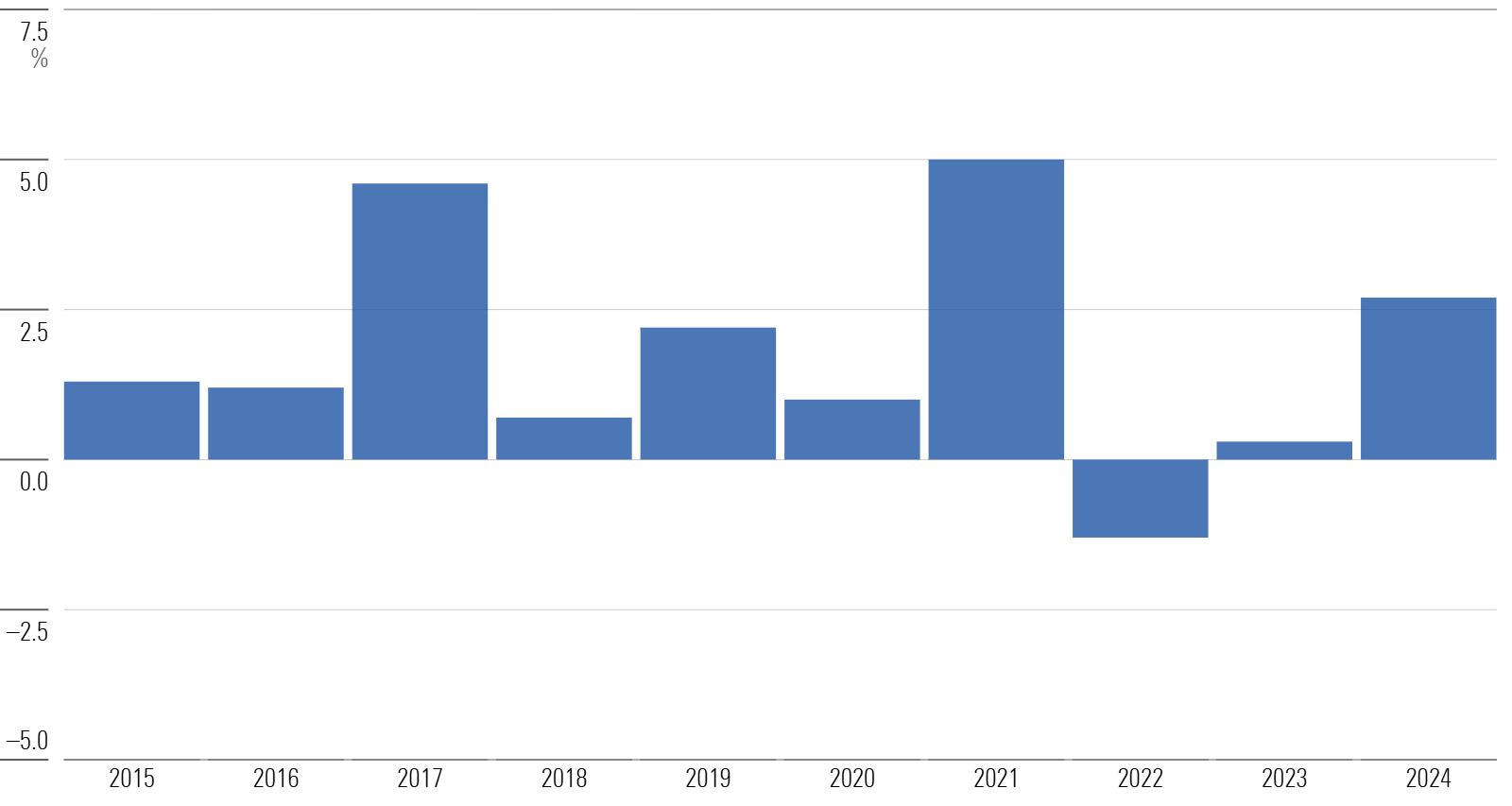

Long-term US funds pulled in $721 billion in 2024, equivalent to 2.7% of year-end 2023 assets. That rate was the best since 2021, and the third-best mark over the past 10 years. December saw $97 billion of inflows, bringing the fourth-quarter total to $294 billion. Only sector-equity funds and allocation funds suffered net outflows in 2024; the remaining eight category groups enjoyed inflows.

Passive Begins to Distance Itself From Active

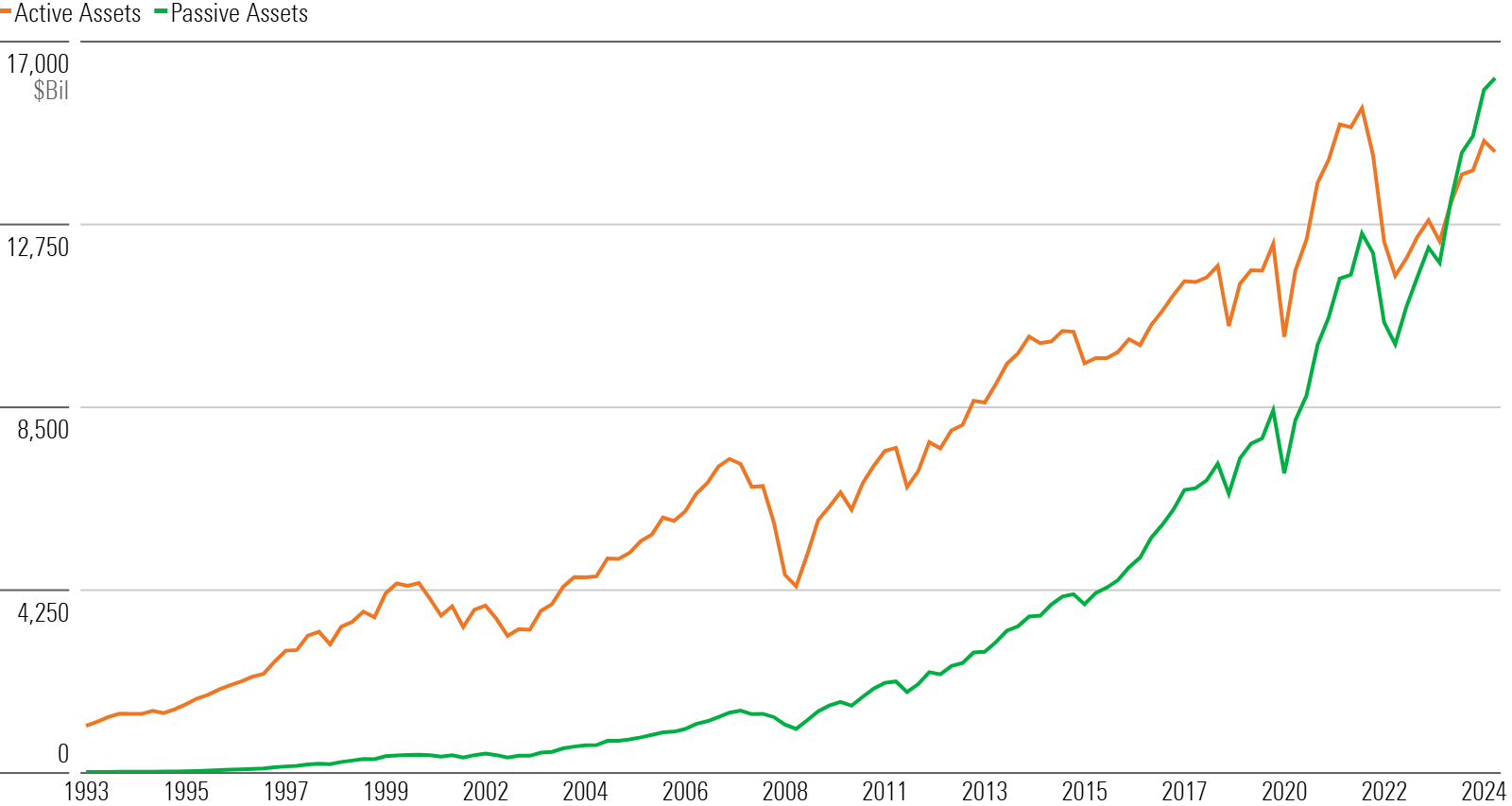

After overtaking active fund assets for the first time ever in 2023, passive funds extended their market share advantage in 2024. About 53% of assets in long-term open-end funds and exchange-traded funds are now in indexed strategies. There is little evidence that this trend will revert.

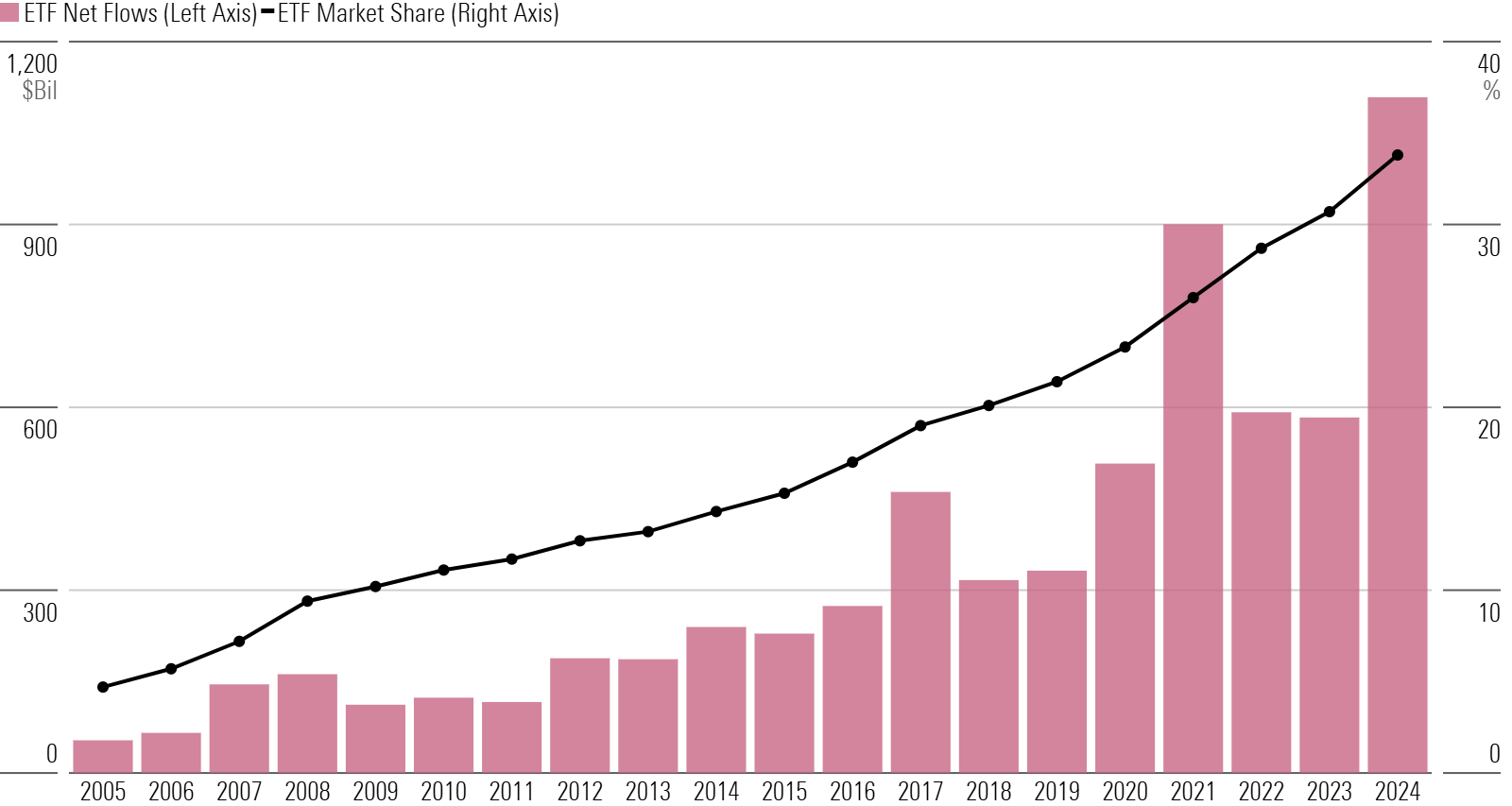

2024 Was a Year of Milestones for ETFs

Investors piled a record $1.1 trillion into ETFs in 2024 behind soaring stock markets and an ever-expanding menu of offerings. That avalanche of inflows propelled ETFs’ total assets past $10 trillion. That translates to about one third of the total US fund market—a dramatic leap from ETFs’ 14% market share at the end of 2014 and 5% share as of 2004.

Active US Equity Funds’ Steep DeclineThe three largest category groups all ended the year with a lower share of assets in actively managed funds than ever before. However, the trend for taxable-bond funds was nearly flat, while international equity funds saw a modest shift. Active US equity funds, however, continued to languish. They now hold just over a third of the category group’s overall asset base.

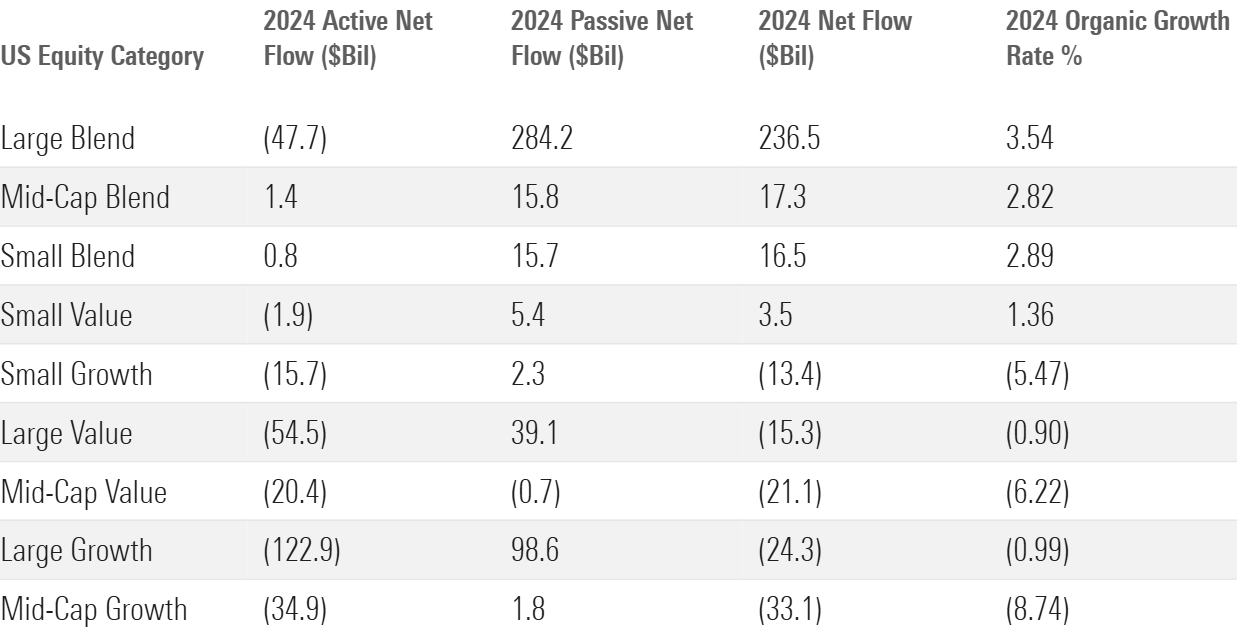

US Equity Fund Flows Are a One-Category Act

US equity funds took in $167 billion in 2024, but most categories within the group suffered outflows. Passive large-blend funds took in $284 billion, as behemoths like Vanguard 500 Index Fund continued to eat up the landscape. Mid- and small-cap blend funds also enjoyed decent flows, though they were similarly bolstered by index funds. Mid-growth funds, which skew toward active, had their second-worst year on record in terms of growth rate.

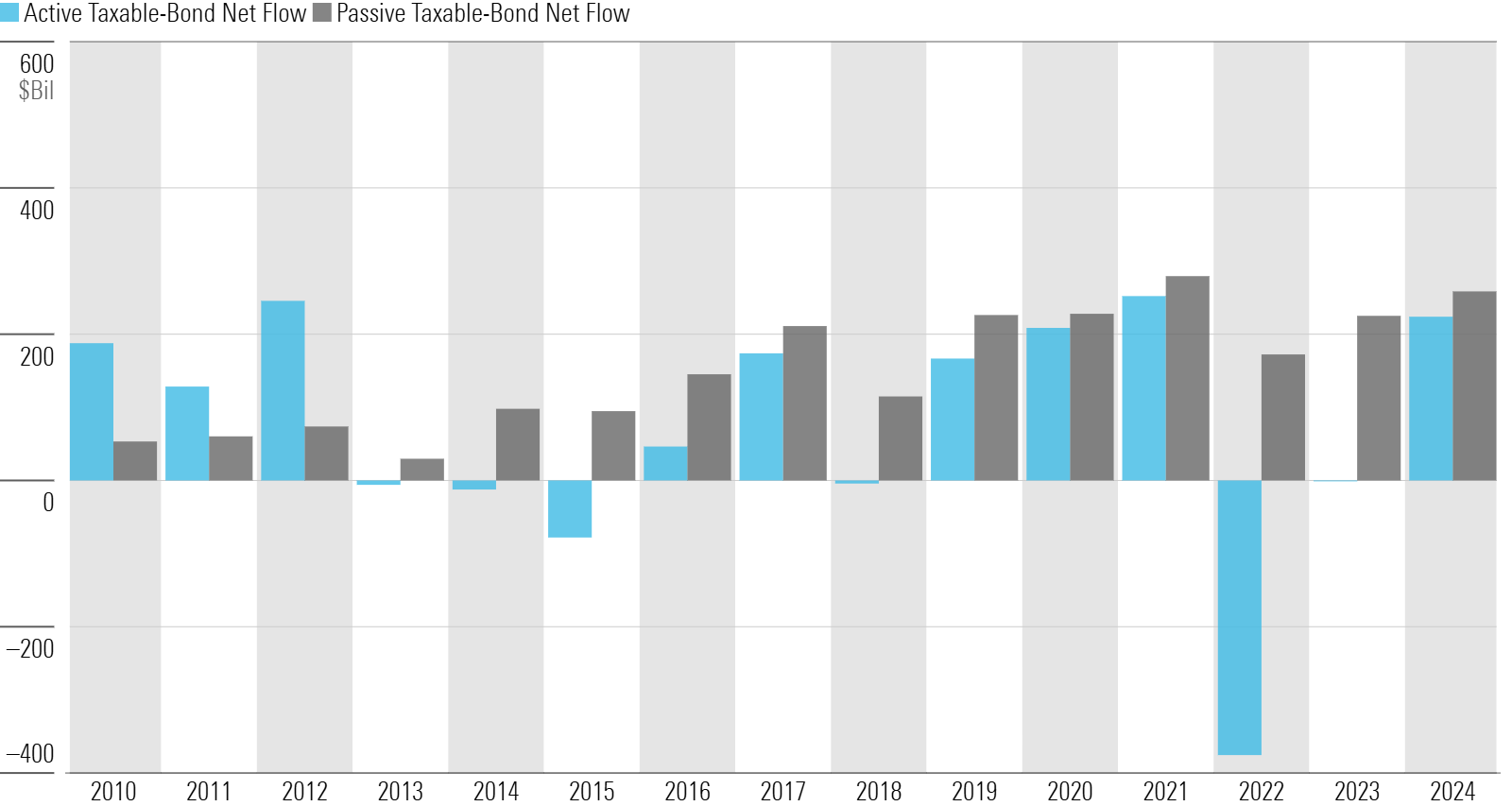

Taxable-Bond Funds Return to Form in 2024

Flows into index bond strategies were predictably solid in 2024, and actively managed funds rounded back into form after a rocky two years. That balance helped the taxable-bond cohort rake in $482 billion on the year, triple the next-closest category group. That marked its best haul since 2021 and translated into a 9.3% organic growth rate.

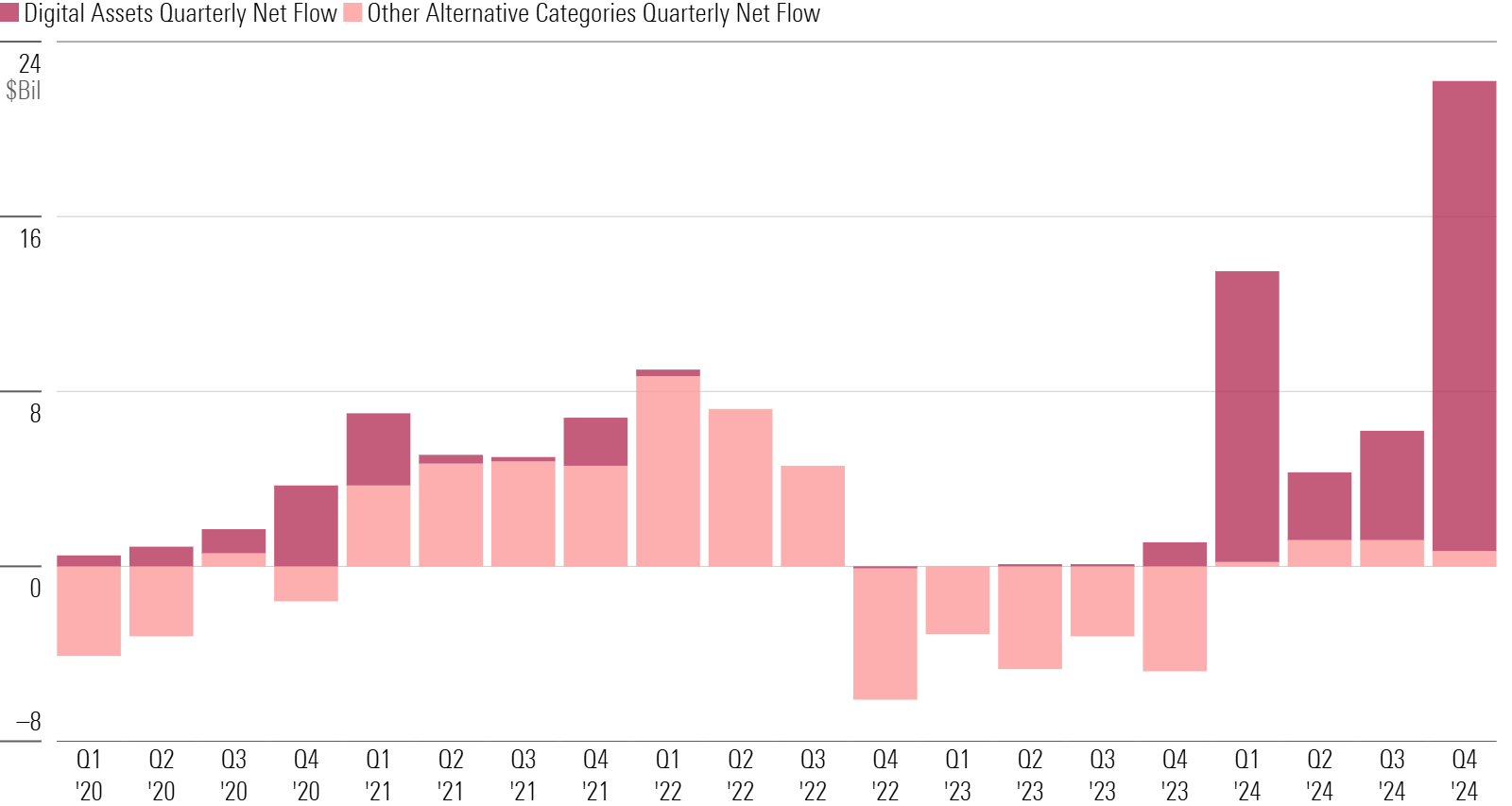

Bitcoin Boost Sparks Record Flows Into Alternatives

Alternative funds reeled in $46 billion in 2024, double the $23 billion record set in 2021. The advent of spot bitcoin funds made all the difference. Launched in January, the “new nine” spot bitcoin ETFs helped the digital assets category collect $13 billion in the first quarter, then closed the year by collecting $22 billion in the fourth, the bulk of which came after the US presidential election.

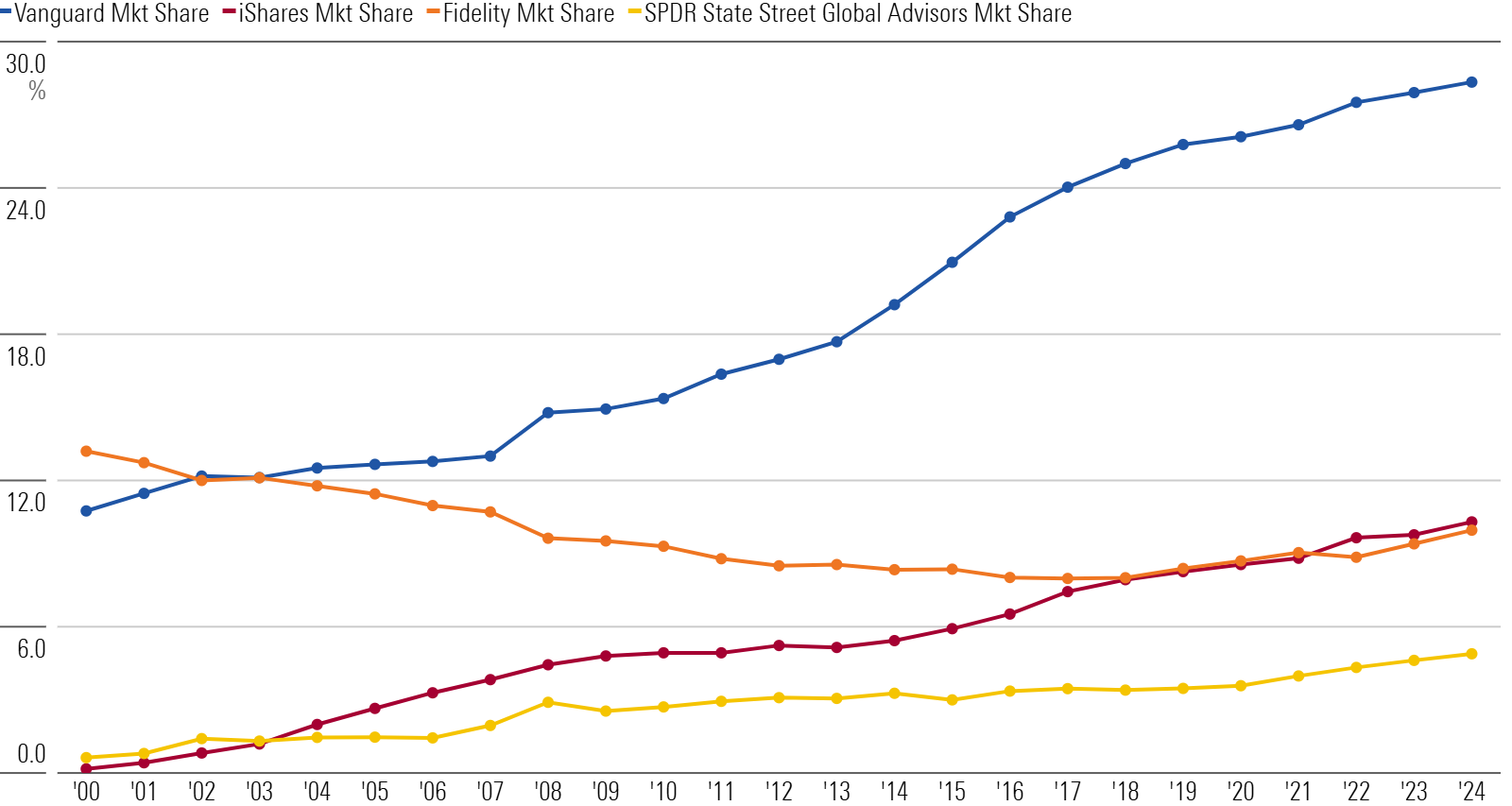

Passive Brass Stays Ahead of the Pack

IShares raked in $287 billion to lead all fund families for the third consecutive year. Vanguard ranked second with $222 billion, followed by Fidelity at $104 billion and State Street Global Advisors at $80 billion. These families are united by the immense capital stashed in their passive offerings. That has helped them steadily gain market share, or, in the case of the once-active-focused Fidelity, claw some of it back.

This article is adapted from the Morningstar Direct US Asset Flows Commentary for December 2024. Download the full report here.